Demand Concerns vs. Geopolitical Risks: What’s Next for Brent Crude Prices?

2024.08.14 16:38

- Rising US crude inventories are putting downward pressure on oil prices, interrupting a six-week slump.

- Geopolitical tensions in the Middle East and supply issues in Libya could potentially drive prices up.

- Softening demand from global airlines, especially for jet fuel, complicates the demand landscape.

- Conflicting signals from fundamental factors are expected to keep market participants on high alert.

prices are heading for their second consecutive day of losses due to rising crude inventories, as reported by the EIA. The EIA data revealed that US crude stockpiles increased last week after six straight weeks of declines during the peak of the US summer season.

US increased by 1.357 million barrels, breaking a six-week downward trend and contradicting the anticipated 2 million barrel decrease.

The EIA data is anticipated to put downward pressure on prices in the upcoming session, but will it be sufficient to deter oil bulls? Geopolitical risks in the Middle East persist, along with supply concerns in Libya, where the threat of civil war between rival factions could impact supply.

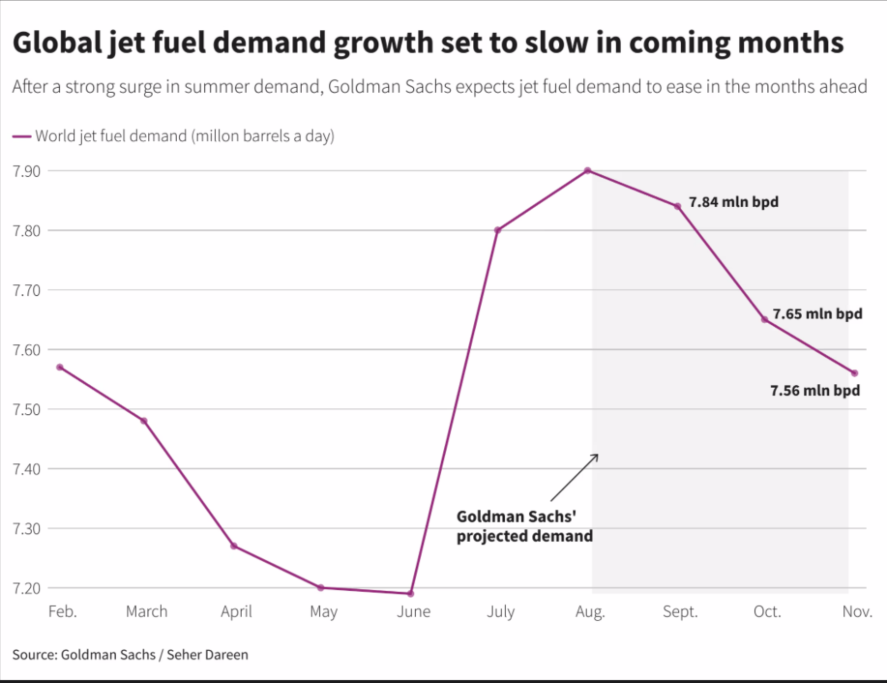

Conversely, there’s growing apprehension about weakening demand from global airlines. Jet fuel, accounting for about 7% of global demand, was expected to boost demand as travel continues to rebound post-pandemic.

Goldman Sachs reports that global jet fuel demand is projected to decline in the coming months. Specifically, Goldman anticipates demand to be 400,000 bpd from August through October, a decrease from the Bank’s forecast of 600,000 bpd for 2024.

Source: LSEG

A potential slowdown in economic activity could further reduce air freight demand, complicating the demand outlook. These factors point towards lower oil prices, yet geopolitical risks and technical factors are supporting a rise in oil prices. The question remains: which will prevail?

Technical Analysis

From a technical standpoint, Brent appears ready to climb higher after breaking the descending trendline and retesting it today. However, as mentioned earlier, the fundamental factors raise some intriguing questions.

Examining the H4 chart below, you can observe that prices have been making lower highs and lower lows since peaking on Monday at the 83.00 level. Yet, the trendline break and retest, which also touched the 100-day MA, suggest a bullish continuation may be on the horizon.

This setup is currently very compelling with numerous factors to consider, but the potential risk-to-reward ratio remains attractive. Immediate resistance is found at 81.58, followed by the weekly high and 200-day MA at 83.00.

A dip below the 100-day MA brings the 80.00 psychological level into play. Falling below the 80.00 mark would invalidate the bullish setup and could make a retest of recent lows a real possibility.

Brent Oil Four-Hour (H4) Chart, August 14, 2024

Source: TradingView

Support

Resistance

Original Post