Will U.S. Inflation Shake Up the British Pound?

2022.12.13 07:43

[ad_1]

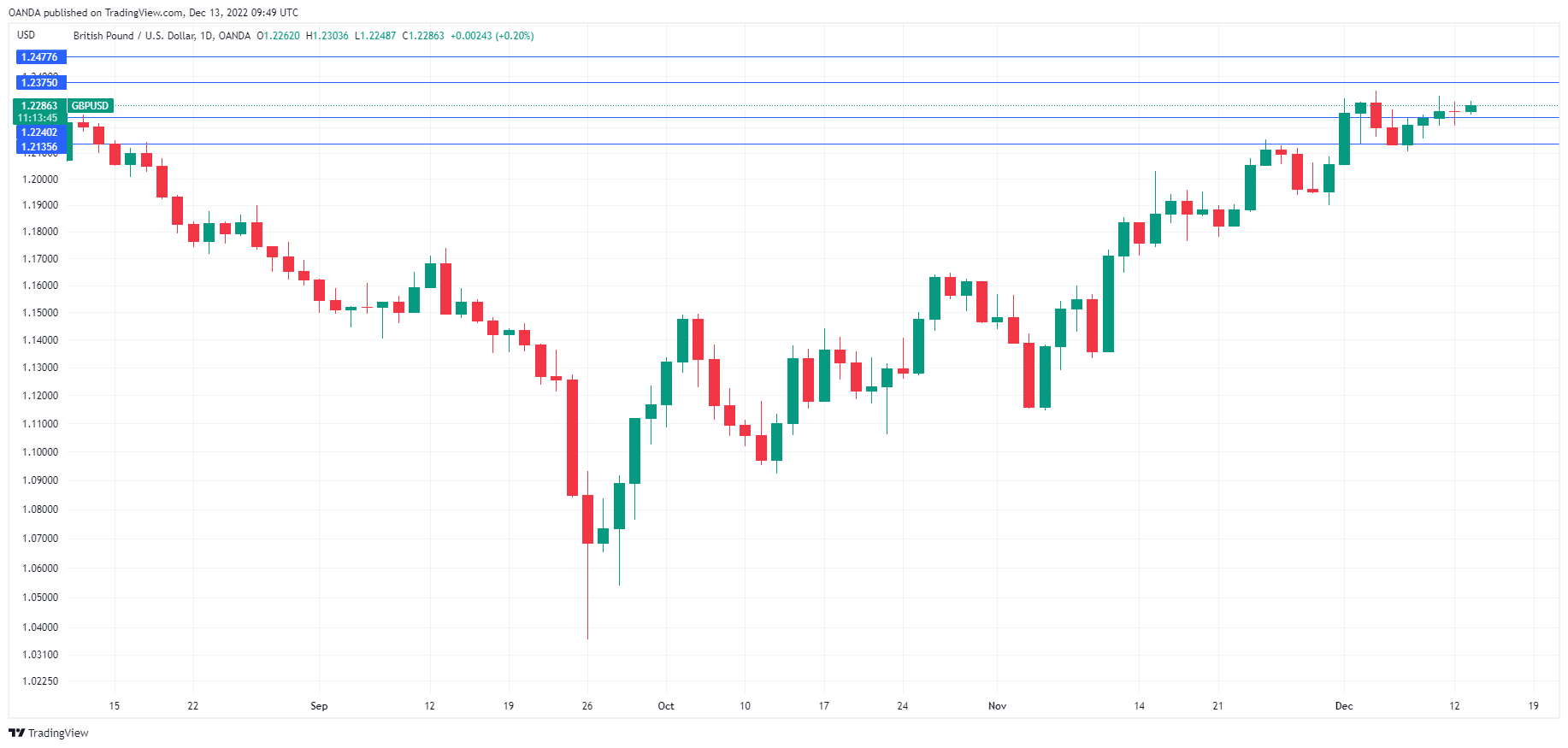

The British pound remains calm this week and is trading at 1.2286, up 0.20%.

It is a busy week on the economic calendar, but isn’t showing much interest. Today’s UK was within market expectations, which resulted in a muted reaction from sleepy sterling. The unemployment rate ticked upwards to 3.7%, up from 3.6%. Wage growth climbed to 6.1%, up from 5.9% and above the consensus of 5.8%.

Wages remain well below the inflation level of 11.1%, but will still be of concern to Bank of England policy makers, who will want to avoid the spectre of a wage-price spiral, which would make the battle against inflation that much more difficult. This may not be something that the BoE can control, with the threat of public workers going on strike to demand more pay. The BoE is likely to continue raising rates, despite weak economic conditions, as defeating inflation remains its first priority. The BoE meets on Thursday and is expected to raise rates by 50 basis points, which would bring the cash rate to 3.50%.

US CPI Expected to Dip

All eyes are on the report for November, which will be released later today. The consensus stands at 7.3%, following a 7.7% gain in October. The timing of the report is interesting, as it comes just one day before the Federal Reserve meeting on Wednesday. Inflation fell in October and was softer than expected, and the US dollar took a plunge, as the markets became hopeful of a dovish pivot from the Fed. If inflation is again lower than expected, the dollar could find itself under pressure, although the markets could be more cautious with a Fed meeting just around the corner.

GBP/USD Technical

- 1.2240 and 1.2136 are the next support levels

- There is resistance at 1.2374 and 1.2478

[ad_2]

Source link