Fed Eases Rates: Optimizing Stock Opportunities as Dollar Holds Steady

2024.11.08 10:42

- Fed cuts rates and keeps door open to a December move

- Powell appears confident about the inflation outlook

- Equities’ euphoria continues, strongest weekly rally of 2024

The Fed Announces a Rate Cut

With the markets still digesting Trump’s win, the announced the much-anticipated . Unswayed by concerns that Trump’s second term might lead to extreme protectionism and thus keep inflation high, the FOMC cut rates by 25bps, with Chairman Powell appearing content with the outlook, despite the positive talk about growth.

The more hawkish statement, due to the removal of the phrase that “the Committee has gained greater confidence that inflation is moving sustainably toward 2%”, was successfully countered by the dovish press conference. Powell’s comment that “the baseline for next year is to gradually move rates towards the neutral rates” means that more cuts are on the agenda, and that the December meeting, with its updated dot plot, is likely to be a live one.

The market is convinced that another 25bps rate cut will be announced on December 19, as it is currently assigning a 92% probability to this outcome. Despite the strength of the US economy potentially hindering back-to-back rate cuts, some investment houses highlight that the Fed’s window of opportunity for further rate cuts might be shrinking fast, as Trump will officially take over on January 20.

The reacted favourably to Powell’s message, edging lower toward the 4.3% level. However, it remains elevated, around 60bps above the level recorded just ahead of the September Fed gathering that delivered the first rate cut. The current level of yields is offsetting the accommodation provided by the Fed, and thus keeping funding costs high for firms.

US Stocks’ Post-Election Euphoria Continues

Meanwhile, US stock indices, which benefited greatly from Trump’s return to the White House, got another boost yesterday, with the climbing above the 6,000 level and recording a new all-time high. This is shaping up to be the best week for the world’s largest stock index since November 2023, when the market first realized that the rate hiking cycle concluded. Smaller capitalization stocks remain in demand, with the outperforming the other major US stock indices.

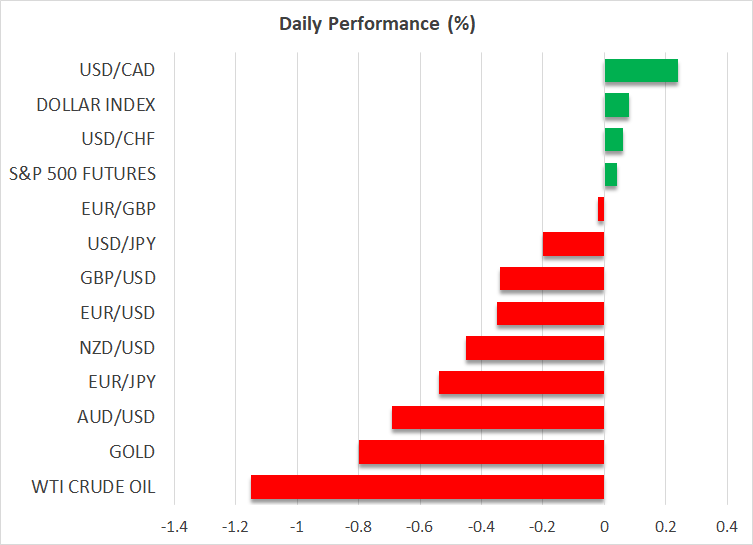

Dollar Remains Strong, Yen Gets a Tiny Boost

The was probably the least affected by the Fed’s rate cut. It gained slightly versus both the and the but weakened against the yen. The small downleg in is probably the result of the continued verbal intervention from Japanese officials, who have been alarmed by the recent pace of the yen’s underperformance.

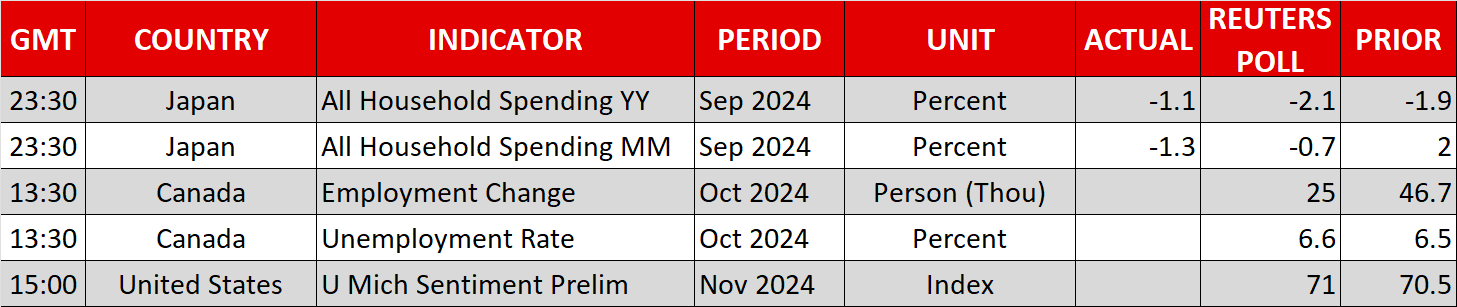

In addition, expectations for a December BoJ rate hike are high, with the market currently fully pricing in a 10bps rate move, despite the ongoing political uncertainty following the recent Japanese snap election. Moreover, recent data prints have been modestly positive, apart from the consumer side of the economy. The September retail sales figure was weak, with this negative sentiment also depicted in the October consumer confidence index.