US Dollar Gaps Down as Trump Seems to Be Losing Iowa

2024.11.04 08:45

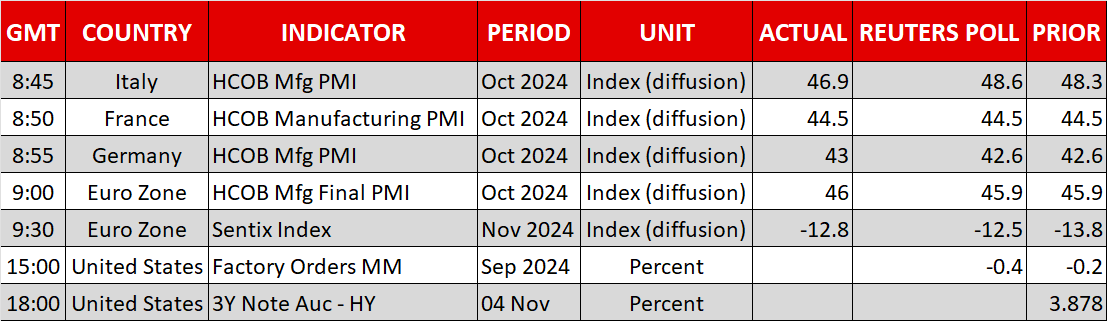

- Nonfarm payrolls slow to the smallest gain since Dec 2020

- Dollar opens Monday with negative gap on US election poll

- What will Fed officials decide just after the election?

- RBA gets the ball rolling tonight; expected to stand pat

Dollar Brushes Off Very Weak Nonfarm Payrolls

The finished Friday’s session up against most of its major peers, despite nonfarm payrolls slowing to 12k last month, the smallest gain since December 2020.

Despite the surprisingly low number, the market brushed off the report, considering it an outlier rather than painting a clear picture of the US labor market and the broader health of the economy. Indeed, job growth almost stalled in October due to strikes by aerospace factory workers and as hurricanes shortened the collection period for payrolls.

The response rate dropped as well to 47.4%, which is the lowest since January 1991 and well below the 69.2% average for October in the last 5 years.

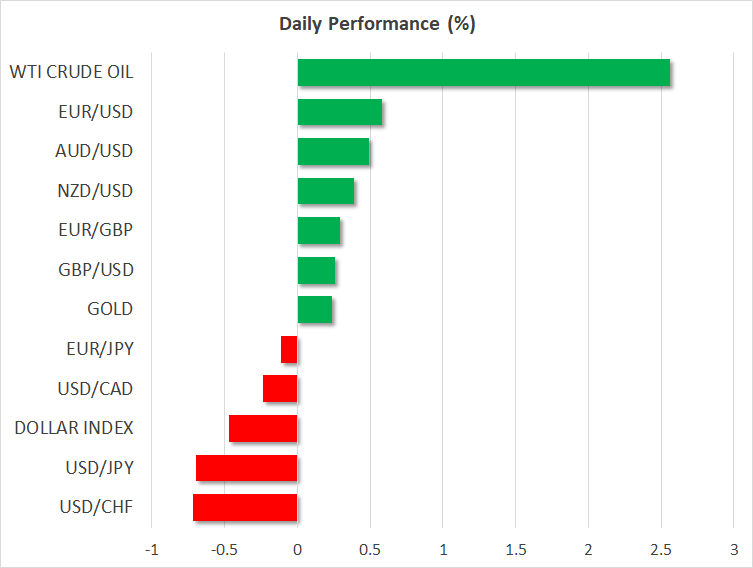

Poll Shows Harris Taking a Lead in Iowa; Dollar Pulls Back

Having said all that though, the greenback was unable to hold onto Friday’s gains, opening today’s session with a negative gap as, according to a US election poll released on Saturday, US Democratic presidential candidate Kamala Harris has taken a lead of three percentage points in Iowa, a state that Trump easily won in 2016 and 2020 and had a 4-point lead just a few months ago in September.

Trump has pledged to cut taxes and impose import tariffs, especially on Chinese goods, policies that are seen as inflationary. Therefore, whenever his chances of returning to the Oval Office were increasing, the US dollar strengthened as higher inflation could mean slower rate reductions by the Fed. Perhaps that’s why the dollar reacted negatively to the poll showing that Trump is losing Iowa.

This also corroborates the notion that a potential Harris win will result in a weaker dollar, despite Harris being considered the current administration’s continuity candidate, as her policies are not seen to be as inflationary as Trump’s.

Will the Election Outcome Impact Fed Thinking?

How a new president will impact the Fed’s thinking will start being revealed on Thursday, as just two days after the US elections, the Fed will decide on interest rates. The Committee is widely anticipated to cut interest rates by 25bps, but there has been a decent chance for a pause in December.

Ahead of the US jobs data, that probability was 30%. However, after the slowdown in nonfarm payrolls and after the weekend poll showing Trump is losing Iowa, that chance dropped to around 17%. Should Fed officials indeed appear more cautious on future rate reductions after a potential Trump win, Treasury yields may rise further, and the US dollar could enjoy gains.

RBA Could Remain on Hold for a While Longer

Nonetheless, for now, central bank enthusiasts may turn their attention to the RBA policy decision due out tonight. Australian policymakers have not hit the rate cut button yet, noting at their September meeting that underlying inflation remains too high.

With inflation expectations also remaining elevated, it is unlikely for this Bank to cut rates this time. Investors are not expecting a cut in December either, assigning only a 20% chance for such a move.

Thus, if their view is confirmed, the may instantly gain some ground, but its latest downtrend may not be reversed until traders become convinced that China will proceed with meaningful measures to shore up its economy. China’s National People’s Congress (NPC) standing committee meets this week, and it will be interesting to see whether more details on stimulus will be revealed.