8 Stock Market Predictions for the Week: Earnings, PCE to Keep Investors Busy

2023.04.24 04:49

There is a lot of important economic data to look forward to at the end of this week, including the release of figures on Thursday and the on Friday, along with the and the final reading of the University of Michigan survey for April.

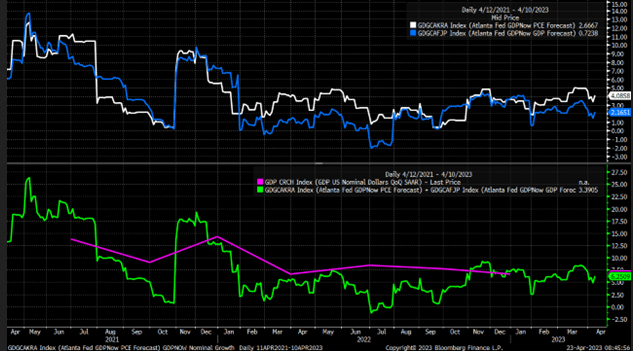

Real GDP is expected to increase by 2% in the first quarter, while the is expected to be at 3.7%, indicating a 5.7% nominal GDP growth rate. The Atlanta Fed GDPNow model predicts a faster-projected growth rate of approximately 2.2% for the first quarter, with inflation estimated to be around 4.1%, resulting in a nominal GDP growth rate of 6.25%. While this difference is not significant, it is worth noting and considering for comparison purposes.

Nominal GDP Chart

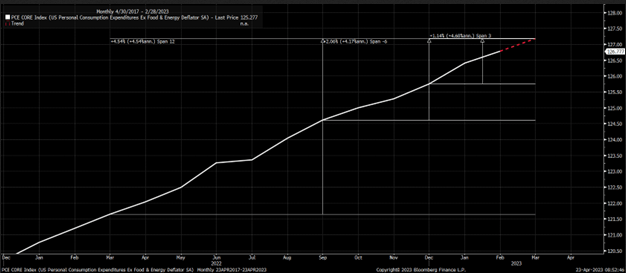

The March is anticipated to rise by 0.1% to 4.1% year-over-year, a decrease from the 5.0% reported in February. Additionally, the is expected to rise by 0.3% month-over-month, resulting in a year-over-year increase of 4.5%, down from 4.6% in February.

If the Core PCE does rise by 0.3% for the month, the rate of change for the first three months of the year would be a 4.7% year-over-year increase. These Core PCE numbers are important to the Fed, and based on the data from January through March, it seems that whatever improvement was seen at the end of 2022 may be fading.

Core PCE Chart

I have previously stated that the most challenging aspect of the battle against inflation would be in the 4 to 5% range, which is the current level we are experiencing. Another crucial figure to watch out for is the CORE PCE Services less housing, which has not shown any significant improvement in recent months and has been steadily increasing, reaching 4.6% year-over-year in February.

PCE Chart

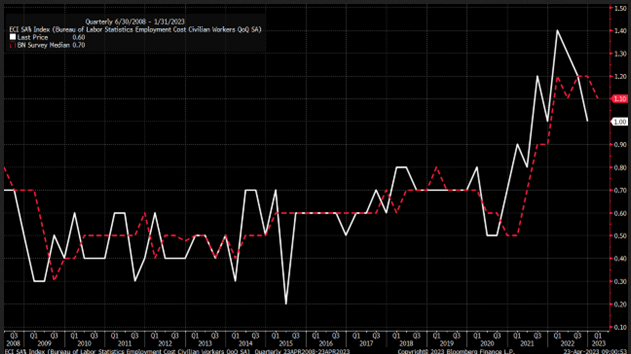

In addition to the GDP and PCE data, the Employment cost index will be released on Friday morning. It is anticipated to rise to 1.1% from 1.0% in the fourth quarter.

ECI Chart

Despite some people believing that inflation is either over or nearing its end, the estimates for the March PCE suggest that inflation is still an issue and that much work is left to be done, even if the results come in as expected.

If the figures exceed expectations, it will further support the case for not only a rate hike in May but also a rate hike in June. The probability of a rate hike in June is currently at 22%, which is a significant change from just a few weeks ago when rate cuts were anticipated.

Rate Hikes Chart

1. TLT

It is possible that the reason why iShares 20+ Year Treasury Bond ETF (NASDAQ:) and bond yields have not decreased is due to ongoing inflation concerns. This is also why the TLT risks dropping even lower, currently hovering around the support level of $104.

If that breaks, it could easily fall to $99.50. Despite multiple opportunities to rally beyond $109 since December, each time it has reached that price, it has stopped rising and reversed direction. Therefore, it is likely that the TLT has more room to fall, which suggests that yields will continue to rise.

2. TIPS

The iShares TIPS Bond ETF (NYSE:) ETF, which measures real yields, has experienced a similar trend to the TLT, with multiple opportunities to increase but failing to do so. Currently, the TIP ETF appears to be forming a head and shoulders pattern, which could potentially result in a drop below the support level of $108.50, confirming the pattern and sending the TIP ETF back to the gap of around $106.

