2 Reasons Why March Is the Graveyard of Stock Market Predictions

2023.03.20 08:48

- March has historically been a graveyard for stock market predictions

- As the situation in global markets grows increasingly uncertain, could we be looking at a repeat?

- While the Fed could potentially calm markets down by slowing the rate cycle later this week, investors should brace for more volatility

Throughout history, there have been countless instances where famous analysts or companies in the sector have made predictions with great conviction and then turned out to be dead wrong.

Since we are in March, here are two that happened this month and were among the most talked about:

1. On March 16, 1930, Julius H. Barnes said,

“The spring of 1930 marks the end of a period of great distress. American business is returning to a normal level of prosperity.”

The Depression would last another nine years.

2. On March 9, 2000, the closed above 5000 for the first time. Famed analyst Ralph Acampora of Prudential Securities predicted that the index would reach 6,000 in 12 to 18 months.

A year later, the Nasdaq had fallen -59% to 2052.

Now, as the global banking system comes under pressure due to several bank failures and with the Fed stuck between a rock and a hard place when it makes its this week, could we be looking at a similar scenario?

Let’s take a deeper look.

The Onset of Panic

1. Credit Suisse

Credit Suisse’s (NYSE:) share price has been declining for several years due to reputational scandals, the collapse of the U.S. hedge fund Archegos and the Anglo-Australian financial services firm Greensill, and many changes in top management.

All this led to a loss of 7.4 billion euros in 2022, almost five times more than in 2021 when it lost 1.6 billion euros. The mistrust continues, and with it, the flight of customers and money from the bank.

The Swiss National Bank has had to inject liquidity to help the bank. However, the cost of insuring against a default on Credit Suisse’s five-year debt doubled on Friday compared to the beginning of the week.

On Sunday, finally, UBS (NYSE:) agreed to acquire Credit Suisse for 3 billion Swiss francs ($3.23 billion), and take on potential losses of up to $5.4 billion in a quick merger orchestrated by Swiss authorities.

2. SVB

The U.S. bank was bailed out after a large portion of its customers, mostly technology companies, withdrew their money, and there was a run. It didn’t help that the bank suffered losses of $1.8 billion on the sale of part of its bond portfolio.

The regulator shut the bank down when they saw that the demand for repayment of money was much higher than the bank’s liquidity at the time. They did the same with Signature Bank.

3. First Republic

The largest U.S. banks swooped in to rescue First Republic Bank with an avalanche of cash totaling $30 billion. JPMorgan Chase (NYSE:), Citigroup (NYSE:), Bank of America Corp (NYSE:), and Wells Fargo (NYSE:) each put in $5 billion.

Morgan Stanley (NYSE:) and Goldman Sachs (NYSE:) contribute $2.5 billion each, while five other banks contribute $1 billion each.

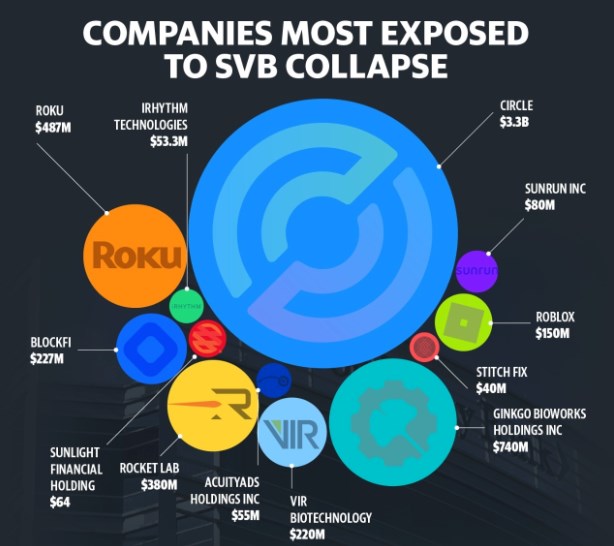

The following chart shows the companies most exposed to the SVB.

Companies Most Vulnerable to SVB Collapse

Source: Reuters

The Federal Reserve and the FDIC assured that they would guarantee deposits at the two institutions. It is worth remembering that many companies had uninsured deposits at SVB (93.9% of the bank’s assets exceeded the FDIC limit).

The banks with the highest exposure to uninsured deposits (FDIC guarantees up to $250,000 per account per customer) include the following:

- Bank of New York Mellon (NYSE:) 96.5%

- SVB Financial Group 93.9%

- State Street Corp (NYSE:) 91.2%

- Signature 89.7%

- Northern Trust Corporation (NASDAQ:) 83.1%

- Citigroup Inc (NYSE:) 77%

- HSBC (NYSE:) 72.5%

- First Republic Bank (NYSE:) 67.7%

- East West Bancorp (NASDAQ:) 65.9%

S&P 500 Withstands the Onslaught, For Now…

Since 1950, the has delivered a positive total return in 57 of 73 years (78% of the time), despite an average intra-year decline of -13.8%. There is no reward without risk.

The market moves a lot, and it moves down a lot too. You have to accept that and get used to it. Otherwise, stay out. If the S&P 500 does not make a new all-time high in 2023, it will be the first year since 2012 without at least one all-time high.

Investors have gotten used to that in recent years. The number of times the S&P 500 made all-time highs in a year over the last decade:

- Year 2013: 45

- Year 2014: 53

- Year 2015: 10

- Year 2016: 18

- Year 2017: 62

- Year 2018: 19

- Year 2019: 36

- Year 2020: 33

- Year 2021: 70

- Year 2022: 1

Anyway, since 1929, it was “normal” to see years without a historical high in the S&P 500, there have already been 50 years, and in 2023 it could be 51.

Both the U.S. () and European banking indexes () reflect all that is happening, and both coincidentally began to plummet when they hit their respective resistance.

Stoxx 600 Banks Daily Chart

Stoxx 600 Banks Daily Chart

Meanwhile, the index rose 5.8%. This was the best week since November. The four largest technology companies added more than $560 billion in market value.

Microsoft Corporation (NASDAQ:) rose more than +12.4%, its biggest weekly gain since April 2015, and closed at its highest level since August.

Alphabet (NASDAQ:) rose +12.1%, its biggest weekly gain since 2021, Amazon (NASDAQ:) rose +9.1%, and Apple (NASDAQ:) rose +4.4%.

The S&P 500 also posted a weekly gain of +1.4%. The financial sector was the worst performer, with First Republic Bank plunging more than -70% for the week. Regional Banking (NYSE:) lost -15%, its second consecutive double-digit weekly loss.

Investor Sentiment (AAII)

Bullish sentiment, or expectations that stock prices will rise in the next six months, fell 5.6 percentage points to 19.2%. The last time optimism was lower was on September 22, 2022 (17.7%). It remains below its historical average of 37.5%.

Bearish sentiment, or expectations that stock prices will fall in the next six months, rose 6.7 percentage points to 48.4%. It is also above its historical average of 31%.

***

Disclosure: The author does not own any of the securities mentioned.