Will NZD/JPY Break Above Resistance?

2023.05.29 05:42

resistance at 8555/75. Shorts need stops above 8590.

Targets: 8520, 8480.

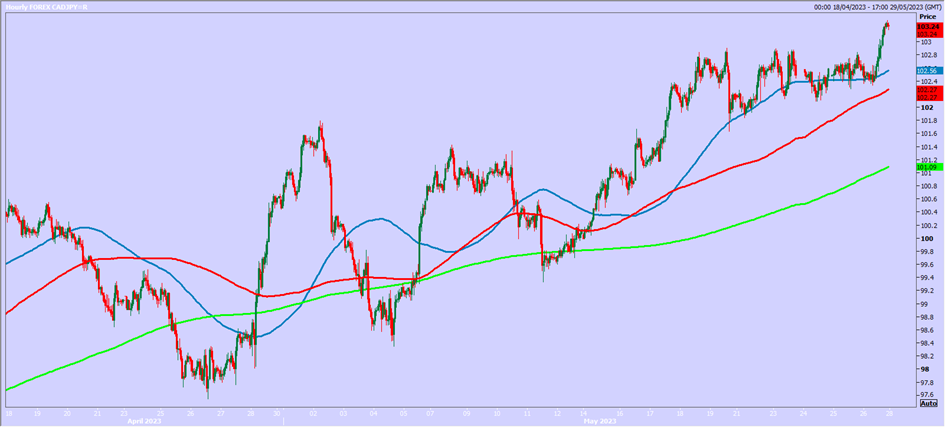

continues higher as expected but I have not managed to get us in to a long. I should have had us buying on a break above 102.90 so I will use this as a support today.

Longs at 102.90/70, stop below 102.50.

we unfortunately missed buying at first support at 149.75-65 by only 3 pips.

stuck in a 2 week range but longs at support at 167.60/40 worked last week on the bounce to my target of 168.55.

Try longs again at support at 167.60/40 – stop below 167.10.

Targets: 168.20, 168.55, 168.80.

Resistance at 1.6880/1.6900. Shorts need stops above 1.6920.

Targets: 1.6845, 1.6820.

collapsed as predicted on Sunday last week & finally hit my target & Fibonacci support at Fibonacci 1.0730/20, although we over ran to 1.0700.

On Friday as predicted we did recover a little to my first target of target 1.0750/60 with a high for the day exactly here.

No buy signal yet but a break above 1.0750/60 tests strong resistance at 1.0790/1.0810. I would try a short here with stop above 1.0830.

Longs at 1.0730/10 could be risky but if you try, stop below 1.0695.

A break below 1.0695 this week should be a sell signal & can target 1.0630, then 1.0600, perhaps as far as 1.0570.

bounced from just above good support at 1.2290/80 in severely oversold conditions which was as expected.

The pair beat minor resistance at 1.2360/70 but a short position at 1.2390/1.2400 worked perfectly with a high for the day exactly here & a nice tumble to my targets of 1.2340 & 1.2320. A low for the day exactly here in fact.

Could hardly have been more accurate on the levels for GBPUSD last week.

Again shorts at 1.2390/1.2400 should stop loss above 1.2420.

Targets: 1.2340 & 1.2320.

I am not going to suggest a long as I think there is a good chance we will continue lower this week. Watch for a break below the 100 day moving average at 1.2290/80 to trigger further losses despite severely oversold conditions.