WTO Rules Against US Tariffs on Steel, Aluminum Imposed by Trump

2022.12.08 15:24

[ad_1]

(Bloomberg) — The World Trade Organization said the US violated trade rules when it imposed steel and aluminum tariffs that former President Donald Trump said were necessary to protect America’s national security, according to an email from Norway’s Foreign Ministry.

Such a ruling, which has yet to be confirmed by the WTO, would undermine one of Trump’s most controversial trade decisions. It could also increase pressure on President Joe Biden to reconsider a series of internationally unpopular tariffs aimed at protecting US manufacturing jobs in swing state voting districts.

The Norwegian government sent out an email announcing the decision, but a spokesman declined to comment further because the report hasn’t yet been published by the WTO. In Geneva, a WTO spokesperson also withheld comment.

Such a ruling is unlikely to impact American metal producers because the US can effectively veto it by lodging an appeal at any point in the next 60 days. WTO appeals cannot currently be heard, because the Trump administration paralyzed the appellate body in 2019.

National Security Claim

The dispute started in 2018, when Trump deployed a little-used Cold War-era law known as Section 232 of the Trade Expansion Act of 1962, which allows the president to adjust imports if the Department of Commerce finds evidence of a national-security threat from foreign shipments.

The Trump administration moved forward with the tariffs despite a warning from former US Defense Secretary James Mattis that the duties were not necessary for the US to meet its “national defense requirements” and may have a “negative impact” on America’s allies.

China, the European Union, Turkey and a half-dozen nations — Canada, India, Mexico, Norway, Russia, and Switzerland — lodged concurrent disputes at the WTO that argued the measures violated their basic WTO rights. The EU and a handful of nations also retaliated with tariffs against billions of dollars worth of US exports.

Back then, the US argued the WTO couldn’t resolve the dispute because the measures were necessary to protect sovereign American security interests, and thus permitted under a WTO exemption that allows governments to take “any action which it considers necessary for the protection of its essential security interests.”

Muted Economic Impact

The WTO ruling is unlikely to have an immediate impact on US steel and aluminum producers like Nucor Corp (NYSE:)., Steel Dynamics (NASDAQ:) Inc., Reliance Steel & Aluminum Co., and Alcoa (NYSE:) Corp.

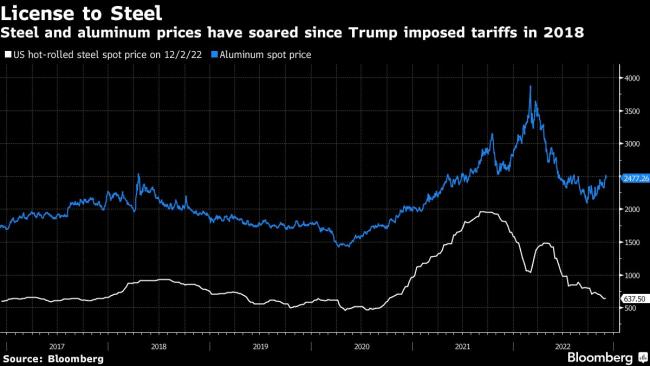

The tariffs provided an initial lift to US steel and aluminum prices back in 2018, but the market later mounted a scorching rally in 2021 generated by hamstrung supply chains that failed to keep up with stimulus-fueled consumer spending for everything from automobiles to toasters.

Now, rising economic headwinds and a softening market for construction are increasing pressure on the US metals industry, which has seen prices fall precipitously from levels reached in 2021.

[ad_2]

Source link