10-Year Treasury Yield’s Break Above 4.35% Is Worrisome

2023.09.25 04:50

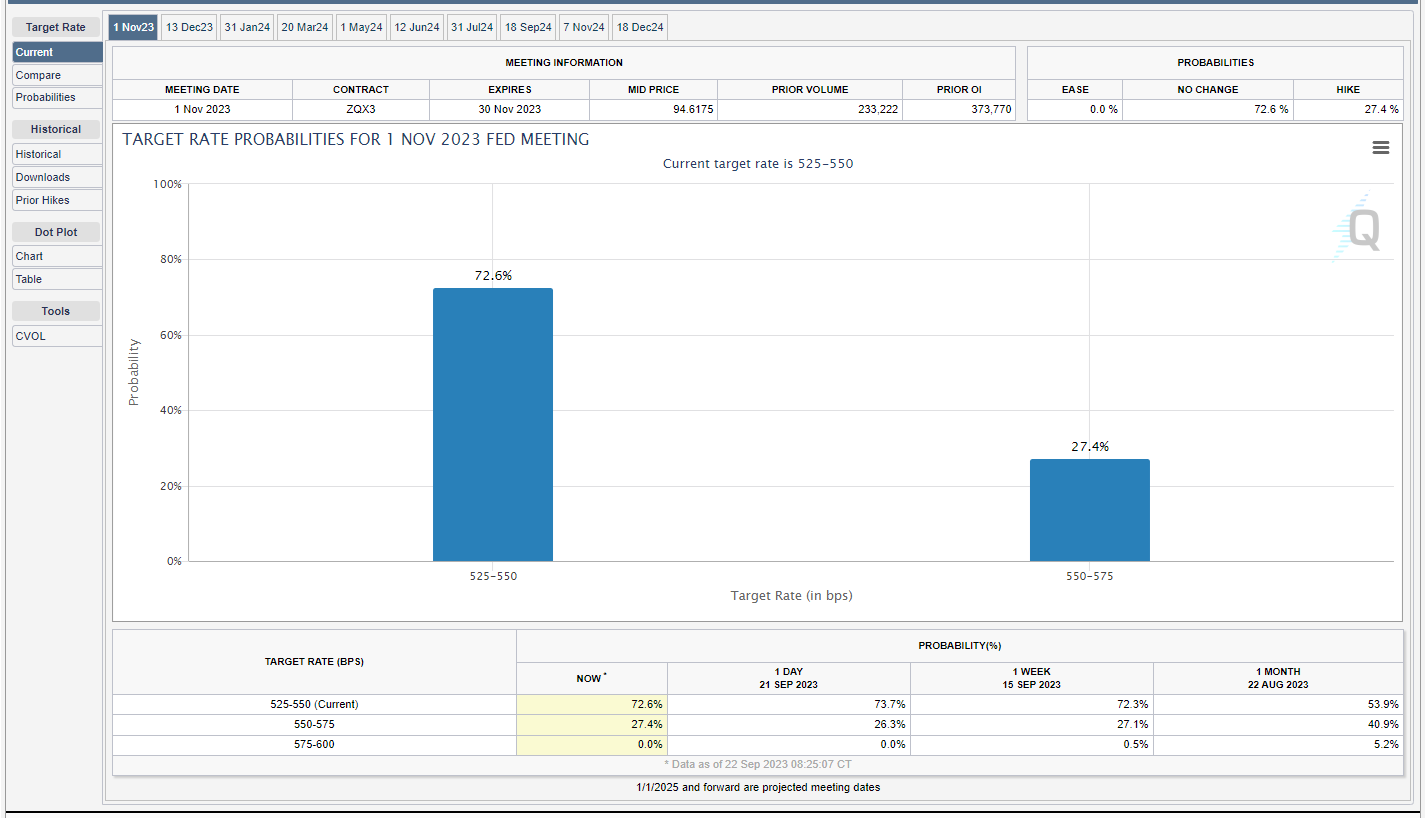

Target Rate Probabilities

Target Rate Probabilities

Despite the commentary around Jay Powell’s “hawkish commentary” at the Wednesday, September 20th, ’23 FOMC presser, the odds that the FOMC will maintain the current fed funds range of 5.25% – 5.50% increased sharply after the meeting, from below 50% to this morning’s (September 22 ’23) probability of 72.6%. (Source: CME FedWatch tool.)

It’s easy for Jay Powell and the Fed members to “talk tough” – it’s a far cheaper and easier way to conduct monetary policy.

The bully pulpit is always the most convenient way to keep the community on edge.

When you listen to the mainstream financial media, it seems like the mantra “higher for longer” automatically means there will be additional fed funds rate hikes down the road, but don’t automatically assume that’s the case. “Higher for longer” means the Fed could maintain the fed funds rate at its current level and let the economy weaken, in order to get inflation down to the 2% range.

