Zombies, Pandemics, Economic Meltdown: These Stocks Will Survive Any 2024 Crisis

2024.01.04 10:07

Increasing odds of rate cuts by the Fed next year have fueled optimism among many investors and analysts regarding the market’s direction. However, the year commences with heightened tension across various fronts, particularly in geopolitics.

The recent experience during the COVID period underscores the unpredictability of events, emphasizing the need for caution and preparedness for unforeseen circumstances.

Two significant geopolitical concerns loom large: the escalating conflict between Israel and Hamas, with the potential for wider repercussions, and Russia’s invasion of Ukraine, which poses the risk of evolving into broader, possibly global, conflicts.

Beyond these tangible threats, there are also less apparent risks to consider.

A Black Swan Event Is Always a Possibility

The rising likelihood of a massive hack, facilitated by advancements in AI, could disrupt global communication or transportation networks to varying extents.

This theme is explored in Netflix (NASDAQ:)’s latest blockbuster ‘Leave the World Behind’, which envisions such a scenario rapidly leading to a civil war situation.

In this respect, the US elections also represent a risk not to be overlooked, as American society is more divided than ever.

It should not be forgotten that Trump’s presidency ended in an attempted putsch, while his supporters attempted to storm Congress following his defeat, and given that he intends to run again this year, this is unlikely to reduce the divisions.

A catastrophe on a global scale could also find its source in the problem of the massive, and according to more and more economists, even unsustainable US debt, which recently exceeded $34,000 billion.

Now, many believe that the two ways out of this situation are either hyperinflation, via devaluation, or bankruptcy, if the country can no longer meet its debt repayments.

In either case, this would undoubtedly lead to the loss of the dollar’s status as the world’s reserve currency and an in-depth reorganization of the international financial system.

Also, a redistribution of the cards in terms of power on the international stage, with all the risks and uncertainties that this implies.

Last but not least, many scientists are warning that global ecology is close to several points of no return, and have warned that massive environmental climate disasters could occur over the next few years, which also constitutes a potential black swan.

To help investors prepare for the worst-case scenarios, in this analysis we review several potentially “apocalypse-proof” stocks, selected from areas likely to have the wind in their sails if the world heads towards a massive global crisis that would challenge today’s society.

Note, however, that the outlook for these stocks would undoubtedly change radically from current levels should an event of an “apocalyptic” nature actually occur.

1. Campbell Soup

In times of panic, one of the people’s first reflexes is to stock up on food that can be stored for a long time, and canned soups, including those from Campbell Soup Company (NYSE:), are popular choices, as we saw with the company’s surge in sales at the start of the Covid period.

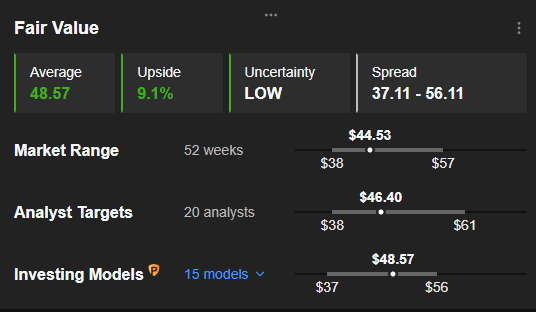

As for the outlook, InvestingPro Fair Value, which synthesizes 15 recognized financial models, suggests a bullish potential of 9.1% for CPB, while analysts forecast an average rise of 4.2% over a 12-month horizon.

Campbell

It’s also worth noting that Campbell Soup is a solid dividend stock, having paid out over the past 54 years, yielding 3.32% currently according to data available on InvestingPro.

2. Lockheed Martin

On a completely different note, defense company Lockheed Martin (NYSE:) is also probably one of the bets not to be overlooked, especially if a world war becomes (even) more likely.

The company is involved in almost every aspect of the US military-industrial complex, and is the world’s largest supplier of defense services, receiving more US government contracts than any other company.

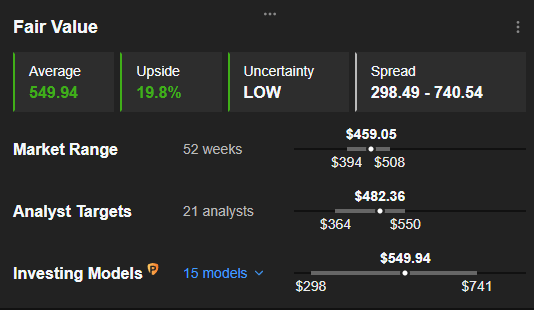

In terms of the medium-term outlook for Lockheed Martin shares, InvestingPro’s Fair Value of $549.94 reflects a potential upside of almost 20% on the current price.

