Zoom Stock Looks Attractive Amid Extreme Bearish Sentiment

2022.11.22 14:08

[ad_1]

- Zoom stock is under pressure after the company reported its slowest quarterly sales growth on record

- The company is struggling to retain customers who are returning to their normal routines

- ZM’s latest earnings report shows some signs that Zoom’s pivot to enterprise clients is gaining momentum

Once a pandemic-era darling, Zoom Video Communications (NASDAQ:), is finding it hard to regain market interest. The San Jose, California-based company’s stock was down more than 6% on Tuesday morning after reporting its slowest quarterly sales growth.

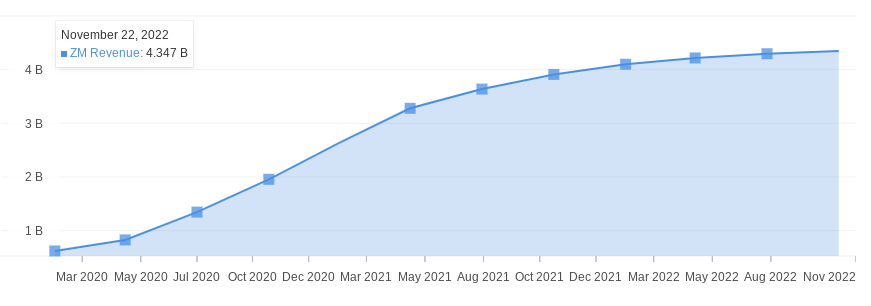

5% to $1.1 billion for the period that ended on Sept. 30, in line with analysts’ estimates. For the full year, the software company reduced its sales forecast to as much as $4.38 billion from its August projection of as much as $4.4 billion.

After becoming one of the most widely used internet tools during the pandemic, Zoom has struggled to retain customers returning to their normal routines. In the post-pandemic environment, more business and personal meetings are happening in real life, and those occurring online aren’t necessarily over Zoom.

The full-year sales guidance that Zoom issued late yesterday says that its revenue from online consumer and small business customers will decline by about 8%.

Source: InvestingPro

Seeing an uncertain path for the company to sustain these subscribers, especially when Zoom is facing fierce competition from Microsoft’s (NASDAQ:) Team, investors aren’t willing to bet again on ZM stock which is one of the worst-performers among the companies listed on the NASDAQ. The stock is down about 90% since reaching an all-time high of $565 about two years ago.

Despite this widespread pessimism and extremely bearish sentiment on the street, the company’s latest earnings report isn’t that bad. Some signs show that Zoom’s pivot to enterprise clients is gaining momentum.

After seeing the latest data, I believe the worst for ZM could be over.

Healthy Growth on Enterprise Segment

The company expects a healthy 20% growth in its enterprise business in the current fiscal year. In the period that ended Oct. 31, Zoom had 209,300 enterprise customers, an increase of 14% from a year earlier, making up a growing portion of total sales.

By the end of the quarter, Zoom had 3,286 customers contributing more than $100,000 in trailing 12-month revenue, an increase of 31% from the period a year earlier. Sales in the Americas region grew 11% while Europe, the Mideast, and Africa dropped 9% due to currency fluctuations.

Another positive sign that showed that the pace of slowdown in the small business segment is stabilizing, Zoom reported that the average monthly churn among those online customers was 3.1% in the fiscal third quarter, down from 3.7% in the same period last year.

Despite the post-pandemic challenges that Zoom is facing, I don’t see Zoom as a basket case with no future in the hybrid work environment. The company thrived during the pandemic due to its unique product, which is easy to use with many attractive functionalities.

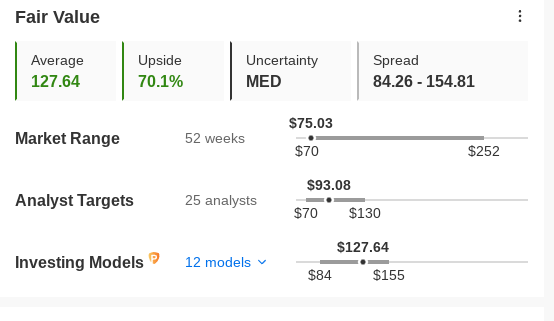

ZM Fair Value

Source: InvestingPro

Zoom is trying to use that same innovative mindset to grab market share in the enterprise market. The company announced earlier this month that it’s adding email and calendar features to its suite of tools to centralize more work on Zoom’s platform. The company’s new email and calendar tools can be linked with other popular providers like Alphabet’s (NASDAQ:) Gmail and Microsoft’s Outlook.

Persistent team video calls, billed as digital coworking spaces, will also be added to the platform in 2023, along with more advanced artificial intelligence tools, including call analytics and customer-facing chatbots.

In a recent note, JPMorgan expressed similar optimism on the long-term appeal of Zoom stock. Its note said:

“Our assessment is positive on Zoom’s underlying technology, continued innovation, and market position, and we are impressed by the cash-generative financial profile, though we believe these are offset by near-term growth and margin headwinds as Zoom pivots to optimize business mix and ramps spending to explore new avenues of growth as well as address competitive evolution.”

Bottom Line

Zoom stock may not regain its former pandemic-era glory. However, the company is rebuilding its business with a sharp focus on business clients by adding new features and products. This pivot may take time to pay off, but throwing this name in a rubbish bin could be a mistake.

Disclosure: As of this writing, the author has no positions in any securities mentioned.

[ad_2]