Wither the Money Supply?

2022.11.30 23:40

[ad_1]

In the world of stocks, investors may be taught about a variety of things that move the markets. The economy. Corporate profits. Geopolitical events. Technical price patterns. Greed. Fear.

There’s some truth in the complexity. At times, however, Ockham’s razor applies.

Remember Ockham’s razor from Philosophy 101? The principle suggests that the simplest explanation is better than more complicated explanations.

In other words, what is the simplest explanation for why stocks have been rising or falling in the 2020s? The money supply.

Consider what transpired in 2020. The U.S. government shut down activity clear across the country to battle COVID. Yet the government and our central bank believed it needed to make up for the circumstances by creating trillions of dollars that consumers/businesses could circulate.

Stocks rocketed throughout the pandemic in large part due to a 40% increase in the M2 Money Supply. (See the green arrow below.)

M2 Money Supply vs S&P 500

M2 Money Supply vs S&P 500

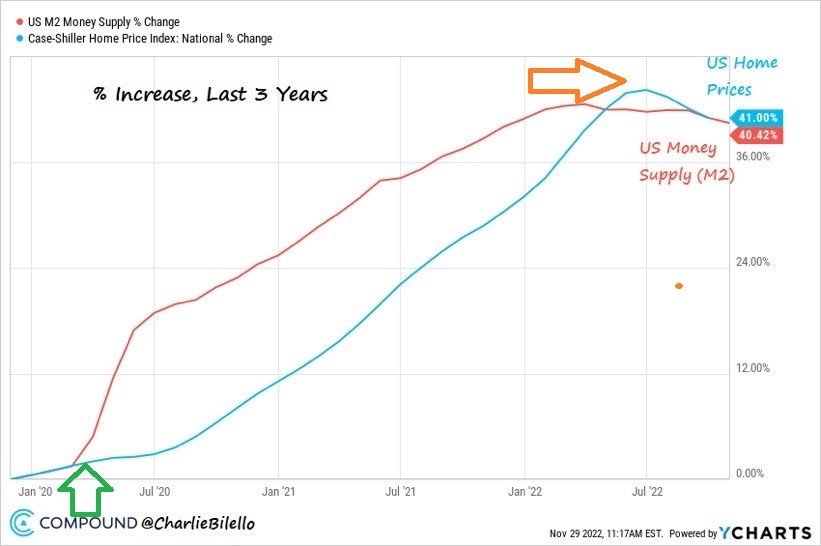

The same can be said for real estate. U.S. home prices catapulted an astonishing 40% over the last three years. That’s the same percentage increase for M2 Money Supply itself.

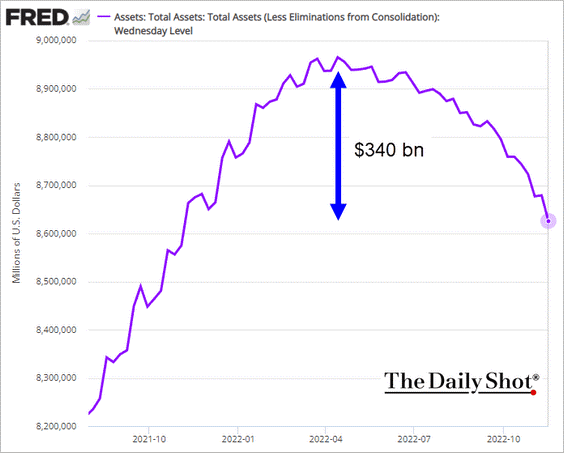

Now get a gander at what began happening in 2022. Our central bank, the Federal Reserve, decided that it needed to undo its contribution to the growth in the money supply.

Indeed, since Q2, the Fed has been reducing its balance sheet via a process known as “quantitative tightening.” Ever since, stocks have been floundering.

Real estate has been toiling as well. Home prices have dipped across the nation for three consecutive months.

Meanwhile, the Fed is only getting started with removing dollars from the financial system. The more it removes, the more one should anticipate asset prices like stocks and real estate to falter.

Total Assets

Granted, home values have barely come down from all-time record highs. And the stock market’s 17% year-to-date losses are relatively minor in the big picture.

On the flip side, people feel decidedly less wealthy. There’s an adverse psychological reaction that occurs when folks feel like they’ve got less than before.

With the Fed continuing to exert downward pressure on M2 Money Supply growth, stocks and real estate are likely to fall further. Bonds have already been brutalized. Even losses in crypto may exact a hefty toll.

An extraordinary wealth effect occurred in 2020-2021. Expect the wealth effect’s reversal that began in 2022 to continue into 2023.

[ad_2]

Source link