3 Reasons Why the Fed Will Have to Be Even More Hawkish in 2024

2023.09.21 05:12

- The Federal Reserve paused its rate hiking campaign on Wednesday but signaled the potential for more tightening ahead.

- Soaring energy and food prices will make it harder for the Fed to bring inflation back down to its 2% goal.

- As such, the market needs to brace for the possibility of even more rate hikes in 2024.

- Looking for a helping hand in the market? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

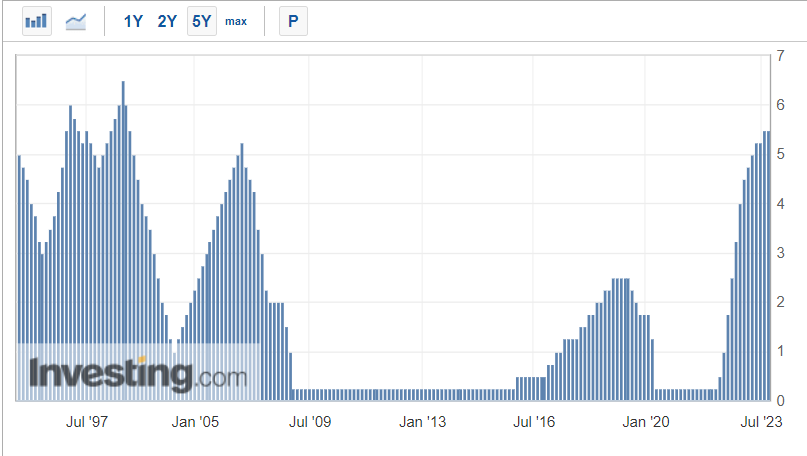

The held its benchmark interest rate unchanged in a widely expected decision on Wednesday and struck a hawkish tone as the central bank’s ongoing battle against inflation appears to be far from over.

FOMC officials said they still see one more 25 basis point rate hike before the end of this year, with the Fed funds target rate peaking in the 5.50%-5.75% range.

The U.S. central bank also warned of much tighter monetary policy through 2024 than previously expected.

“We are in a position to proceed carefully as we assess the incoming data and the evolving outlook and risks,” Fed Chair Jerome Powell said in a press conference after the release of the statement and projections.

“We’re prepared to raise rates further if appropriate, and we intend to hold policy at a restrictive level until we’re confident that inflation is moving down sustainably toward our objective,” Powell stated.

Yet suddenly, some inflation alarms are ringing again amid a furious rally in energy and food prices. Indeed, a lasting spike in fuel and food costs would unravel progress on the inflation front, potentially forcing the Fed to continue its rate-hike campaign for longer than currently expected.

1. Oil Rising Back Towards $100

The recent surge in oil prices is making the Federal Reserve’s path toward a 2% inflation target much more difficult.

, the U.S. oil benchmark, briefly rose above $92 per barrel earlier this week for the first time since November 2022, sparking fears that a significant source of inflationary pressure is starting to pick up again.

In fact, oil prices have rallied more than 30% since late June amid ongoing supply cuts by Saudi Arabia and Russia, which are putting a squeeze on the market.

Wall Street analysts are starting to talk about $100 oil if positive momentum in the energy market continues.

If crude prices keep going higher and reach triple-digit territory, that could be a problem as rising energy prices tend to increase input costs for goods and services, making everything more expensive.

“Energy prices being higher is a significant thing,” Powell said on Wednesday, adding that higher, sustained energy prices over time can affect consumer spending.

