5 Potentially Undervalued Pharma Companies

2022.10.18 13:23

[ad_1]

The pharmaceutical industry is a top investment option, with the sector experiencing rapid growth in recent years. The COVID-19 pandemic has also shifted the market focus to the pharmaceutical sector as leading biotech companies rushed to develop vaccine candidates to curb the spread of the virus.

Consistent research and the development of new medicines, as well as their commercialization, are transforming the pharmaceutical industry in profound ways that are likely to have both short and long-term implications for investors. Furthermore, advances in medicine and life sciences are being fueled by increased investment from governments, biopharmaceutical companies, startups, and academic institutions, to drive innovation and profits.

The Centers for Medicare and Medicaid Services predicts that national healthcare spending in the United States will reach $6.2 trillion by 2028, which is a clear indication of the massive scale of the industry, which makes it one of the most closely monitored business segments by policymakers.

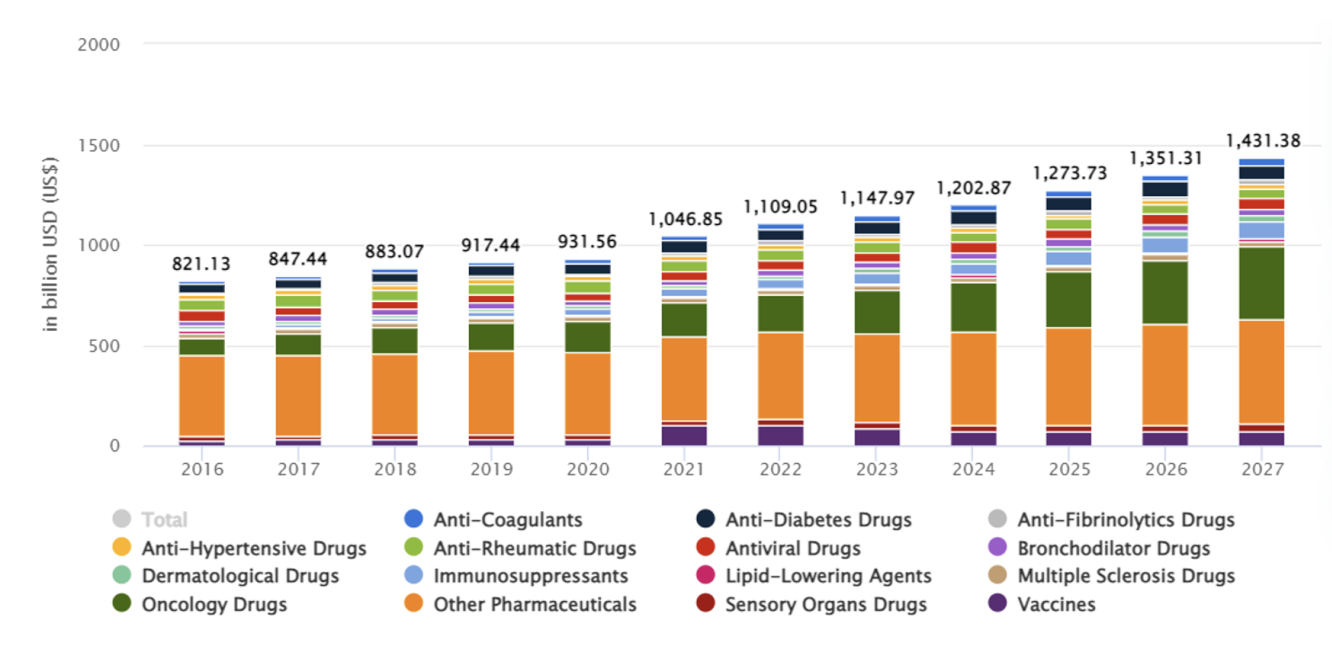

As demand for medical products and services increases, Statista predicts revenue in the pharmaceuticals market to exceed $1.1 trillion in 2022. The market will grow at compounded annual growth rate (CAGR) of 5.23% between 2022 and 2027, resulting in a market value of more than $1.4 trillion by 2027.

Revenue by Segment

Health care is one of the most stable industries as well since people will continue to spend money on medicines and related services regardless of the state of the global economy, which makes pharmaceutical stocks attractive safe haven investments in today’s uncertain economic environment.

Although many investors focus on industry giants in this sector, there are many smaller, fast-growing companies that are well-positioned to outperform the broad market in the coming years. Below are 5 companies that deserve the attention of investors.

InnoCan Pharma Corporation

InnoCan Pharma (CSE:) is an Israeli specialty pharmaceutical company that focuses on the research and development of CBD-loaded exosomes (CLX), the use of CBD-loaded liposomes, and the commercialization and sale of branded CBD-integrated pharmaceutical and topical treatment products. The positive results of the company’s LPT platform during an animal clinical trial prompted InnoCan to enter the veterinary medicine market and commercialize its technology for the treatment of a wide range of dog disorders as well. The demand for cannabidiol (CBD) for health and wellness applications is growing, and InnoCan is positioning itself as a key player in this market with its current pipeline of technological and pharmaceutical products.

Gilead Sciences

Gilead Sciences (NASDAQ:) is a biopharmaceutical company that focuses on the discovery, development, and commercialization of antiviral medications for the treatment of COVID-19, hepatitis B, hepatitis C, influenza, and HIV/AIDS. Additionally, the company offers medications for patients undergoing cell therapy, oncology, and hematology treatments. The company recently announced that the supplemental Biologics License Application (sBLA) for Trodelvy for the treatment of adult patients with HR+/HER2- Metastatic Breast Cancer has been accepted for priority review by the U.S. Food and Drug Administration (FDA).

Collegium Pharmaceutical

Collegium Pharmaceutical (NASDAQ:) is a specialty pharmaceutical company that develops and commercializes pain management medicines with tamper-resistant features and extended-release delivery via its patent-protected DETERx formulation platform. The company has broadened its product portfolio to include meaningfully differentiated medications through internal product development and acquisitions of the Nucynta franchise in 2020 and BioDelivery (NASDAQ:) Sciences International (BDSI) in 2022.

Signify Health

Signify Health (NYSE:) is a healthcare platform that provides payment programs to governments, employers, health systems, health plans, and physicians by leveraging advanced analytics, technology, and nationwide healthcare provider networks. The company discontinued the Episodes of Care Services segment in July to focus on its home and community services business and its acquisition of Caravan Health. Signify was awarded National Committee for Quality Assurance (NCQA) certification for the Healthcare Effectiveness Data and Information Set (HEDIS) in September.

Quidelortho Corp

QuidelOrtho is a vitro diagnostics company that focuses on the development and manufacturing of diagnostic testing technologies, cellular-based virology assays, and molecular diagnostic systems. The company’s product portfolio includes point-of-care tests for infectious diseases, critical cardiac health, and autoimmune biomarkers, as well as clinical and at-home COVID-19 detection products. In September, the company announced a multi-year partnership agreement with the Los Angeles Rams to promote health awareness and COVID-19 testing.

Conclusion

The pharmaceutical sector is poised to grow exponentially in the coming years, and investing in this sector today with a long-term perspective could help growth investors enjoy lucrative returns in the long run. Striking a balance between investing in established and young pharmaceutical companies is the right way forward as investors will then have meaningful exposure to fast-growing, small-scale companies that are likely to deliver multibagger returns in the future.

[ad_2]