3 Imminent Breakouts Gold Investors Should Not Miss

2024.10.22 04:54

and broke out again late last week.

Gold closed above $2700 last Thursday, and Silver followed Gold’s breakout with one of its own.

Last Friday, Silver closed above $33, surpassing resistance at $32.50, which had held Silver since the middle of May. The breakout from a rough inverted head-and-shoulders continuation pattern projects to a target of $38!

This is quite exciting for the precious metals sector, but here are some additional potential breakouts to watch.

1. Inflation-Adjusted Gold Price

First is the inflation-adjusted Gold price. This is significant because it is the best indicator for gold miners over long periods of time.

Data from MacroTrends shows Gold against the CPI is closing in on a 45-year breakout. The data from the top chart is not updated yet, but if it were, it would look quite similar to the MacroTrends version.

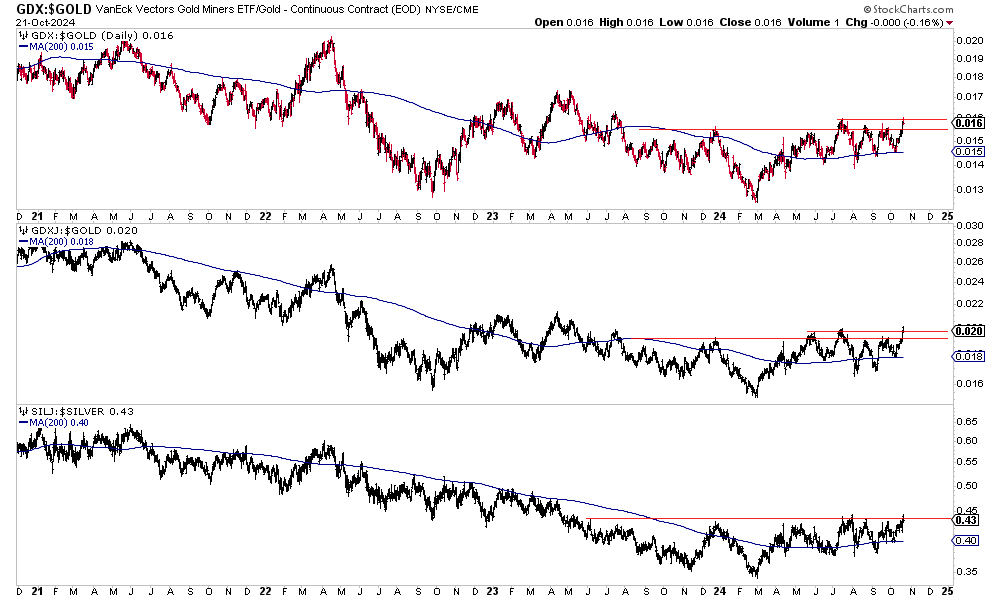

2. Miners

Next up are the miner ETFs against their respective metals.

We plot VanEck Gold Miners ETF (NYSE:) (top) and VanEck Junior Gold Miners ETF (NYSE:) (middle) against Gold and Amplify Junior Silver Miners ETF (NYSE:) against silver at the bottom.

The gold stocks are very close to breaking out against Gold, and the same can be said about the silver stocks breaking out against Silver.

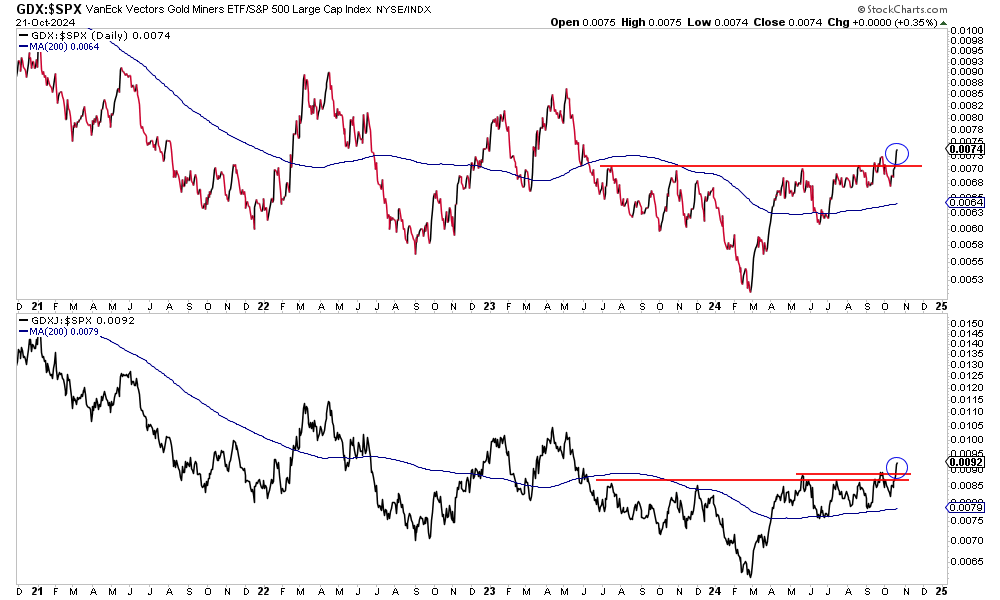

3. Gold Vs. S&P 500

Finally, we plot the gold stocks against the .

Gold stocks have broken out to new 16-month highs against the stock market.

The precious metals sector is becoming more overbought, but plenty of charts show this move has a long way to go.

The breakout in the inflation-adjusted Gold price has tremendously bullish implications over the coming years.

The strengthening of gold and silver stocks against the metals and also against the stock market has bullish implications over at least the next 12 months.

To invest in gold and silver stocks, continue to focus on quality assets and value. A few months ago, I emphasized quality more, but now I focus more on value.