5 Key Risks Investors Must Monitor Closely for Navigating 2024

2023.12.20 05:16

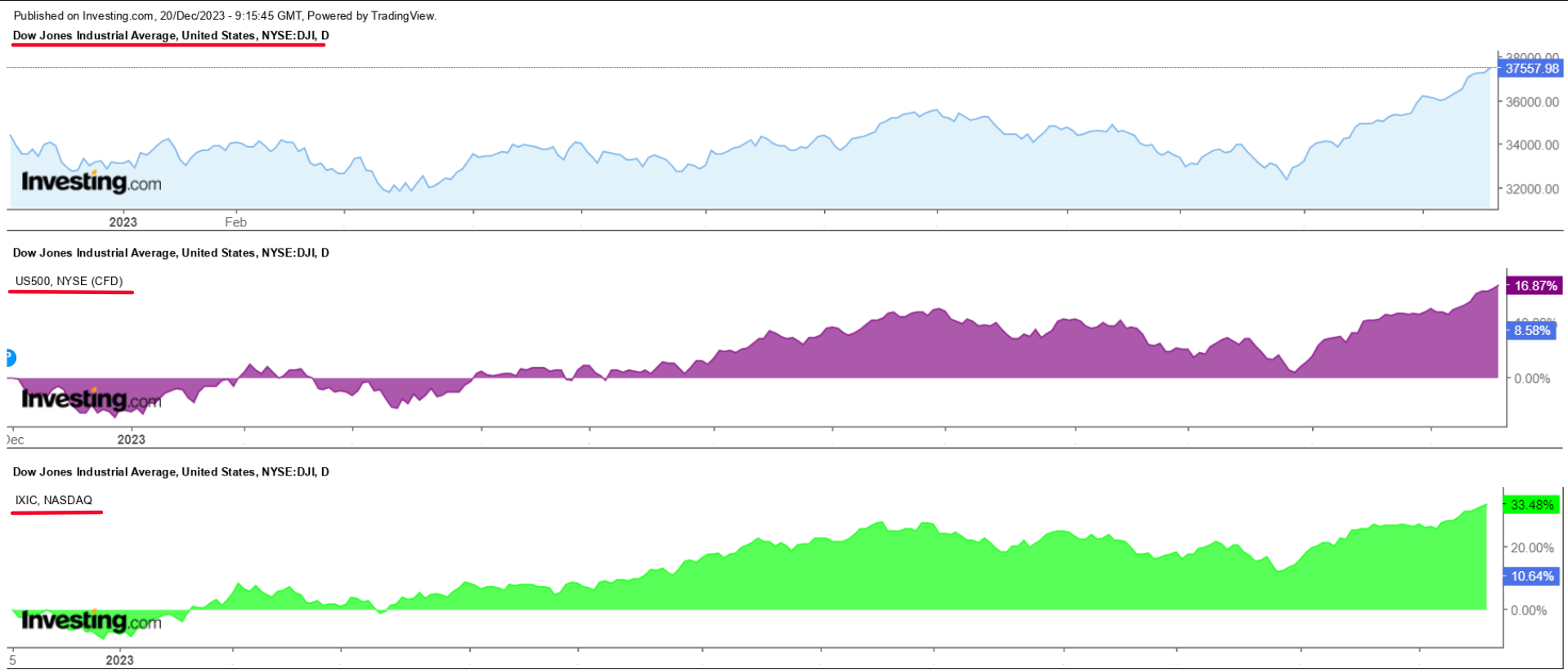

- U.S. stocks are on track to end 2023 on a high note amid bets the Fed is all done raising interest rates.

- 2024 is just around the corner, and despite the upbeat mood, a plethora of risks loom ahead and should be on investor radars.

- Looking for a helping hand in the market? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

With just a handful of trading days left in 2023, stocks on Wall Street are on track to close out the year on a solid note with investors growing increasingly optimistic that the Federal Reserve is done with raising interest rates.

The has been top performer, surging 43.3% year-to-date boosted by the ‘Magnificent 7’ group of mega-cap tech stocks, including Nvidia (NASDAQ:), Meta Platforms (NASDAQ:), Tesla (NASDAQ:), Alphabet (NASDAQ:), Microsoft (NASDAQ:), Apple (NASDAQ:), and Amazon (NASDAQ:).

Meanwhile, the benchmark and the blue-chip are up 24.2% and 13.3% respectively for the year.

As investors chart their course through 2024, a landscape fraught with uncertainties looms ahead, necessitating a vigilant eye on five significant risks that could sway markets and investor sentiment throughout the year.

These five risks underscore the need for a cautious and adaptable approach in navigating the complexities of 2024.

1. Fed Policy Uncertainty

The Federal Reserve’s stance on interest rates stands to be the most pivotal factor influencing market dynamics in 2024. The dichotomy between growing expectations for rate cuts versus a scenario where the Fed holds rates higher for longer creates a climate of unpredictability going into the new year.

