Natural Gas: Weakness to Persist

2022.11.28 02:49

[ad_1]

The last two hours before the weekly closing signaled that weakness will continue for as the G7 and the EU hasn’t yet decided whether to cap Russian and gas prices. The price cap mechanism and the EU embargo on imports of Russian crude set to enter into force in less than two weeks, on Dec. 5, could keep the energy prices on the edge.

On the other hand, a mild but messy pattern will set up over the US for the next seven days as weak weather systems track across the country, along with nice-to-mild breaks in between for lighter-than-normal demand as the southern US warms into the upper 50s to 70s, while mild to only slightly cool over the northern US with highs of 40s and 50s besides 30s near the Canadian border. Cold air will arrive over the West mid-next week with lows of -0s to 30s. Overall, Moderate-Low demand for the next six days increasing to high later.

The natural gas bulls tried to sustain above the psychological resistance at $7 last week. It encouraged big bears to remain aggressive before the weekly closing on Friday, as the mild weather pattern could be supportive during the first two trading sessions of the upcoming week.

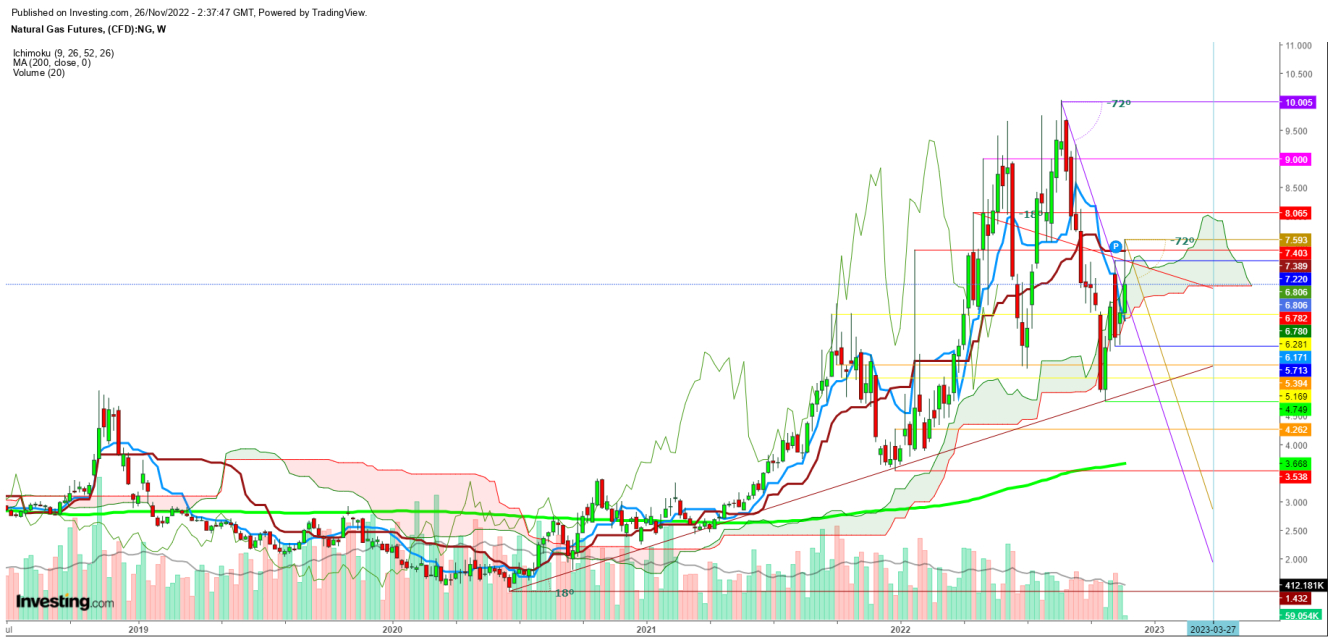

Natural gas futures weekly chart.

Natural gas futures weekly chart.

In the weekly chart, natural gas indicates that exhaustion is likely to continue as a ‘bearish crossover’ has resulted in the formation of one more ‘exhaustive candle’ in the last week.

This weekly exhaustive candle could be confirmed during the upcoming week if natural gas breaks below the significant support at $5.713.

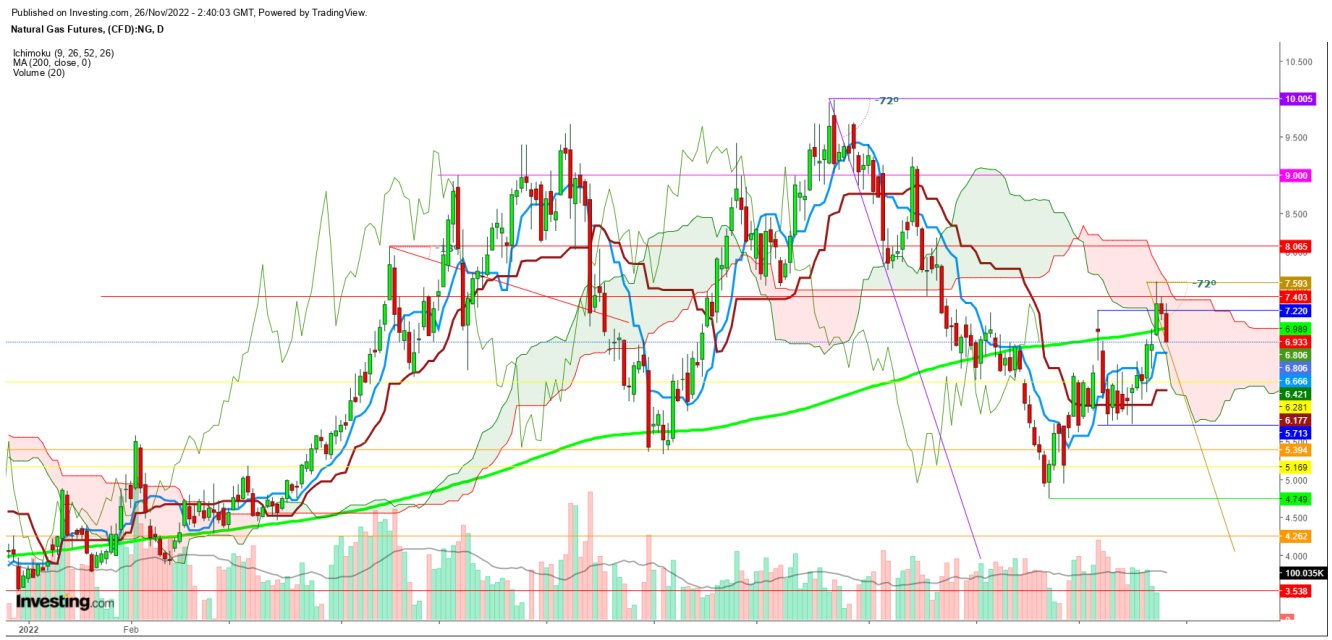

Natural gas futures daily chart.

Natural gas futures daily chart.

In the daily chart, the prices indicate a continuation of the selling spree, as the last weekly closing is below the 200 DMA.

Immediate support is at the 9 DMA, which is currently at $6.665, and the second support could be 26 DMA, which is currently at $6.177. A breakdown below this could push the prices to test the next significant support at $5.169.

The overall trend looks bearish after a breakdown below 200 DMA on the last trading session of this week. However, I still find that some of the bulls could jump from the lower levels during the upcoming week amid growing volatility as the weather could tilt the sentiments mid-week.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.

[ad_2]

Source link