Williams for a more aggressive rate hike

2022.11.28 12:35

[ad_1]

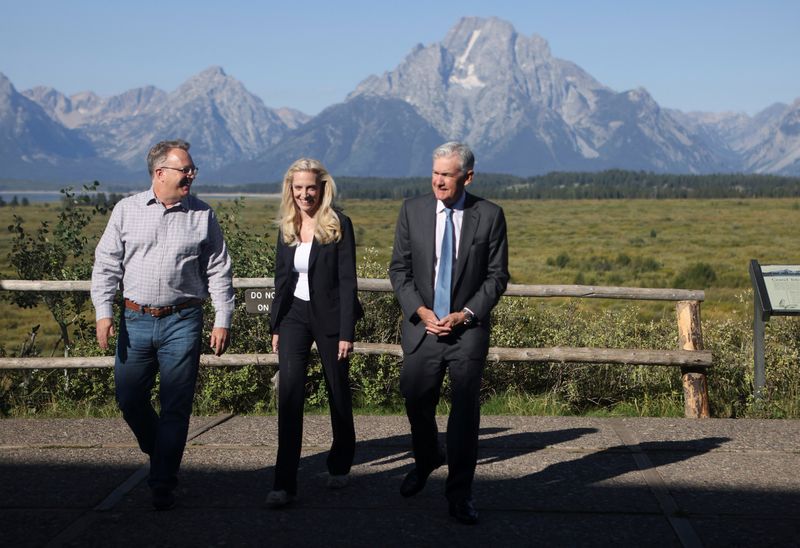

Williams for a more aggressive rate hike

Budrigannews.com – John Williams, president of the New York Federal Reserve, said on Monday that the U.S. central bank still has work to do to lower very high levels of inflation and that he anticipates a significant rise in unemployment as a result of this policy path.

“The ability of our economy to perform at its full potential is undermined by persistently high inflation,” Williams stated.He mentioned that there have been indications of progress in lowering inflation, but he also said that the Fed will need to take more action to bring inflation back to the target that the central bank set.

In prepared remarks for a gathering of the Economic Club of New York, Williams stated, “Further tightening of monetary policy should help restore balance between demand and supply and bring inflation back to 2% over the next few years.”More tight financial strategy has started to cool interest and decrease inflationary tensions,” he said, adding that “it will require some investment, yet I’m completely sure we will get back to a supported time of cost steadiness.”

Williams is also vice chair of the Federal Open Market Committee, which decides rates. The next monetary policy meeting of the central bank is scheduled for December 13 and 14.As officials attempt to reduce the highest levels of inflation seen in four decades, it is widely anticipated that the Fed will raise its policy rate, which is currently in the range of 3.75 percent to 4.0%.

Since the summer, the Fed has moved in historically large increases of 75 basis points, compared to its more normal cadence of quarter-percentage-point increases, increasing the cost of short-term borrowing very aggressively this year.

However, Fed officials have indicated in comments since the November meeting that they may be able to slow the rate of increases as they near a resting point for their rate-raising campaign.Because of this, there is a chance that the Fed will increase its target rate by 50 basis points at the next meeting.

Williams did not indicate whether he preferred the size of the Fed’s next move or how much he believes the central bank will need to raise rates in the future.He is planned to take crowd and media inquiries after his conventional comments on Monday.

In his prepared remarks, Williams stated that unemployment will likely rise while the economy is likely to avoid a recession.

Williams stated that the labor market remains extremely tight, with rapid wage increases and robust hiring.He stated that the unemployment rate will likely rise to between 4.5 percent and 5.0 percent by the end of the following year, with economic growth anticipated to be slightly positive this year and next.

In the meantime, inflation should be reduced by slowing global growth and improving supply chains.

Contrasted with the 6.2% ascent in September in the Federal Reserve’s favored expansion measure, the individual utilization uses cost record, Williams said expansion ought to simplicity to somewhere in the range of 5.0% and 5.5% by the end of 2022 and to 3.0% to 3.5% one year from now.

In addition, Williams stated in his prepared remarks that the bond market has largely resisted the Fed’s actions.

[ad_2]