Will the U.S. CPI Report Cause Another Market Storm?

2023.03.13 10:10

The last CPI report before the Fed’s March policy meeting is due on Tuesday at 12:30 GMT and after the recent nasty surprises in the data, anxiety is running high about another hot print. Fed chief Jerome Powell has already upped the stakes by opening the door to a return to double rate hikes, while the US dollar is enjoying a mini revival. Are there more surprises in store for the markets this week?

Stalling progress to reduce inflation

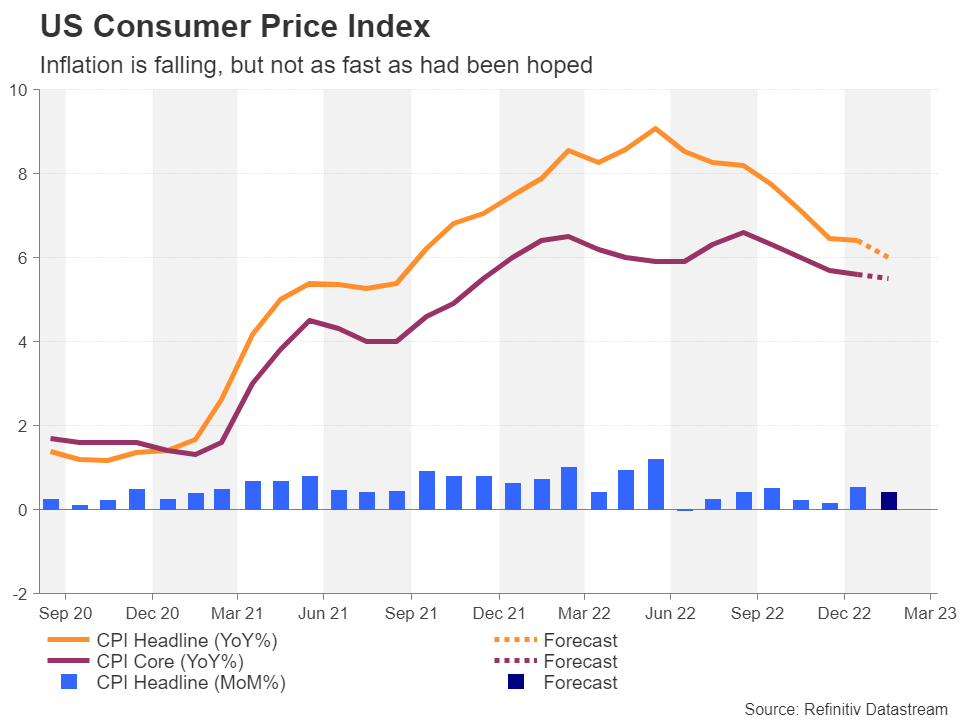

As the fight against inflation rages on, there is good and bad news. The good news is that inflation in the US is falling. The bad news is that it’s not declining fast enough according to the latest metrics. The consumer price index was up 6.4% y/y in January, down just 0.1 percentage points from December. The decline in core CPI also slowed, but more worrying was the uptick in core PCE inflation, which the Fed attaches the most weight to in its decision making.

The forecasts for February suggest the sticky inflation picture hasn’t altered much since January as month-on-month, both headline and core CPI are expected to have increased by 0.4% – more than double the pace needed to achieve yearly inflation of 2%.

On an annual basis, the headline rate of inflation is expected to moderate to 6.0% y/y, while core CPI is projected at 5.5%.

Retail sales likely moderated in February

Another warning sign lately that the impact of last year’s rate hikes has yet to be felt and the economy continues to run near full capacity is the rebound in consumption. Retail sales jumped by 3.0% m/m in January and this was later backed up by a similarly strong surge in the personal consumption reading. For February, retail sales are forecast to have fallen back by 0.3% m/m.

Softer retail sales numbers could help calm some nerves should they come on the back of another set of stronger-than-expected CPI figures, but probably not by much.

