Gold Retreats From a Five-Month High; Euro Continues to Rise

2023.10.23 06:30

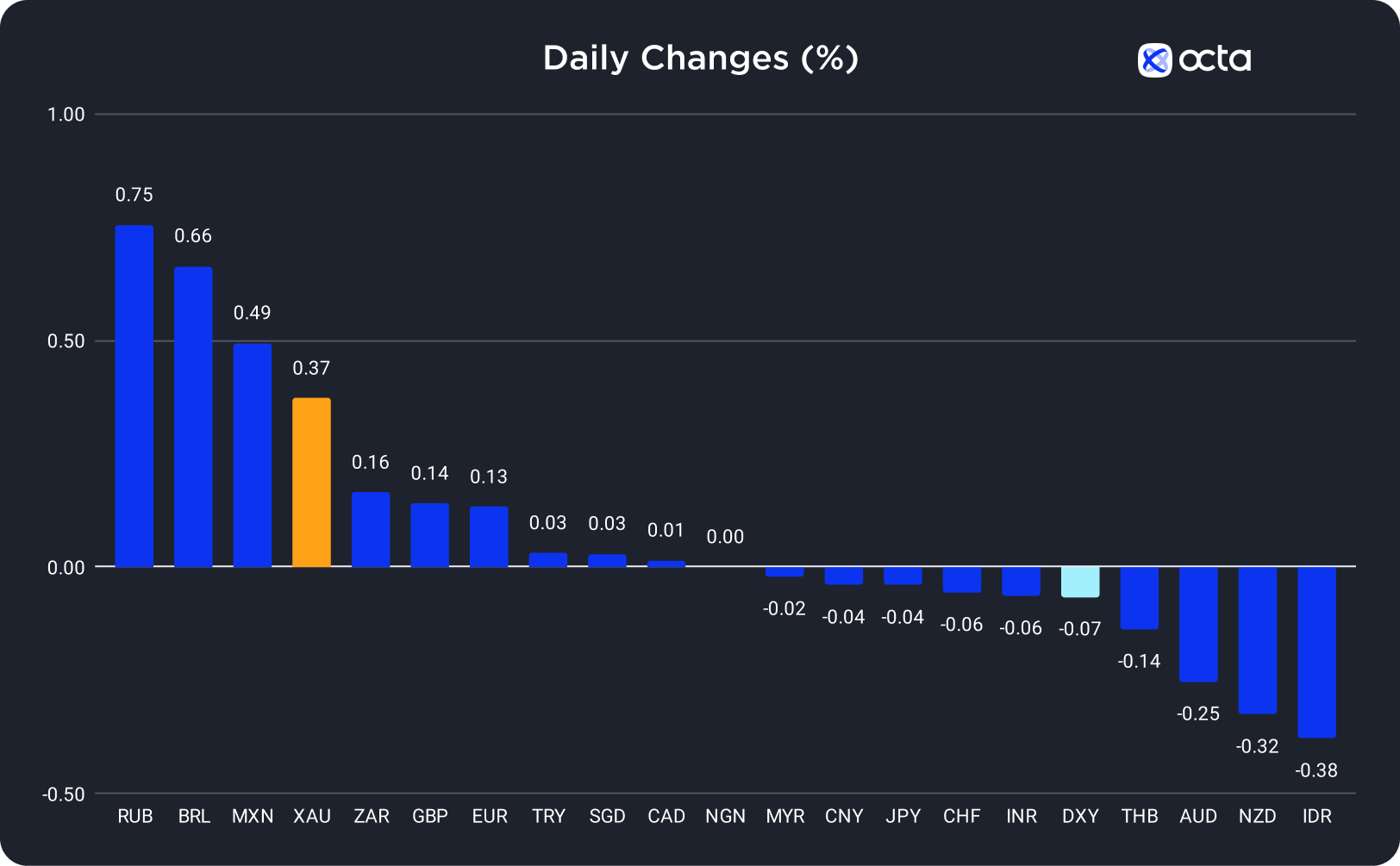

On Friday, the Russian rouble (RUB) was the best-performing currency among the 20 global currencies we track, while the Indonesian rupiah (IDR) showed the weakest results. The (CHF) was the leader among majors, while the underperformed.

Changes in Exchange Rates on 20 October

Changes in Exchange Rates on 20 October

Gold Price Retreats from a Five-Month High, But Safe-Haven Flows Remain Strong

The price almost reached a critical 2,000 level on Friday before taking profit from sellers brought XAU/USD lower. Overall, the pair grew by 0.37%, rising for the second consecutive week.

Gold gained almost 10% over the past two weeks as conflict between Israel and Hamas fuelled worries over political instability in the broader region and increased bullion’s safe-haven appeal.

‘People fluttered into gold and found a sense of safety amid geo-political risks. If there is an escalation in the Middle East conflict, gold prices will push through 2,000,’ said Phillip Streible, the chief market strategist at Blue Line Futures in Chicago.

The macroeconomic environment also supported the yellow metal. On Thursday, Federal Reserve (Fed) Chair Jerome Powell hinted that the central bank might leave the interest rate unchanged in the upcoming monetary policy meeting.

XAU/USD initially dropped in the Asian trading session but rose during the early European trading session. ‘The failure to trigger a long overdue consolidation and correction back down towards 1,946 could see prices move higher to eventually challenge resistance around 2,075, the nominal record high from 2020,’ said Ole Hansen, the head of commodity strategy at Saxo Bank. However, gold has already gained around 160 US dollars since the beginning of the Middle East conflict. Thus, the pair is technically overbought. Any successful diplomatic efforts to prevent the conflict from escalating further will immediately reduce the safe-haven flows into the bullion, potentially triggering a massive sell-off. Also, there are some macroeconomic risks. The market expects the U.S. base rate to stay unchanged for the rest of the year, and the U.S. Treasuries yields remain record high, exerting a downward pressure on gold. In addition, Powell hinted that rate cuts might not happen as promptly as the market had anticipated.

The Euro Continues to Rise as Investors Look for the Upcoming Economic Data

The (EUR) gained 0.13% on Friday as the US Dollar Index (DXY) decreased slightly before the weekend.

Despite the ongoing conflict in the Middle East, EUR/USD has been in an uptrend for the past week. The rally accelerated last Thursday after Jerome Powell, the Federal Reserve (Fed) Chair, indicated a potential pause in the U.S. rate-hiking cycle. This week is important for the EUR/USD. Tomorrow morning, the S&P Global’s Purchasing Managers’ Index will give insights into the health of the eurozone’s economy. Strong data could reverse the prevailing pessimistic outlook on EUR/USD, supporting eurozone yields and strengthening the euro. In addition, the meeting of the European Central Bank on Thursday may provide more clarity on the region’s monetary policy.

EUR/USD was rising in the Asian and early European trading sessions. Today, the macroeconomic calendar is uneventful, but traders should continue monitoring the Middle East conflict’s developments. Fundamentally, the risk of devaluation for the European currency remains real as the divergence between the U.S. and the Eurozone monetary policies continues to favor the US dollar.