Yen steady, Asian stocks weak as wild week winds down

2024.07.25 23:09

By Kevin Buckland

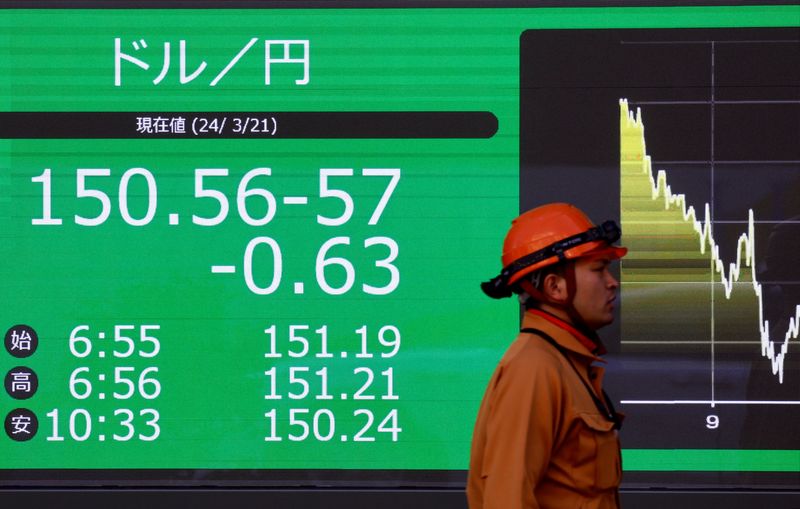

TOKYO (Reuters) – The yen stabilized near a 12-week high against the dollar on Friday while Asia-Pacific equity markets remained on the back foot a day after their worst session since mid-April.

Regional stocks took their cues from Wall Street, where the and tech-heavy Nasdaq slipped further after Wednesday’s frenetic selling.

MSCI’s broadest index of Asia-Pacific shares fell 0.55% on Friday, extending the 1.88% tumble from the previous day.

Taiwan’s stock benchmark slumped 3.3% as it reopened from a two-day closure due to a typhoon.

eased 0.07% after failing to sustain earlier gains.

However, some markets rebounded, with Hong Kong’s up 0.74% and Australia’s benchmark adding 0.85%.

U.S. stock futures also pointed higher, with rising 0.36% and Nasdaq futures advancing 0.45%.

U.S. economic data from overnight gave some cause for optimism, with economic growth faster than expected in the second quarter and inflation cooling. That helped dispel worries that the expansion was in danger of an abrupt end, while also supporting wagers for a Federal Reserve interest rate cut in September.

Friday’s release of the PCE deflator, one of the Fed’s preferred price gauges, will be “the next test, and arguably climax to the week’s trade,” said Kyle Rodda, a senior market analyst at Capital.com.

“There are concerns about upside risk to the current consensus estimate for the PCE Index,” Rodda said.

“While a modest upside surprise wouldn’t necessarily derail the path back to the target of inflation, it could impact the expected timing of the first (Fed) cut and the number of cuts that could come over the next six months. That could rattle the markets at a time when sentiment is already a little cautious.”

Safe-haven demand for the yen cooled overnight, and an unwinding of long-held bearish bets lost steam after the Japanese currency gained 2.4% this week against the dollar, putting it on track for its best performance since late April.

The dollar last traded 0.28% lower at 153.525 yen, after dropping as low as 151.945 on Thursday for the first time since May 3, and then springing back by the end of the trading day.

The area between 152 and 151.80 has proved to be “a brick wall of demand,” said IG analyst Tony Sycamore.

“We continue to expect this support level to hold, with a squeeze back toward 155.30ish not out of the question ahead of Wednesday’s Bank of Japan meeting,” Sycamore said. “After that, all bets are off.”

The Bank of Japan and the Fed announce policy decisions on July 31.

The rate futures market has priced in a 67.2% chance that the BOJ will raise rates next week by 10 basis points (bps), up from a 40% chance earlier in the week, according to LSEG estimates.

Markets see only a slight chance for a Fed rate cut of at least 25 bps next week but are fully pricing in a September reduction, according to CME’s FedWatch Tool.

U.S. two-year Treasury yields eased slightly in Asian hours to 4.4389% but were well off the overnight low of 4.34%, a level last seen in early February.

The 10-year yield was down slightly at 4.2466%.

Elsewhere in currency markets, the euro rose 0.11% to $1.0857 and sterling added 0.1% to $1.2863.

Oil prices rose slightly as the stronger-than-expected U.S. economic data raised expectations for increased crude demand from the world’s largest energy consumer.

futures for September rose 7 cents to $82.44 a barrel. U.S. West Texas Intermediate crude for September increased 4 cents to $78.32 per barrel.