Fed to stay the course

In his semi-annual testimony to Congress, Chair Powell warned that rates may have to be raised higher than previously anticipated. This hints that unless there’s a big miss on Tuesday, policymakers are unlikely to let their guards down anytime soon given just how strongly both the jobs and inflation data have overshot all expectations.

So for the March meeting, the decision about the size of the hike may not be as important as the destination of where rates will peak.

Can there be more CPI-fuelled gains for the dollar?

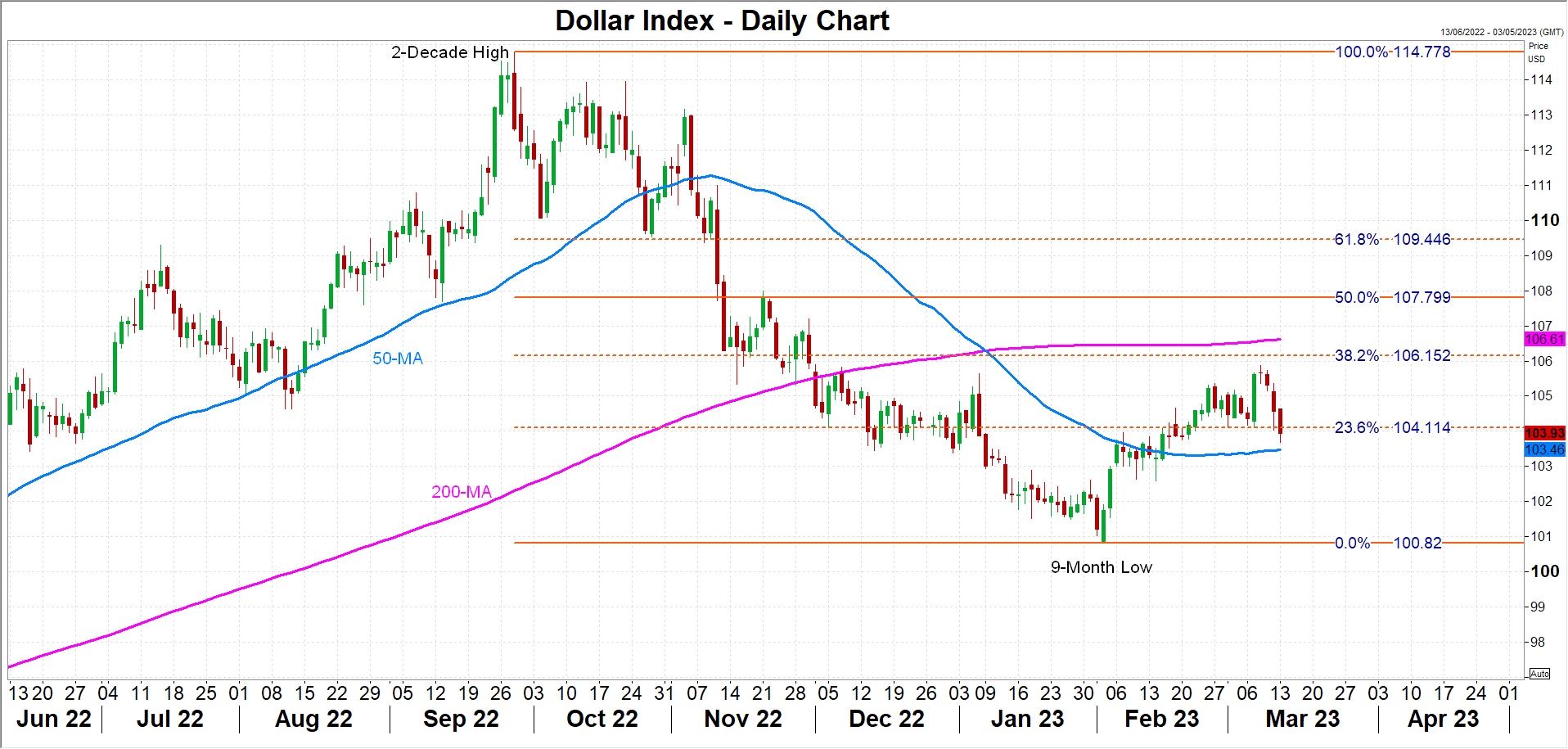

For the dollar, however, even in-line CPI numbers could nudge it higher against a basket of currencies. The is currently trading just above its 50-day moving average, which is climbing towards 103.50.

