Winklevoss twins’ exchange seek dismissal of SEC lawsuit over Gemini Earn

2023.05.26 18:28

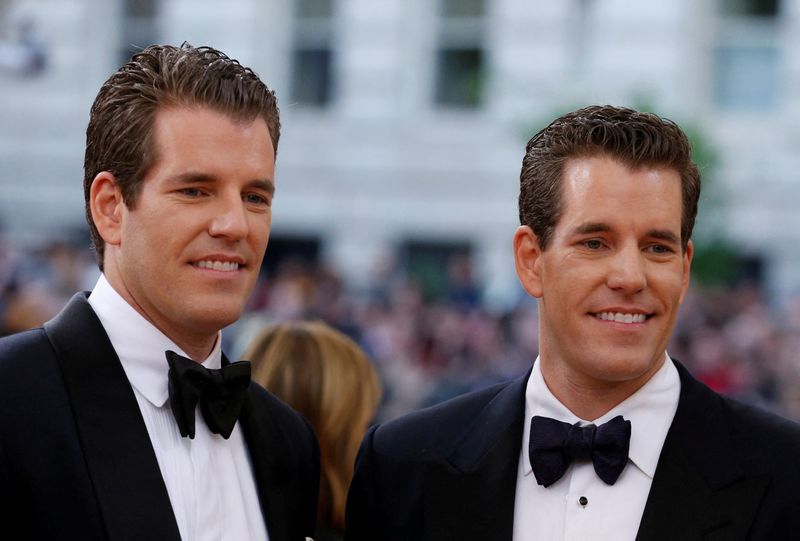

© Reuters. FILE PHOTO: Entrepeneurs Tyler and Cameron Winklevoss arrive at the Metropolitan Museum of Art Costume Institute Gala (Met Gala) to celebrate the opening of “Manus x Machina: Fashion in an Age of Technology” in the Manhattan borough of New York, May 2, 20

By Jonathan Stempel

(Reuters) – An exchange run by the twins Tyler and Cameron Winklevoss on Friday asked a U.S. judge to dismiss a Securities and Exchange Commission lawsuit claiming it illegally sold unregistered securities in a program that promised high interest rates to hundreds of thousands of investors.

Gemini Trust Co’s request was filed in Manhattan federal court, in response to the SEC’s Jan. 12 civil lawsuit against the exchange and the cryptocurrency lender Genesis Global Capital LLC, a unit of Digital Currency Group.

The SEC had sued over Gemini Earn, which let customers lend crypto assets such as bitcoin to Genesis, with Gemini taking an agent fee as high as 4.29%.

According to the regulator, the program let Gemini and Genesis raise billions of dollars of crypto assets, before Genesis halted withdrawals last November in the wake of the collapse of Sam Bankman-Fried’s FTX cryptocurrency exchange.

The SEC said Genesis held $900 million of assets from about 340,000 Gemini Earn customers. Gemini and Genesis were accused by the regulator of having bypassed disclosure requirements meant to protect investors.

In Friday’s filing, Gemini said the loan agreements among itself, Genesis and customers were neither sold nor traded on secondary markets, and did not transfer title to assets, and therefore did not qualify as securities.

“Accordingly, there was no requirement that any party register it with the SEC,” it said.

The SEC declined to comment.

Genesis’ lawyers did not immediately respond to requests for comment, but have said they will also seek a dismissal.

The SEC has been cracking down on cryptocurrency markets since Gary Gensler became its chair in 2021.

He said in January that the case against Gemini and Genesis helps “make clear to the marketplace and the investing public that crypto lending platforms and other intermediaries need to comply with our time-tested securities laws.”

The case is SEC v Gemini Trust Co et al, U.S. District Court, Southern District of New York, No. 23-00287.