Stocks Steadier, U.S. Dollar Softer as Markets Weigh Recession Risks

2022.12.19 10:32

[ad_1]

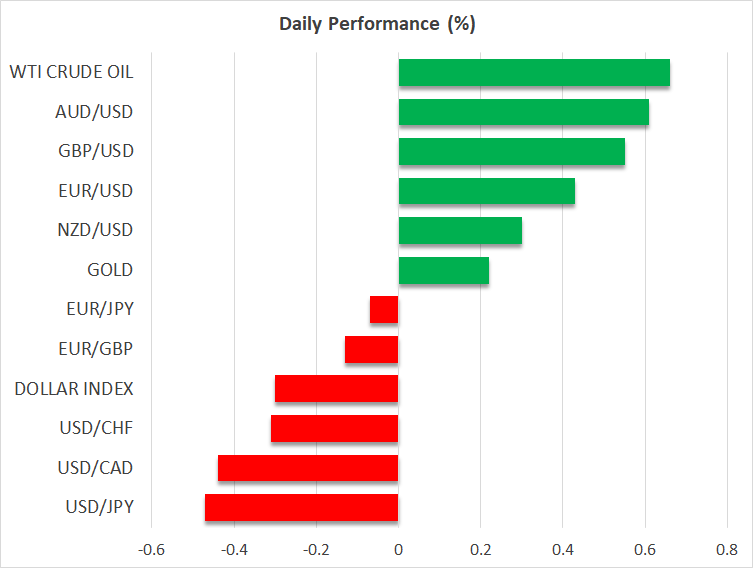

- Weak PMIs heighten recession fears in the US, dollar slips from highs

- But equities attempt to end losing streak as investors pare back rate hike expectations

- Chinese stocks struggle amid surging virus cases as authorities pledge to boost growth

- Bank of Japan in focus as speculation of a policy shift intensifies

Poor PMIs cast doubt on Fed’s dot plot

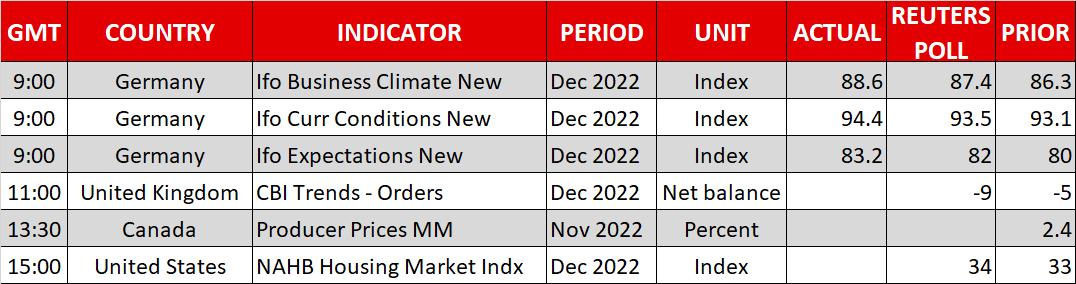

Trading got off to a muted but somewhat more optimistic start on Monday in a week where volumes are expected to thin out in the run-up to Christmas. Markets are still trying to digest an obstinately hawkish Fed on the one hand and increasing warning signs of an impending recession on the other. Friday’s flash PMI releases for December painted a worrying picture about the direction of the global economy, with the US prints slumping further below 50, while a slight improvement in European ones offered little comfort.

The gloomier economic outlook combined with growing indications that price pressures are easing have led investors to price in a lower terminal rate for the Fed than what policymakers pencilled in only last week at their December FOMC rate-setting decision.

Bond markets have been very choppy over the past couple of weeks, but Treasury yields have nevertheless been mostly confined to a sideways range, pressuring the greenback against its major peers as non-US yields have crept upwards.

The fact that neither yields nor the dollar reacted very strongly to Powell’s hawkish message suggests that markets either don’t believe the Fed will stay the course on rates or that the US economy will be hit by a harder downturn than that projected by policymakers.

Either way, this is just another setback for dollar bulls, especially against the euro, which is benefiting from rising Eurozone yields on the back of the ECB’s hawkish meeting last week.

Bank of Japan decision coming up

The dollar has been having a somewhat better time against the Japanese yen lately, establishing a floor in the 134-yen region. But that could be about to change as the Bank of Japan may be setting the stage for an eventual exit out of ultra-accommodative policy.

The Bank of Japan will wrap up the December central bank bonanza early on Tuesday by likely keeping monetary policy unchanged. However, there is mounting speculation that policymakers will signal a review in 2023 of their controversial yield curve control policy, which has kept Japanese yields pinned near zero.

Although it’s unclear whether the BoJ would provide explicit hints of a policy overhaul just yet, the yen could surge simply on the back of tougher language on inflation.

Is it too late for a Santa rally?

European stocks and US futures were edging higher on Monday in what could be one last bid to spur a Santa rally. However, a more probable scenario is that today’s gains are simply a correction following the three straight sessions of losses on Wall Street since last Wednesday.

Investors will likely be on the lookout for fresh commentary from Fed officials over the next few days, while Friday’s PCE inflation data will no doubt be watched closely too.

In Asia, stocks had little to cheer about as the rapid spread of Covid across major Chinese cities raised concerns about supply disruptions as well as about what new measures Beijing might take to contain the virus, having just loosened some restrictions.

But despite reports of rising deaths in China, the government’s attention seems to be mainly on the economy. The country’s leaders have pledged to boost consumption and investment following the conclusion of a two-day annual economic conference. However, the positive headlines about more stimulus have failed to provide any lift to domestic stocks, with the benchmark CSI 300 index closing 1.5% lower today.

[ad_2]

Source link