Yesterday, Today and Tomorrow of Retail Trading

2023.01.12 06:32

[ad_1]

The post-COVID-19 world saw a retail trading boom. However, a lot has changed since then, subsequently affecting traders’ attitudes. As a result, some go-to rules like “buy the dip” don’t seem that relevant anymore. Today, retail traders switch to selling assets and choose to be more careful with long trades. But even with all the changes, the market’s overall trend in retail trading may still surprise you.

Read the text below to learn what the FBS analysts think of what’s happening to retail trading today. Supported by research data and survey results, this expert material will also review the recent past of retail trading and help you take a peek into its possible future.

Yesterday

Since the financial markets emerged, retail traders, individuals that access the market through brokers, have been considered low-skilled actors with little to no chances for long-term success. Massive retail trading volumes are often linked to such drastic market events as deep corrections, crises, or even crashes.

SPX Monthly Chart

Over the last century, one of the most significant corrections ever witnessed by the US stock market happened when retail traders rushed to buy every single stock they came across with. The most recent crises – the dot-com bubble and the 2008 market crash – gutted the wallets of numerous unfortunate retail traders.

The story is always the same: high on euphoria, retail traders rush into the market just before a crisis kicks in. People want to get rich here and now: appetites grow, volumes increase, while risks get ignored. That’s a recipe for disaster.

Retail Chart

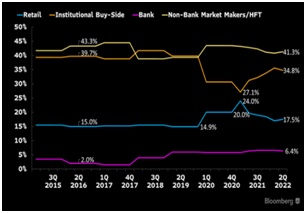

Something similar happened in 2020-2021 when trillions of dollars were injected into the financial system. Bloomberg analysts found that in late 2020 and early 2021, almost 25% of trading volume belonged to retail trading, while institutional investors (e.g., banks and funds) became less active.

After the Federal Reserve started the tightening process in late 2021, the market share of retail traders shrank significantly, almost reaching the initial 15%. At the same time, institutional traders became more active, which made the overall picture look pretty much like before 2020.

Today

Before moving on with predictions and forecasts, let us first see where we’re at and assess how Forex and crypto trading activity has changed over the recent years.

Forex And Crypto Trading Activity

With a daily volume of $6 trillion, Forex is an enormous market. It is unlikely to be significantly affected by retail trading. The cryptocurrency market, on the contrary, used to be mostly the domain for retail trading before the mass adoption started. However, between 2020 and 2022, crypto met new institutional investors, hedge funds, and banks.

With over 24 million active traders, FBS has enough data to analyze the market and give a shortlist of which instruments retail traders choose most often. Starting with the Forex market, FBS clients mostly prefer , , , , , and . Surprisingly enough, EURUSD is the most popular instrument among all regions except for Thailand, where gold (XAUUSD) is traders’ top choice.

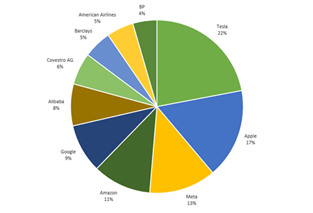

Over the last two years, retail traders still choose the same instruments in trading Forex, metals, cryptocurrency, and even stocks. Despite unique events like the pump of GME stock or the crash of LUNA cryptocurrency, the leaders stay the same, with Tesla (NASDAQ:) as the hottest stock of 2020-2022. Add Apple (NASDAQ:) and Meta, and you will get three companies taking more than 50% of trading volume, showing that traders prefer more volatile and popular technology stocks.

Forex And Crypto Trading Activity

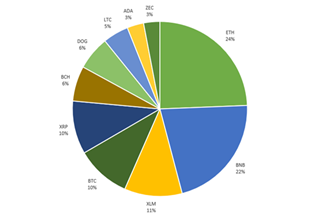

A curious fact about the crypto market: doesn’t even make a top three list. The world’s main crypto humbly sits behind , , and Stellar. Still, the overall distribution of the most popular cryptocurrencies is predictable, with only the most popular and old coins on the list.

Tomorrow

With issues including record-high , Fed’s hawkish policy, and recession on the global markets, the month-to-month decrease in real wages is expected to continue. If previous crises even taught us something, that would be the fact that the problems never dissolve quickly, meaning that we’re in for new record-hitting inflation highs in years to come.

FBS expects several changes to come over the next year. First is the overall decrease in retail trading volumes, as people have less money and cut their spending on investing and trading activities. The cryptocurrency market may face the harshest decline in trading volumes as the crypto industry’s appeal has been undermined.

Second, a cooldown of traders’ sentiment will persist for a long time. After massive liquidations, traders will be more cautious and not rush into buying every uptrend correction. However, this effect will fade over time like it did many times before.

[ad_2]