Larry Summers, who has become the quasi-Bloomberg spokesman on nearly every topic (David Westin seems to have Larry on every weekend) made an interesting point this weekend: either the Fed will be wrong on inflation, and it will tick higher, or the Fed will be wrong on the economy (economic output) and it will weaken in the next few months. (Larry’s comments are paraphrased to make the point.)

It’s a heck of a way to run a $25 trillion economy: having been in the business for almost 35 years, the Fed is either easing to improve economic growth or tightening to slow inflation and economic growth, always to overshoot an invisible mid-point that can never be achieved.

Since the majority of this blog’s posts are written on the weekend and after market hours when the TV gets unmuted in the office corner, it was noted this weekend that David Rubenstein, the co-founder of the Carlyle Group (NASDAQ:), who now has his own Bloomberg TV show entitled Bloomberg Wealth, interviewed Kim Kardashian this weekend on the success of the Kardashian brand success.

The world has officially broken.

Bespoke Charts:

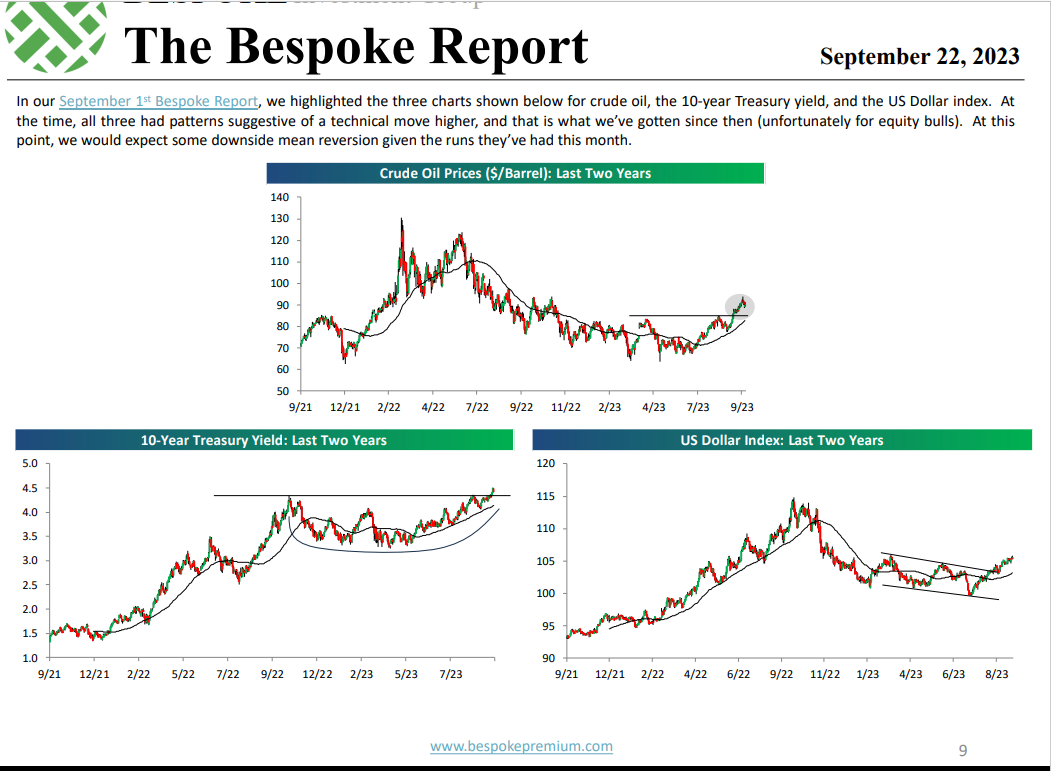

This page was lifted from the Bespoke Report this weekend, September 22, 2023:

Bespoke: Interest Rate Dollar Crude Charts

Bespoke: Interest Rate Dollar Crude Charts

If you want to boil the current market down to three key variables, the , the price of , and are a great start.

If crude oil and the dollar break lower, it might bring the 10-year Treasury yield back under 4.36%.

You have to respect the technicals though: living through brutal bear markets teaches you that painful lesson.

