Will the S&P 500 Rally After Midterm Elections This Time?

2022.11.08 05:45

[ad_1]

Unique macro conditions make a post-midterm stock rally unlikely this year.

Economic and political activity often seem to be tied together. Historically, performance after the US midterms is just one indicator pointing to this fusion. Since World War II ended in 1946, the S&P 500 index has performed well in 17 out of 19 midterm election seasons.

However, the current economic climate is nothing if not historical in its own right, but is there data pointing to the third exception for the S&P 500 this year?

Why Would Midterms be Tied To Stocks

As market correlations go, the one between midterm elections and stock performance is a sound one. Representing the stock market as a whole, the S&P 500 index had the best average returns in midterm years. For the past ten years, November has been the best month of the year for stock gains.

Average S&P 500 Return (1950-2021)

Average S&P 500 Return (1950-2021)

Because midterm elections represent restructuring of the political scene, they also represent direct feedback on the current administration. Whether that favorable feedback is less important than the expectation that a new Congress will increase government spending.

This time, due to the cost of living skyrocketing since President Biden took office, the market expectation is on the Republican side. For instance, the Reuters/Ipsos poll on Nov. 1 showed that only 18% of Americans think the country is going in the right direction, with 69% disapproving.

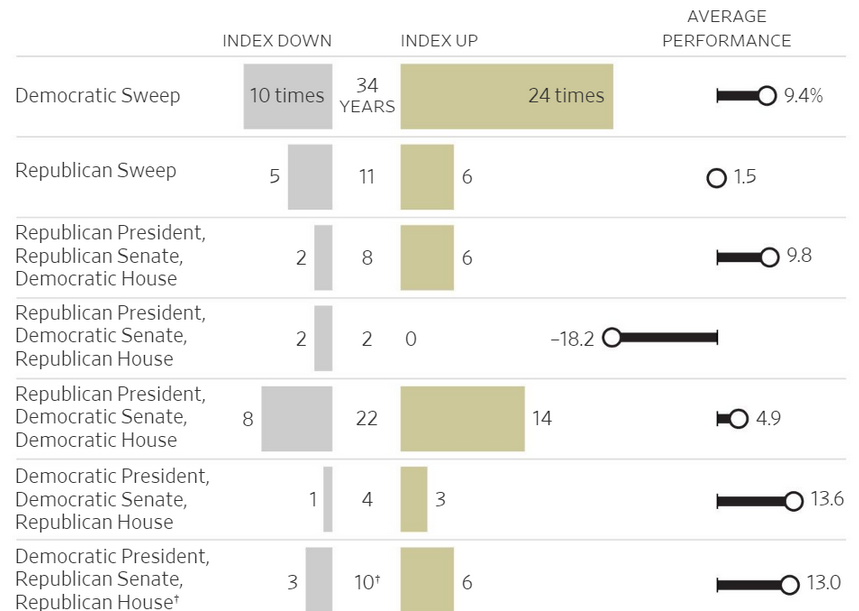

Average Performance based on election results.

Average Performance based on election results.

On Nov. 8, such polling numbers will likely rearrange Congress and Senate seats in Republican favor. However, if there is an R/D split between the House and Senate, a resulting government gridlock may be the most favorable position for markets. After all, neutralizing major policies would also neutralize their market impact, for better or worse.

Will Post-Midterm Performance Be Different This Time?

The macroeconomic landscape is engulfed in especially turbulent weather this year. The key contributor to the 40-year high was the Federal Reserve, which has increased its balance sheet by ~$5 trillion during the last two years. This diluted the value, sparking inflation not followed by the wage rise.

Once the Fed changed course by raising interest rates, the S&P 500 went down -21% this year, followed by Dow Jones at -14%. In contrast, as the Fed tightened global dollar liquidity, the Dollar Strength Index (DXY) grew stronger by +14.48%.

S&P 500 Index Daily Chart

For this midterm election to join the historical trend, the market would have to ignore the fastest rate hike cycle in 40 years. Yet, the Fed became even more hawkish after the last FOMC meeting, resulting in the 4th 75 bps hike increase. Specifically, Fed Chair Jerome Powell said that the central bank’s monetary tools tackle recession better than entrenched inflation.

“If we overtighten, we can use monetary policy tools to support the economy but if we don’t tighten enough inflation becomes entrenched.”

Unless the next on Nov. 10 shows drastic, unexpected improvement, the Fed will continue suppressing the markets with more hikes. In this light, it is not a question of whether this midterm season will spike market performance but which stocks perform better in a recessionary environment.

Which Stocks Are Likely to Do Better Post-Midterm

Given the situation in Ukraine and other hotspots in the world, military spending is expected to increase regardless of the outcome of the midterms. The Congressional Research Service (CRS) report shows that appropriations worth $14.05 billion are set to replenish military equipment sent to Ukraine.

Combined with US’ increased entanglements in Europe, South Korea, and other nations, the largest defense suppliers stand to gain the most – Raytheon Technologies (NYSE:) and Lockheed Martin (NYSE:).

One may also recall that “Big Short” legend Michael Burry rearranged his portfolio in August, refocusing on prison stocks like Geo Group (NYSE:) and CoreCivic (NYSE:). A Republican victory is likely beneficial as they try to tackle the skyrocketing crime rates across the country.

Lastly, President Biden explicitly stated yesterday there would be no more oil drilling of any kind.

Tweet

At a time when energy prices make half the impact on inflation, according to the White House, a Republican victory would likely shift focus away from “clean energy”. After all, although not considered green, more robust and dependable energy sources are supported by an existing infrastructure – talent and technologies.

On the other hand, if Democrats win, novel green companies spearheaded by the likes of Invesco Solar ETF (NYSE:) should gain momentum.

Original article

[ad_2]

Source link