Is Crude Oil About To Pivot Into Bearish Territory?

2022.06.24 18:30

What outcome or outlook for crude oil should we expect when looking at the current macroeconomic environment?

Recession Fears

Oil prices were up during the US session on Friday as fears of insufficient crude oil supply to meet demand during the summer took precedence over those of a recession amid runaway inflation.

Markets fear that economic activity slow will lead to lower global demand. In addition, growth in economic activity in the Eurozone slowed sharply in June – notably in the private sector – to its lowest level in 16 months due to inflation, according to the composite PMI index published on Thursday by S&P Global.

Comments by Federal Reserve Chairman Jerome Powell have also fueled fears of a global slowdown since the Fed’s chairman has not ruled out the risk of recession in the United States.

Indeed, the head of the US Federal Reserve, heard Thursday by the Finance Committee of the House of Representatives, repeated that his priority remained the fight against inflation:

“We’re going to want to see evidence that it really is coming down before we declare ‘mission accomplished.”

Finally, while addressing an audience’s question about whether the war was responsible for inflation, Powell answered:

“No, inflation was high before – certainly before the war in Ukraine broke out.”

Here is an interesting article published on FXStreet that summarizes some of Powell’s remarks in Congressional testimony.

In addition, according to several media, Joe Biden’s proposal to temporarily lift the federal tax on gasoline and diesel did not have sufficient support to be adopted in Congress (a mandatory step).

Fundamental Analysis

In a rare occurrence, plagued by technical issues, the US Energy (NASDAQ:USEG) Information Agency (EIA) has announced that it will not release weekly US oil inventory and oil inventory figures this week. So, let’s look at the statistics from the American Petroleum Institute.

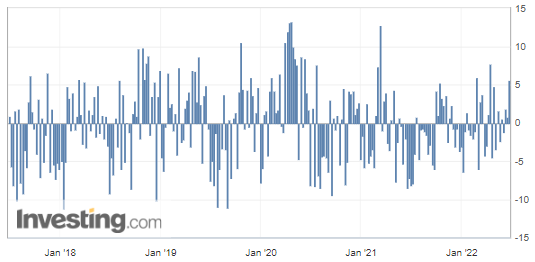

US API Weekly Crude Oil Stock

The weekly commercial crude oil reserves in the United States increased by over 5.607M barrels. At the same time, the forecasted figure was expected to be in negative territory (-1.433M), according to figures released on Wednesday by the US American Petroleum Institute (API).

Weekly Commercial US Crude Oil Reserves

Weekly Commercial US Crude Oil Reserves

US crude inventories have increased by over 5.607 million barrels, which firmly confirms slowing demand and could be considered a strong bearish factor for crude oil prices. This figure would indeed signal a drop in Americans’ appetite—at least at the current fuel prices—for petroleum products. US Crude Oil Inventories

US Crude Oil Inventories

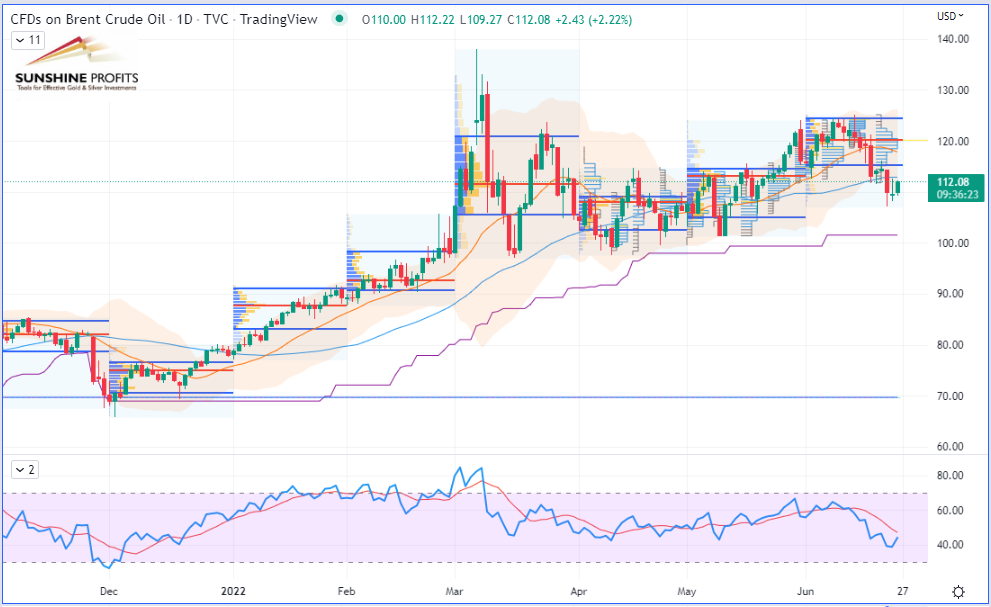

Brent Crude Oil Futures (August Contract) Daily Chart

Brent Crude Oil Futures (August Contract) Daily Chart

To conclude, is it even worth pointing out that in the event of a recession, the demand for petroleum products would fall, the current astronomical refinery margins would collapse, and therefore, a key bullish factor for crude oil would certainly vanish?

* * * * *