After raising borrowing costs by 525 basis points since March 2022 to the current 5.25%-5.50% range, many market participants are growing more confident that the Fed’s policy tightening campaign is all but over.

As of Wednesday morning, there is a roughly 75% chance of a rate cut at the Fed’s March 2024 meeting, according to the Investing.com , while odds for a May cut stand at about 95%.

Hopes for looser monetary policy surged in the wake of the Fed’s dovish pivot last week, with policymakers pointing to three rate cuts in 2024.

However, there have been signs of divergence among Fed officials in the days after the last meeting as some FOMC members began pushing back on the market’s bullish reaction.

Whether the resilience of the economy will prompt a prolonged period of elevated interest rates or whether signs of strain will necessitate a pivot towards rate cuts remains a crucial question.

This uncertainty casts a shadow over market expectations, driving cautious and calculated investor behavior in an environment where policy signals could significantly impact asset valuations and risk perceptions.

The Fed is at risk of committing a major policy error if it begins to loosen monetary conditions too soon, which could see inflationary pressures begin to pick up again.

2. U.S. Recession and Global Economic Slowdown

What could determine how quickly or how much the Fed will cut rates in 2024 is whether the U.S. economy falls into a recession or not.

Despite widespread expectations of a looming downturn, the economy has proven considerably more resilient than anticipated by many on Wall Street and economic growth has held up better than expected in the face of higher rates, fueling investor optimism about a soft landing.

However, we’re not completely out of the woods yet, as the Fed expects the economy to grow a tepid 1.4% in 2024, slowing sharply from 2.6% this year.

And with Fed policymakers acknowledging that the effects and impact of their rate hikes have yet to be fully felt in the economy, growth could slow at an even deeper pace next year.

In addition, the looming specter of a potential recession in key global markets, most notably Europe and China, poses another threat which would require market participants to reevaluate their investing strategies for 2024.

Europe’s sluggish economic growth and persistent challenges, compounded by uncertainties surrounding potential energy supply disruptions, paint a concerning picture. Simultaneously, China, a global economic powerhouse, grapples with decelerating growth momentum amidst regulatory crackdowns and efforts to rebalance its economy.

In such an environment, investors face the daunting task of recalibrating their strategies to safeguard against the far-reaching implications of a broader global economic downturn.

3. Stubborn Inflation

With cooling and the Federal Reserve signaling rate cuts in 2024, many investors seem to be adopting a bullish outlook for the year ahead.

Indeed, U.S. inflation has come down significantly since June 2022, when it peaked at a 40-year high of 9.1%, amid the Fed’s aggressive rate-hiking cycle.

Nonetheless, consumer price inflation remains well above the central bank’s 2% target, despite the Fed’s persistent efforts to rein in CPI, which increased at an annual rate of 3.1% last month.

Moreover, fresh disruptions in global supply chains pose a further threat, potentially triggering a reacceleration of inflation in 2024, and creating additional challenges for economic stability.

As such, I believe the risk looms large that inflation could defy expectations and persist at elevated levels for longer than markets currently expect, which would have a far-reaching impact on the Fed’s monetary policy plans.

The intricacies of these challenges demand astute monitoring, as any unexpected acceleration in consumer prices could not only dent market confidence but also necessitate recalibrating investment strategies in anticipation of prolonged inflationary headwinds.

4. Geopolitical Turmoil, Unpredictable Energy Markets

Geopolitical tensions are likely to cast shadows over global markets and continue to be a risk factor demanding investors’ attention in the new year.

Ongoing conflicts in critical regions like Ukraine and the Middle East, combined with escalating hostility, particularly in the South China Sea, serve as potent catalysts for market fluctuations.

Market players must grapple with the reality that geopolitical upheavals, fueled by regional disputes and global power struggles, have the potential to disrupt market equilibrium and reshape global investment landscapes.

The energy sector remains vulnerable to sudden shifts driven by geopolitical factors. Oil prices could spike in the event of worsening geopolitical tensions and supply constraints in the Middle East.

Indeed, heightened tensions in vital regions such as the Red Sea or escalations involving key players like Iran could instantaneously drive energy prices upward, imposing fresh challenges on global economic stability and inflationary pressures.

Navigating through such intricacies of geopolitical tensions, supply constraints, and potential conflicts demands a comprehensive reassessment of investment portfolios, risk appetites, and market exposure.

5. U.S. Presidential Election Uncertainty

As the specter of the 2024 U.S. presidential election looms large, political uncertainties interlace with market dynamics.

The contrast and evolving narrative around potential candidates introduce another layer of complexity, with former President Donald Trump now the clear favorite to defeat Joe Biden according to polls and betting sites.

Trump currently holds an advantage of about five percentage points over Biden among registered or likely voters as the November 2024 election draws closer.