2. Gasoline Prices Are Surging Again

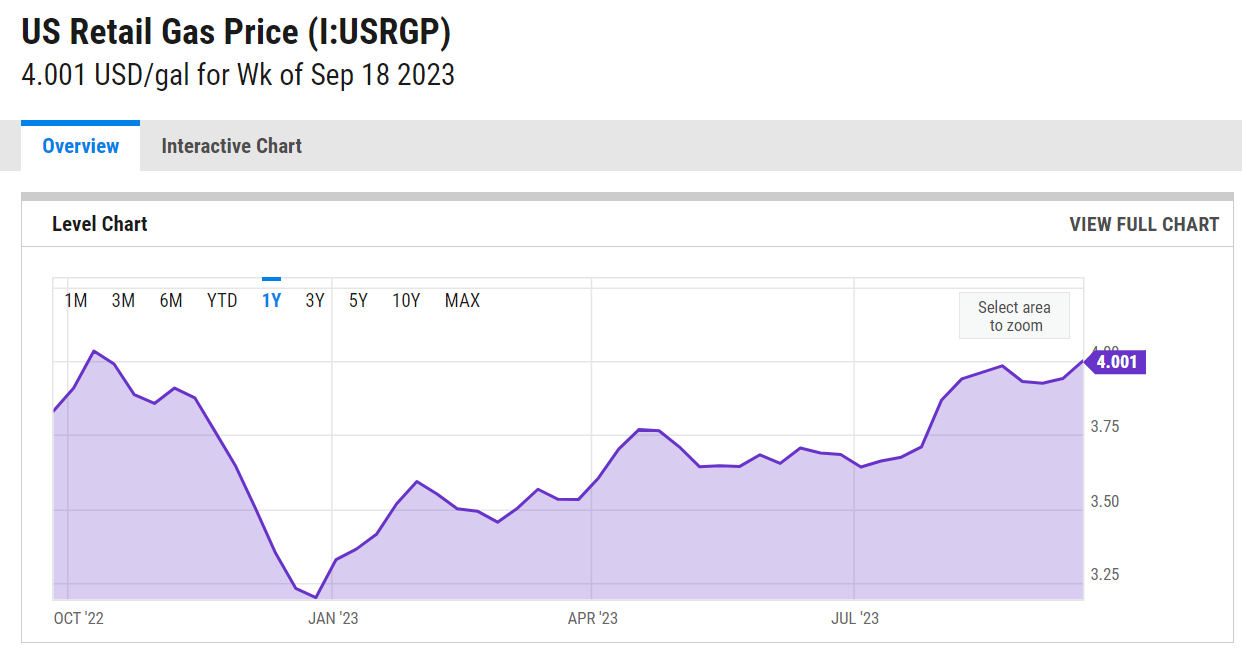

Prices at the gas pump are suddenly surging, causing headaches for U.S. consumers and Fed officials alike.

prices have increased nearly 9% in the past two months in what has been a rare late summer rally, adding to the view that headline inflation will reaccelerate in the coming months.

The national average price for a gallon of unleaded gasoline climbed to an 11-month high of $4.00 on Wednesday, which according to AAA, is a seasonal record on a trailing 12-months basis.

In California, gas prices have soared more than 10% in just the last month to an average of $5.79 per gallon, the highest since October 2022.

It is unusual to see gas prices moving higher at this time of year, as the end of the U.S. summer driving season tends to weigh on demand.

The worrying trend is, to some extent, now at the mercy of Mother Nature as hurricane season looms. Analysts have warned that a major hurricane that strikes the key U.S. Gulf Coast region could lift national gasoline prices to $4.50 or even $4.75 a gallon.

3. Food Commodities Are Rallying

It’s not just oil and the energy-related commodities that have been piling on to their robust gains in recent weeks.

have gone parabolic recently, rallying to extremely high prices as bad weather conditions in Florida and diseases in crops have left many oranges unusable. Prices of the breakfast beverage are now up 22% in the last three months.

Meanwhile, and are also some of the best-performing assets right now, with both climbing to fresh all-time highs this week as worries about tight U.S. supplies going into next year continued to fuel the bull market. As such, expect beef prices to get more expensive at the grocery store.

Elsewhere, prices of other agricultural commodities such as , , , , and , have also been trending higher, adding to evidence that food inflation is reaccelerating.

Indeed, the Invesco DB Commodity Index Tracking Fund (NYSE:) – one of the sector’s main ETFs – has rallied 14.3% since June 1 to reach its best level since December 2022. The , for its part, is up 5.2% over the same timeframe.

Looking at weather conditions, a U.S. government forecaster said last week there was a more than 95% chance that the El Nino weather pattern would continue through to March 2024, triggering more extreme conditions that could potentially disrupt global food supplies.

Key Takeaway

Rising prices for oil and food, which the Fed’s rate increases do little to control, may have more sway on inflation in the coming months. I wouldn’t be surprised to see inflation potentially picking up from here, with headline rising back towards 5% in the months ahead.

That obviously will throw a wrench into the Fed narrative of potentially pausing for the time being. Taking that into consideration, stubborn inflation may force Fed Chair Powell to raise rates further and leave them higher for longer.

***

Sign Up for a Free Week Now!

Disclosure: At the time of writing, I am long on the via the SPDR Dow ETF (DIA). I also have a long position on the Energy Select Sector SPDR ETF (NYSE:) and the Health Care Select Sector SPDR ETF (NYSE:). Additionally, I am short on the S&P 500, , and via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.