A lift from the data could provide the impetus it needs to reach the 38.2% Fibonacci retracement of the September-February downtrend at 106.15. Slightly above this level is the 200-day moving average at 106.61. This could be an ideal spot for the dollar bulls to pause their advance as they await the outcome of the FOMC meeting on March 21-22.

In the event, however, that inflation cools more than anticipated in February, at least in some of the CPI components, if not the headline figure, the dollar could slip below its 50-day MA and head for the February low of 100.82.

Services inflation holds key to shift in policy outlook

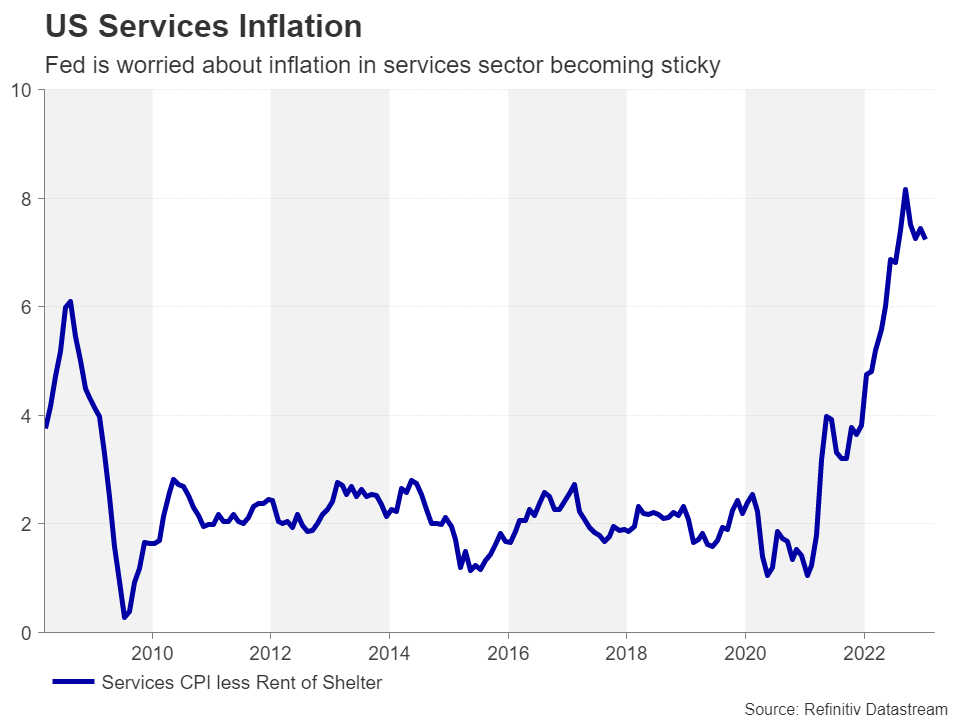

Powell recently indicated that the Fed is not just focusing its attention on the tightness of the labour market, but also on services inflation. In particular, the Fed is carefully tracking core services CPI that excludes housing, which has been stuck above 7% since August last year despite retreating from a peak of 8.2%.

Without some signs in the upcoming report that services inflation is starting to come down more rapidly, investors should not expect any change in the current policy stance. Yet, the sudden collapse of tech lender Silicon Valley Bank (SVB) has already sent panic across Wall Street amid fears of financial contagion to other banks.

Markets saw the Fed funds rate peaking at around 5.6% prior to the SVB crisis but those odds have now fallen sharply to about 5.0%. There could be disappointment if policymakers stick to their guns in 10 days’ time.