S&P 500 Energy Outperforms Other Sectors as Oil Prices Surge

2023.09.11 16:42

In the short-run, energy stocks are outperforming the .

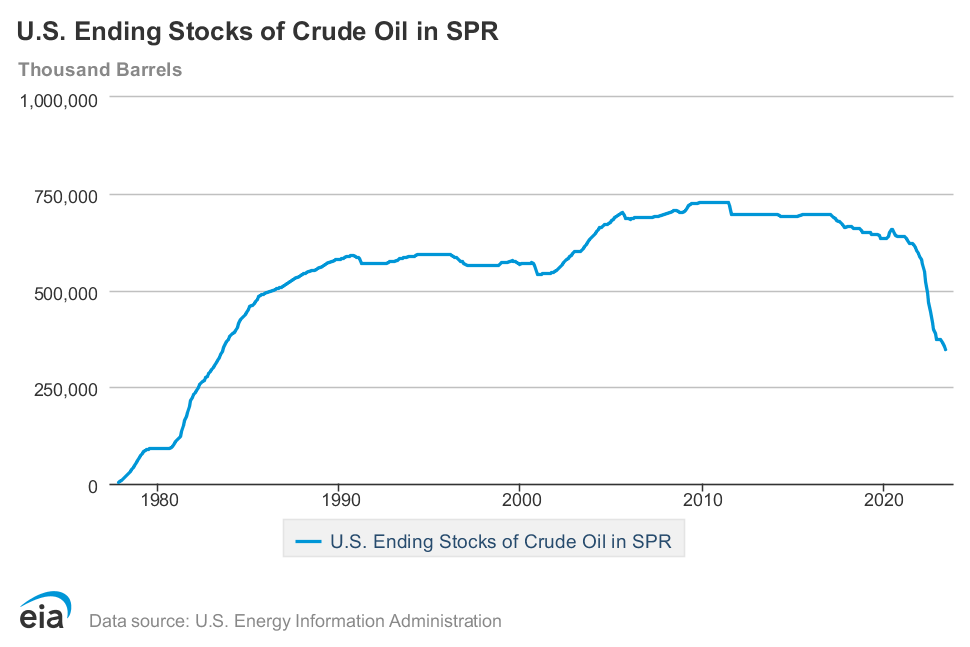

The Strategic Petroleum Reserve (SPR) is at its lowest point since 1983, at 347 million barrels. Established in 1975 from the fallout of the 1973 oil embargo in the Middle East, SPR has a total capacity of 714 million barrels of .

This puts the SPR level at less than half (48%). As the chart below shows, this is an anomalous level of energy security, having mainly remained flat since the mid-1980s.

Image courtesy of EIA

Because the Strategic Petroleum Reserve (SPR) is a buffer against supply disruptions, it sends out important signals. For one, the stock energy market prices higher oil prices as the government’s ability to withdraw from SPR wanes.

This has already come to fruition in the last three months, as price jumped by 21% to $90.84 per barrel, the level it was in November 2022. Second, this also means that inflation is heading for reacceleration.

After all, the Biden admin had identified energy costs in July 2022 as contributing half to the inflation increase. However, for energy stock investors, oil prices getting to the highest level this year translates into gains.

Performance of the Energy Sector Against Other Sectors

adds 7.5% weight to the overall benchmark index. In other words, this is how much SPN contributes to the total market capitalization of the S&P 500, presently holding at $37.16 trillion.

Expectedly, SPN followed closely as Brent crude oil went up since Q2 (ending in June). Overall, the S&P 500’s energy sector increased 11% this quarter. At the same time, the S&P 500 (SPX) rose by 1.87%.

Brent Crude Oil Futures Vs SPN

Brent Crude Oil Futures Vs SPN

Brent crude oil futures (BZ) vs S&P 500’s energy sector (SPN). Image courtesy of TradingView

Across individual energy stock companies, Marathon Petroleum Corporation (NYSE:) yielded the largest gains in the same period, at 32%. Halliburton (NYSE:) closely followed at 28% and ConocoPhillips (NYSE:) at 18%.

Oil Production Cuts to Align with Recessionary Expectations?

For 2023, recessionary expectations are a mixed bag. On one hand, the European Commission forecasted lower DGP for the eurozone’s five largest economies.

“While we avoided a recession last winter, the multiple headwinds facing the EU economy this year have led to somewhat weaker growth momentum than we projected in the spring,”

Paolo Gentiloni, European Commissioner for Economy on Monday’s press conference

To the EU’s economic engine, Germany, this means a contraction of 0.4% vs. the previous forecast of 0.2% growth. Disrupting cheap Russian gas devastated German industry, making it less competitive on the international stage. Year-to-date, Germany’s Industrial Production Index hit 95.70, the year’s lowest point.

On the other side of the Atlantic, Goldman Sachs cut recession odds to 15% over the next 12 months. During the US banking crisis in March, the recession forecast was 35%. For Q3, Atlanta Fed’s GDPNow model now projects a bullish 5.6% growth momentum, oppositional to the eurozone’s contraction.

However, this could be countervailed by the Federal Reserve if inflation is invigorated. In addition to low SPR, higher oil price contribution comes from Saudi Arabia and Russia. As the largest exporters, they have extended oil production cuts through the end of the year.

The Fed could make financial conditions even harsher with more interest rate hikes to counter the inflationary wave.

“There’s no doubt that dynamics around higher oil prices is going to create some anxiety for the Fed,”

Nate Thooft, chief investment officer at Manulife Investment Management

Of course, higher oil prices would trigger higher transportation costs and spill over to products relying on plastics and fertilizers. If the Fed reacts to these price spikes with heavier hikes than expected, we may also be looking at less optimistic recession forecasts for the US.

Then, energy stocks could undergo another boom-and-bust cycle that is so prevalent in the commodity markets.