High Beta, Small Cap Value Still Lead Equity Factors in 2023

2023.02.07 12:35

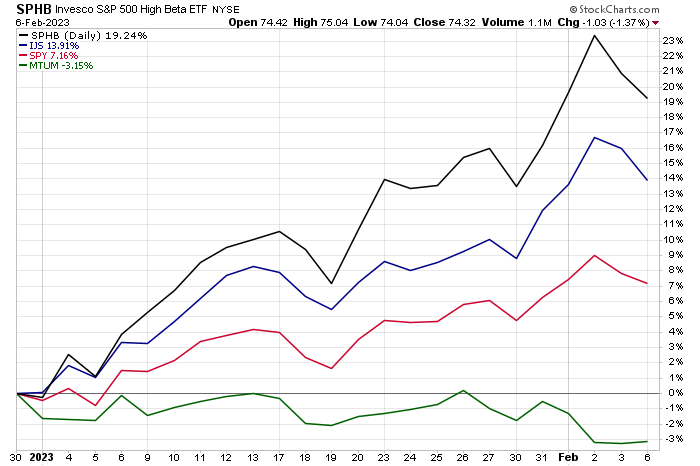

The U.S. stock market rally this year continues to be led by so-called high-beta stocks, which are outperforming the broad market by a wide margin, based on a set of proxy ETFs through Monday’s close (Feb. 6).

Invesco S&P 500® High Beta ETF (NYSE:) is up a sizzling 19.4% so far in 2023. The gain is more than double the broad market’s 7.2% advance, based on SPDR® (NYSE:).

In second place this year: small-cap value shares. The iShares S&P Small-Cap 600 Value ETF (NYSE:) is up 13.9%, a solid premium over the broad market’s year-to-date gain.

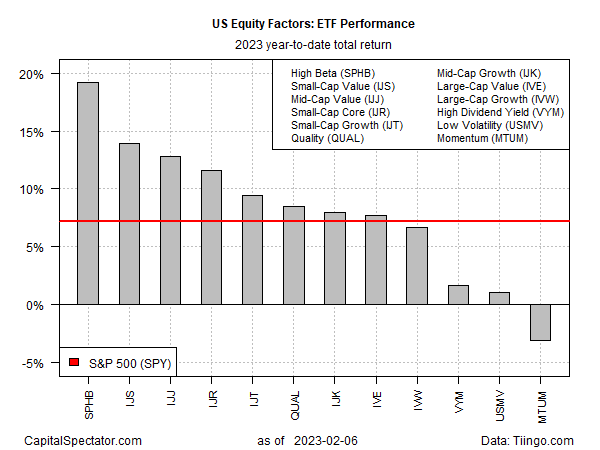

Although most of the major equity factors are posting gains so far in 2023, the downside outlier is momentum. After falling more or less in line with the broad market last year, iShares MSCI USA Momentum Factor ETF (NYSE:) isn’t participating in this year’s rally and instead is in the red for 2023 with a 3.2% loss.

US Equity Factors – ETF Performance

The weak run for momentum stands out in a year that, so far, has witnessed widening participation in 2023’s rally. “We’re seeing strength in the soldiers, and the generals are now joining the rally as well,” says Ari Wald, head of technical analysis at Oppenheimer in a reference to the broad market and mega-cap tech stocks.

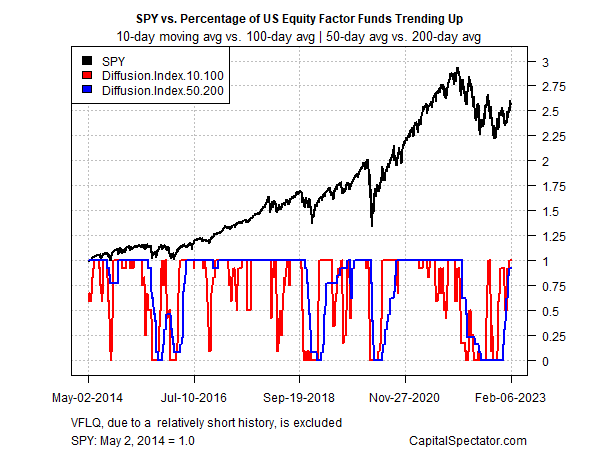

Breadth has improved across the factor ETFs as well. Using a set of moving averages to track the funds listed above shows a sharp recovery in upside momentum recently. The wide-ranging participation suggests that the bullish climate will continue in the near term.

SPY vs US Equity Factor Funds Trending up

But by some accounts, this year’s pop will soon run into turbulence. “The recession’s just starting,” advises David Rosenberg, the former chief North American economist at Merrill Lynch. “The market bottoms typically in the sixth or seventh inning of the recession, deep into the Fed easing cycle.” The Fed will soon pause and then pivot with , he says, but it’s too early to give the all-clear for stocks at this point, he explains. “There’s nothing right now in my collection of metrics telling me that we’re anywhere close to a bottom,” he tells.

Source link