This makes Biden just the second sitting president since polling began to trail in his reelection bid at this point in the campaign. Over the past 80 years, incumbents have, on average, led their eventual challengers by a little more than 10 points about a year out from the election.

The impending electoral discourse could sway investor sentiment and influence strategic investment decisions, creating an atmosphere where political landscapes wield significant influence over market trajectories.

Taking that into account, the looming U.S. presidential election in 2024 casts its own shadow of uncertainty on financial markets.

What To Do Now?

The interplay of these five factors could significantly impact market movements, risk appetites, and investment strategies in 2024.

Staying attuned to these risks and their evolving nature remains imperative for investors seeking to navigate an uncertain terrain and mitigate potential pitfalls in the year ahead.

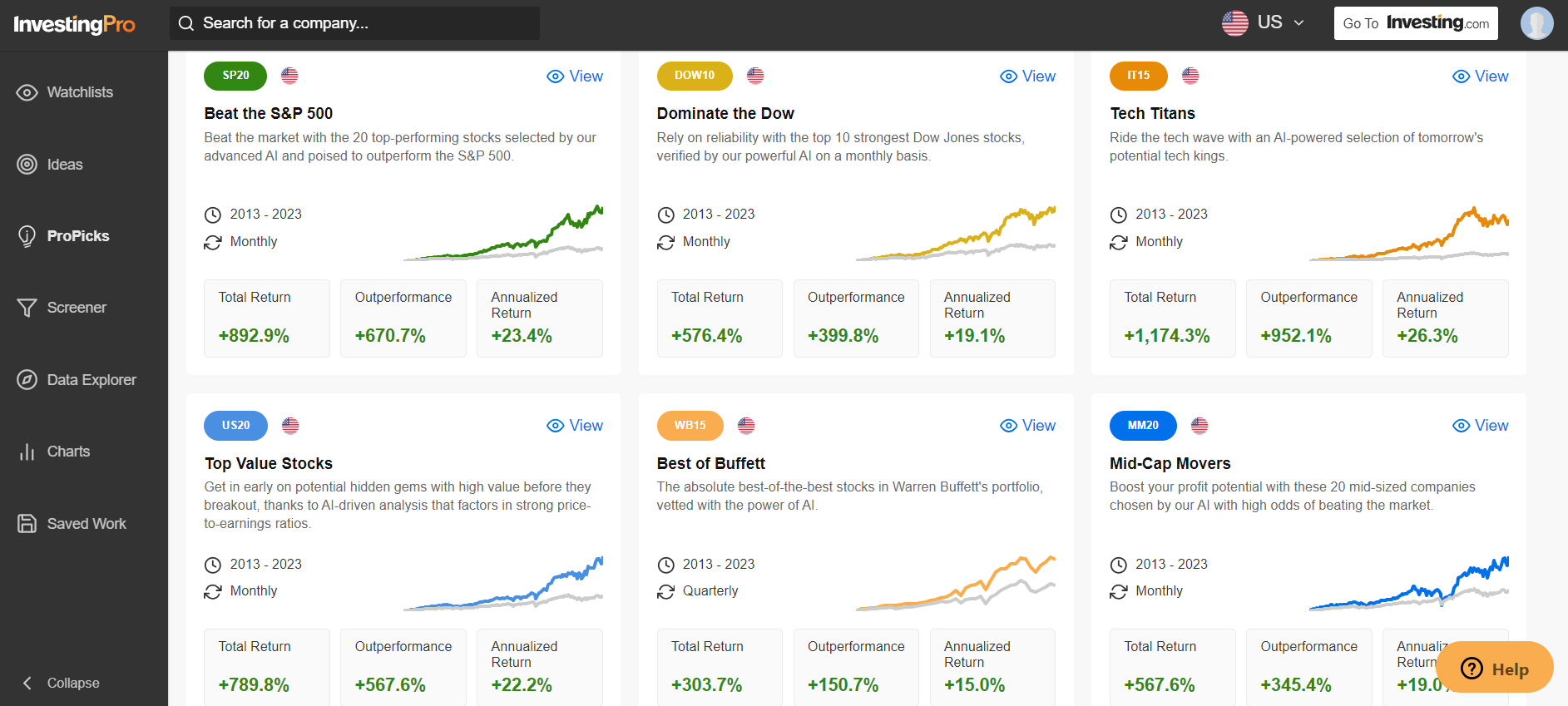

Be sure to check out InvestingPro to stay in sync with the latest market trend and what it means for your trading decisions.

Offering strategies tailored to different investor preferences and risk appetites, ProPicks caters to a wide range of investment styles so that you know what to potentially buy, and when to potentially buy it.

Source: InvestingPro

Source: InvestingPro

ProPicks is available to all InvestingPro subscribers. You can subscribe now, right here.

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.