Lockheed Fair Value

Source: InvestingPro

Analysts, on the other hand, are less optimistic, seeing an upside potential of 5%, but we must also take into account dividends, which currently represent an annual yield of 2.74% on InvestingPro.

3. Iridium Communication

Communication will also be of paramount importance in the event of a world-changing event, and here the shares of Iridium Communications (NASDAQ:) could stand out in a worst-case scenario.

The company operates the Iridium satellite constellation, a network of 66 satellites orbiting the Earth that facilitate voice and data communications from satellite cell phones and other transceiver units.

What’s more, Iridium Communications is currently the only company to offer voice and Internet access services covering 100% of the planet. As a result, the Iridium network should remain operational even if terrestrial communications are wiped out.

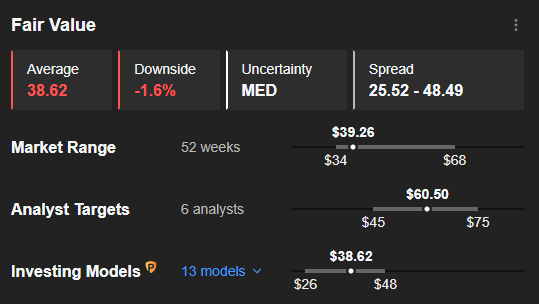

It should also be noted that the stock is currently correctly valued according to InvestingPro models, with a fair value of $38.62, 1.6% below the last known price.

Iridium Fair Value

Source: InvestingPro

Analysts, on the other hand, are far more optimistic, with an average 12-month target of $60.5, more than 54% above the current price. In addition to this potential, the dividend is quite modest, representing an annualized yield of 1.74%.

4. Smith & Wesson

Several worst-case scenarios, particularly those involving a possible civil war or extreme social tensions, could also benefit firearms manufacturers, especially if the public finds that law enforcement agencies are overwhelmed, and crime soars.

In this respect, Smith & Wesson Brands (NASDAQ:) is an ideal choice, having manufactured several famous handguns and rifles since it started business in 1856, and whose sales will undoubtedly benefit greatly from an economic and social collapse.

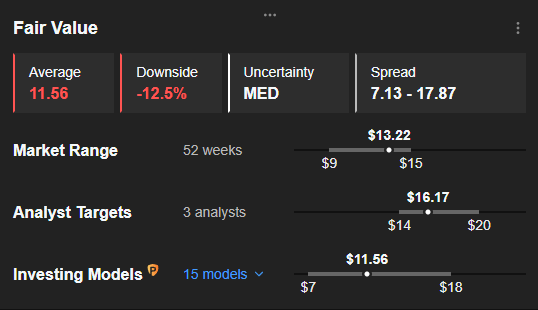

Concerning the outlook, Smith & Wesson’s InvestingPro Fair Value, which synthesizes 15 financial models, indicates a downside risk of 12.5% for the share.

Smith and Wesson Fair Value

Source: InvestingPro

Analysts, on the other hand, anticipate a 22% rise in the share price over the next 1 year. In addition, SWBI investors receive a comfortable dividend equivalent to an annual yield of 3.63%.

5. Amazon

Finally, if the experience of the coronavirus pandemic is anything to go by, online retail giant Amazon (NASDAQ:) could also be a good choice.

Most products imaginable are available on Amazon, and it’s a safe bet that online purchases will soar if it becomes risky (or impossible) to leave home.

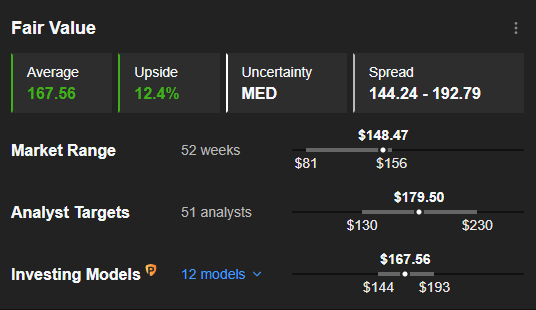

What’s more, the stock should rise by 12.4% on a fair value basis, while analysts see a potential upside of 21%.

Amazon Fair Value

Source: InvestingPro

Unlike the other stocks on this list, however, Amazon does not pay dividends.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship “Tech Titans,” which outperformed the market by 670% over the last decade.

Join now for up to 50% off on our Pro and Pro+ subscription plans and never miss another bull market by not knowing which stocks to buy!

Claim Your Discount Today!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.