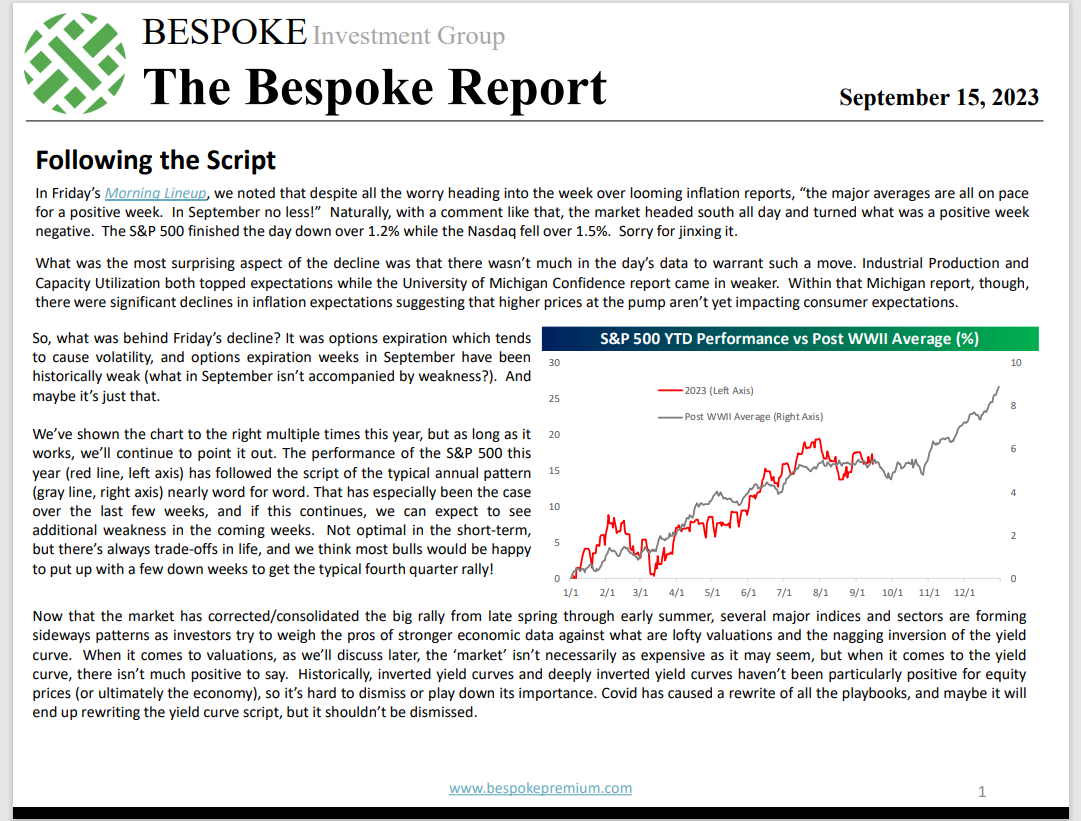

Bespoke: Avg Market Year Path

Bespoke: Avg Market Year Path

Source: Bespoke Charts

Despite, the financial media commentary, the and weakness since July 31 ’23 can still be seen or interpreted as entirely “seasonal”.

The market is following the typical yearly path given in the above Bespoke chart from 9/15/22.

Stay flexible and nimble.

S&P 500 Earnings:

- The forward 4-quarter estimate (FFQE) this week, slipped to $232.63 from last week’s $233.69;

- The PE ratio on the forward estimate fell 18.5x from last week’s 19x thanks to the 2.93% decline in the SP 500 this week;

- The S&P 500 earnings yield rose to 5.38% from last week’s 5.24%, and the early January high of 5.86%;

- If the post-October 1 forward 4-quarter estimate is used (and the quarterly bump is already here), the S&P 500 earnings yield jumps to 5.55%.

- After October 1, the FFQE covers the period Q4 ’23 through Q3 ’24, and in EPS terms, (as of today), the FFQE is $239.69;

- The upside surprise rates for Q2 ’23 are unchanged from the last weeks with EPS +7.9%, and revenue +1.7%.

- Per the IBES data by Refinitiv, there is only 1 S&P 500 component left to reports Q2 ’23 financial results.

This coming week, Nike (NYSE:), Micron Technology (NASDAQ:) and Costco (NASDAQ:) report their August ’23 quarterly financial results.

Summary/conclusion: S&P 500 earnings in terms of the numeric revisions have dried up for a few weeks, and won’t restart until October 10th or so when the bigger banks start to report.

Very few realize that – as of today – the S&P 500 is expecting 12% EPS growth in 2024, up from what will likely be 1% – 2% growth for 2023 once the majority of Q4 ’23 reports end in February ’24.

Here’s the chronology as it stands right now:

- 2025: expected +12% SP 500 EPS growth

- 2024: expected 12% SP 500 EPS growth

- 2023: expected 1% SP 500 EPS growth

What’s interesting is that for this year, the S&P 500 was expected to grow EPS by 4% until around January 20th, 2023, and then by early February ’23, the estimates dropped to a 1% – 2% expected growth rate in S&P 500 EPS, and that expected growth rate has remained constant until today.

2024’s expected EPS growth of 12% was 8% – 9% through most of Q4 ’22 and then increased to 12% as of mid-February ’23 and has remained constant since then.

For 2025, it’s still way too early, so it’s really not worth commenting upon right now.

The point being to all of this is that S&P 500 estimates have remained fairly stable all year for 2023 and 2024, even with Silicon Valley Bank and the March ’23 banking issues.

The technical break above 4.36% in the 10-year Treasury yield is worrisome. We are in the middle of a secular bull market in stocks but potentially facing a secular bear market in bonds (i.e. Treasuries). S&P 500 earnings can grow nicely, the US economy can continue to grow at a 2% rate, and stocks could still struggle as higher interest rates act like a wet blanket on PE expansion.

***

Take everything here with substantial skepticism since it represents one person’s opinion. All S&P 500 EPS and revenue data is sourced from IBES data by Refinitiv. Past performance is no guarantee of future results.