Workday Earnings Preview: Stock Set to Rally on Strong Demand?

2024.11.26 16:03

Workday (NASDAQ:) provides enterprise cloud applications in the United States and internationally. Its applications help its customers to plan, execute, analyze, and extend to other applications and environments to manage their business and operations. It serves professional and business services, financial services, healthcare, education, government, technology, media, retail, and hospitality industries.

WDAY Q3 2024 reports earnings at 4:01 PM ET Monday, Nov 26, 2024

|

WDAY Earnings Statistics from Q3 2013

|

|||

|

EPS |

1W % move post earnings |

2W % move post earnings |

1M % move post earnings |

|

BEATS 43 |

-2.28% |

-3.09% |

-2.57% |

|

MISSES 4 |

6.55% |

4.89% |

-0.02% |

43 beats since Q2 2013 4 Misses since Q2 2013

|

Analyst Ratings |

|||

|

SOURCE |

BUY |

HOLD |

SELL |

|

Refinitiv |

28 |

9 |

1 |

|

TipRanks |

22 |

6 |

1 |

|

Earnings Expectation |

|

|

EPS |

1.72 USD |

|

Revenue |

2.13B USD |

Price Performance:

|

Price Performance [Close 267.69 Nov 25, 2024]

|

|||

|

52-Week Range |

199.81 – 311.28 |

Volume |

3,351,100 |

|

1W |

2.55% |

Average volume |

1,775,375 |

|

1M |

11.74% |

|

|

|

3M |

2.96% |

|

|

|

6M |

24.51% |

|

|

|

YTD |

-2.21% |

|

|

|

1Y |

14.21% |

|

|

Fundamentals:

|

|

|||

|

Market Capitalization, $K |

70,953,752 |

Price/Sales |

9.79 |

|

Shares Outstanding, K |

265,000 |

Price/Cash Flow |

171.27 |

|

Annual Sales, $ |

7,259 M |

Price/Book |

8.51 |

|

Annual Income, $ |

1,381 M |

Price/Earnings ttm (Trailing 12-month) |

171.84 |

|

EBIT $ |

342 M |

Earnings Per Share ttm |

1.56 |

|

EBITDA $ |

688 M |

Most Recent Earnings |

$1.75 on 08/22/24 |

|

60-Month Beta |

1.35 |

|

|

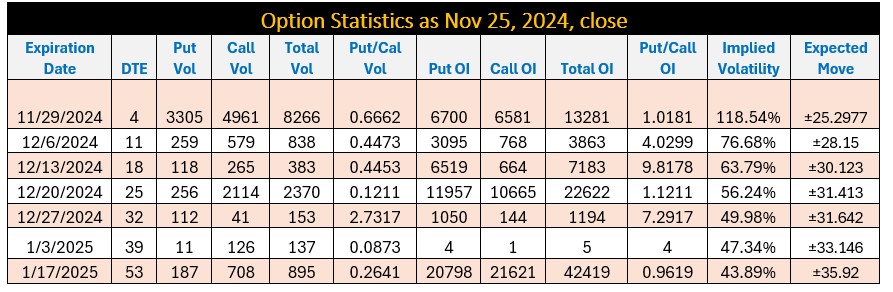

Option Statistics:

- Put/Call ratio for Nov. 29 expiry is 1.0181% more calls than puts which suggests the following three scenarios:

- With Put/Call ratio is around 1.0181 to 9.8178 for the next three upcoming expiries suggest that the traders are very bullish.

- Earning miss or lower guidance could trigger a short-lived sell-off followed by a quick rally.

- Earning and guidance in line or better than estimates may trigger a sharp rally.

Key Highlights:

- WDAY financial management solutions are in high demand.

- Cloud solutions are utilized by 35 federal government clients worldwide.

- Introduction of global HR and payroll solutions in collaboration Strada during the quarter.

- And a partnership with Equifax (NYSE:) to accelerate and streamline the employment and income verification process.

Technical Analysis Perspective:

- WDAY has initiated a bullish flag pattern between August ’24 to Oct’24 targeting 305 to 310 in the coming weeks.

- Stock failed to break November 2021 high at 307 on a second attempt in February 2024 forming a double top pattern a triggered a drop to 199.81 in August 2024.

- It looks that WDAY is going to test 305 -310 obstacle post Q3 earnings. The upside outlook is valid as long as 255/250 support remains intact on a daily close basis after the earnings.

- Failure to hold 255/250 support on daily close chart would pave the way for additional decline to 230 region.

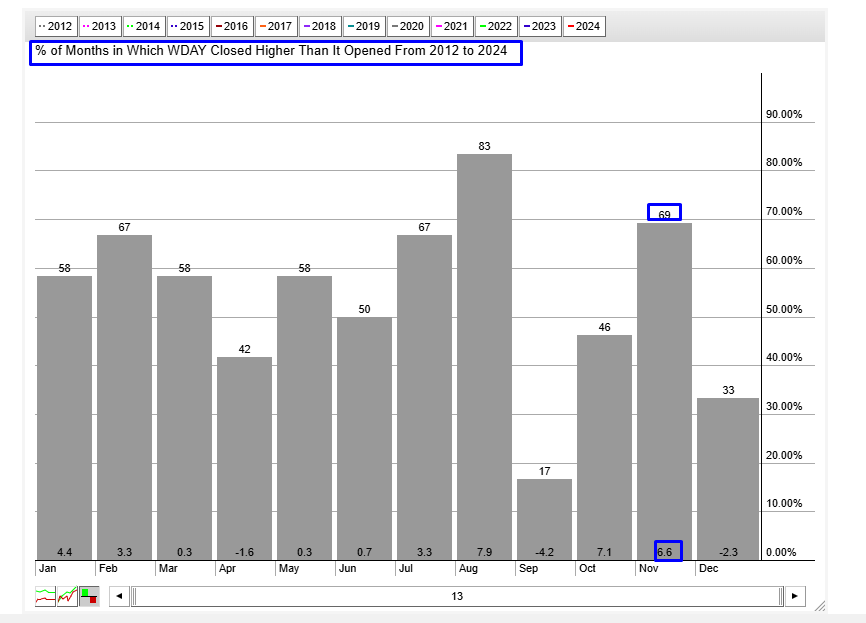

- WDAY closes 6.6% higher in November 69% of the time since 2012.

Conclusion:

WDAY is heading to 305 to 310 marks provided 255/250 support remains intact on daily close basis post Q3 earnings.