Copper Price Peak Signal Suggests Lower Interest Rates Ahead

2024.07.19 17:49

Investors have been watching the Federal Reserve and interest rates closely for the past several months. Well, actually more like the past several years.

But maybe they should be watching copper prices for clues on where interest rates are headed.

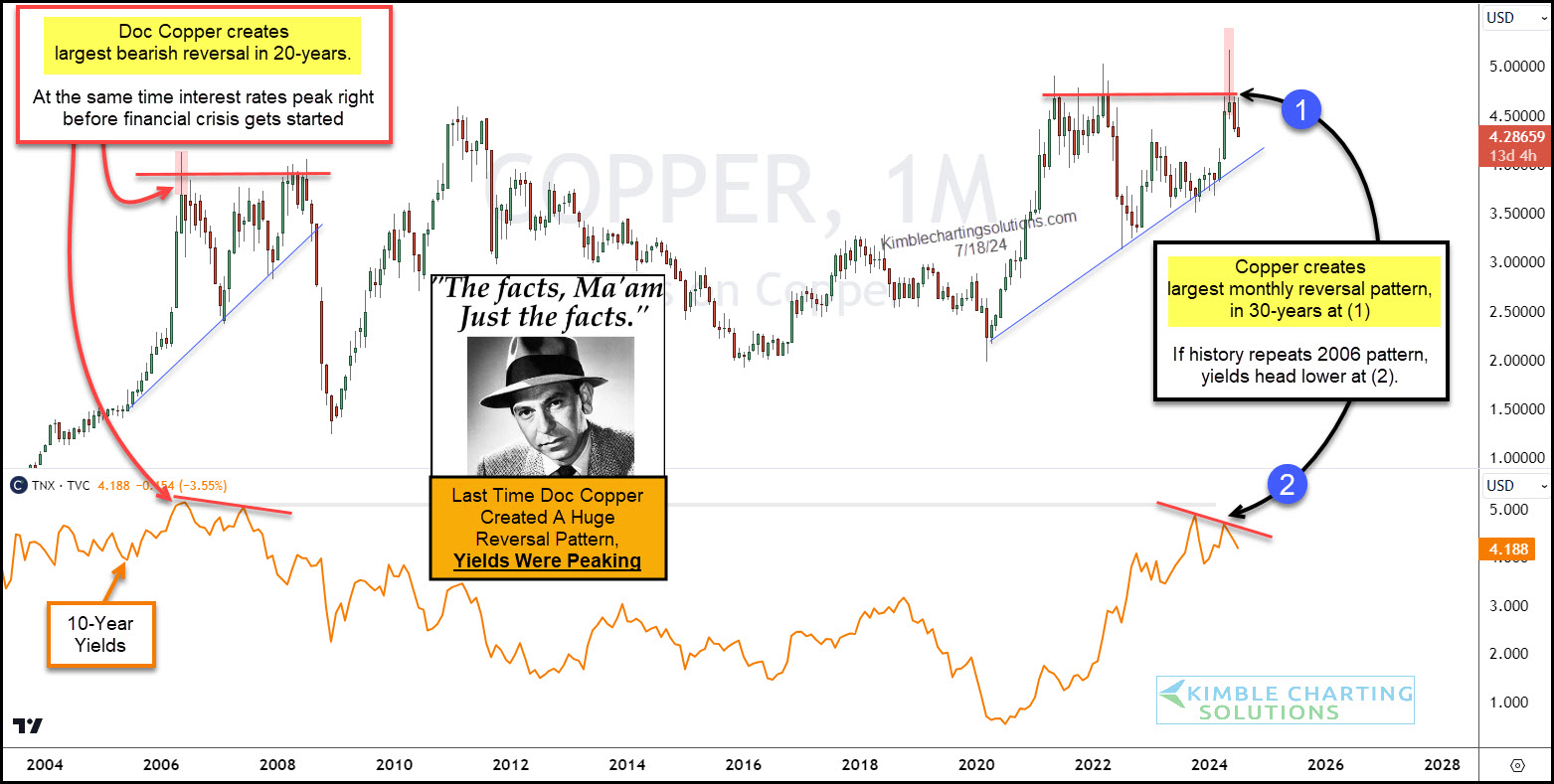

Today we look at a long-term monthly chart of versus the (interest rates).

As you can see, in 2006 good ole Doc Copper created the largest monthly reversal pattern in history at the same time that treasury bond yields (interest rates) were peaking. And this was right before the start of the Great Financial Crisis..

Fast forward to today and you can see that Doc Copper has created its largest monthly reversal pattern in 30-years at (1). If history repeats then we should see interest rates head lower at (2).

Will yields repeat again? Stay tuned.