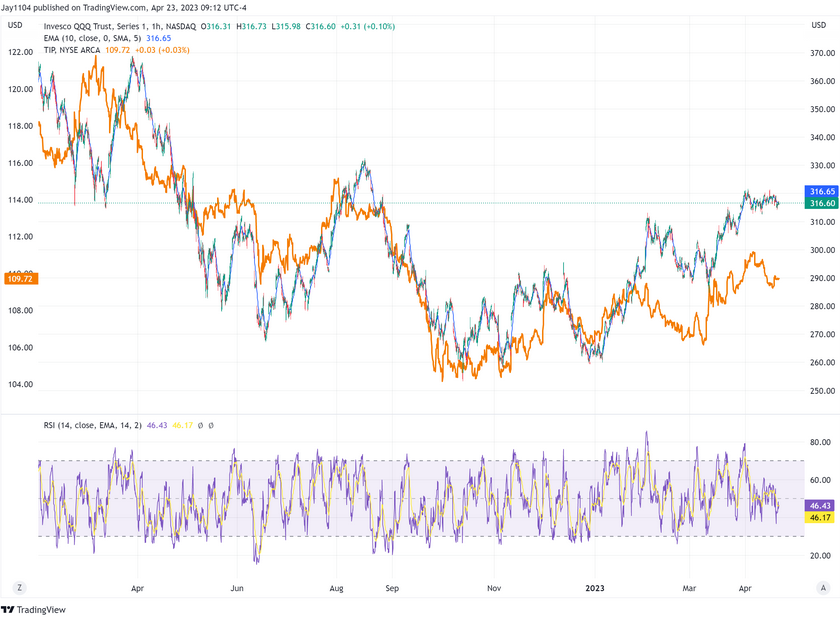

3. Nasdaq

One reason the Invesco QQQ Trust (NASDAQ:) has stopped rising may be the falling TIP ETF, which the QQQ ETF still closely correlates with. As the TIP ETF continues to decline, it may hurt the and the QQQ ETF.

If the TIP ETF continues to fall, it may hurt the QQQ ETF and the , which has struggled to advance and appears to be trending lower. However, until the support level at 4,080 is broken, it is difficult to say that the bears have taken control. Nonetheless, a support break at 4,080 could result in significant losses for the bulls, who may find themselves trapped.

S&P 500 Index 5-Min Chart

S&P 500 Index 5-Min Chart

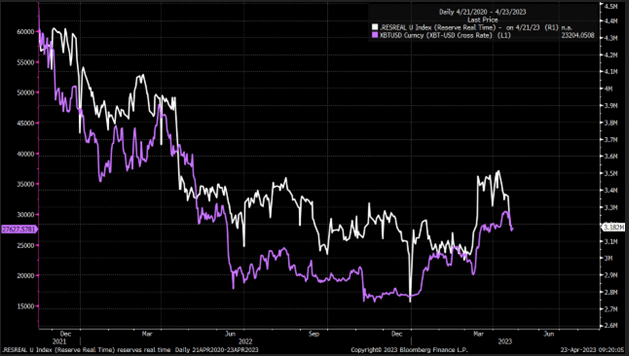

4. Bitcoin

could potentially serve as a leading indicator this week regarding the market’s direction, as it tends to be affected by changes in liquidity levels first. With the TGA rising and reverse repo activity remaining high, the liquidity that entered the market in mid-March is quickly leaving. Bitcoin is very sensitive to changes in reserve balances held at the Fed, meaning it may respond to the changing liquidity levels before other assets.

BTC-Reverse Repo Chart

5. Intel

Intel (NASDAQ:) is also set to report its results on Thursday, and the stock’s breakout attempt from a few weeks ago is failing. The first level of support for the stock is around the gap fill at $29.30, with a second one at $26.90. Both levels could potentially serve as support if the breakout attempt fails.

6. Microsoft

Microsoft (NASDAQ:) is also set to report its results on Tuesday after the close. The stock has been trading in a tight range since March 31 and appears to be in a distribution pattern, just churning at the highs. The critical level to watch for Microsoft is $282, as a break of this level could be a negative sign and suggest a drop to $275 and potentially back to $263.

Microsoft Corp Hourly Chart

Microsoft Corp Hourly Chart

Get All the Information You Need on InvestingPro!

7. Roku

Roku (NASDAQ:) is reporting on Wednesday, and I have never seen the point of this stock; for example, my kids, who used to be Roku users, hardly ever use it anymore. They can find YouTube much more easily from the Samsung app menu on our smart TV. Support at $58 must hold for Roku, or this stock is facing a big drop, perhaps back to the lows, based on the technical setup

8. Visa

Visa (NYSE:) will report on Tuesday after the close, and this, along with Mastercard (NYSE:), and both have been the ultimate hedge against inflation. After all, if prices, and their fee income rise, very easy and clean to grasp. That is probably why VISA is very close to breaking out at this point and heading to an all-time high.

This week’s FREE YouTube Video:

Original Post