Will Earnings Spark a Catch-Up Rally in Tech Stocks?

2023.10.24 09:59

- Stocks are getting cheaper – while interest rates are weighing on stock prices, valuations are starting to approach historic lows.

- Consumer vs. B2B – comps are getting tougher for consumer tech while enterprise tech is at the bottom of the cycle.

- What we learned in 2Q23 – positive July trends offering an early read.

Tech Stocks Are Getting Cheaper

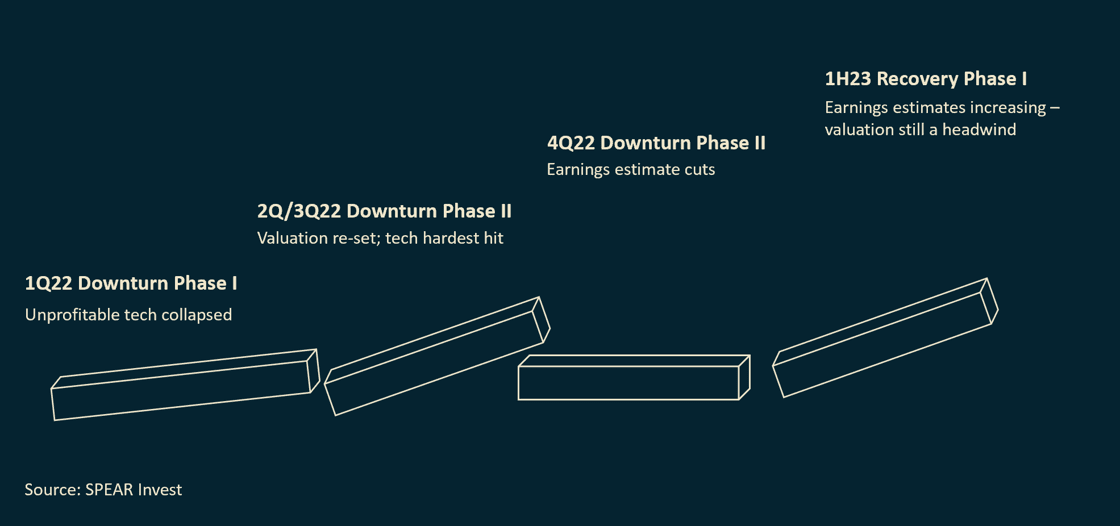

Technology stocks have been consolidating through the summer despite earnings stabilizing and inflecting upwards. But if 3Q23 earnings continue the strong trend, we are likely to experience a catch-up rally into year-end as valuations are now approaching the bottom of a historical range.

In 2Q23 most companies reported strong results ahead of Street expectations. But macro worries, a surge in the , elevated inflation, and US Government credit downgrade overshadowed the strong reported earnings. In fact, many companies that reported blowout results are now trading lower than where they were prior to the announcements.

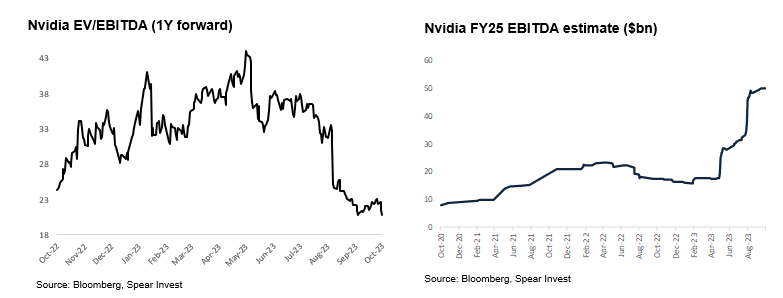

This trend was particularly noticeable for semis (e.g., Nvidia (NASDAQ:)) where the company posted two consecutive quarters of monster beats, but the stock had a difficult time keeping up with the earnings estimate increases.

Nvidia’s FY25 EBITDA estimates increased from ~$20bn in April/23 to ~$50bn today. Since the stock did not have a commensurate move post the results, the valuation multiple collapsed from >40x EV/EBITDA to a reasonable ~20x EV/EBITDA.

While it is common for stocks to react ahead of earnings revisions and stall out once those revisions have taken place, there is a limit to how low the valuation multiple can go if the company does maintain its earnings growth momentum.

While hardware is particularly cyclical and we don’t expect nearly the same magnitude of earnings upside from software and cloud infrastructure providers, we do believe that those earnings have bottomed and will start getting revised upwards.

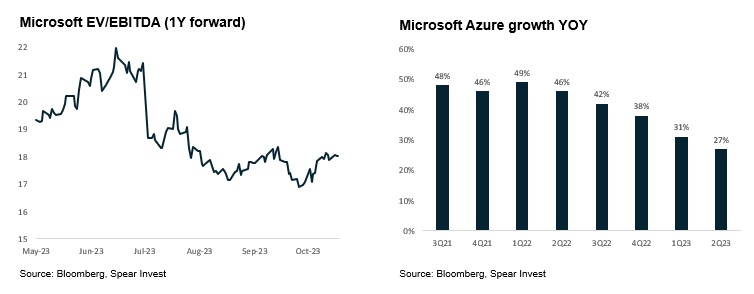

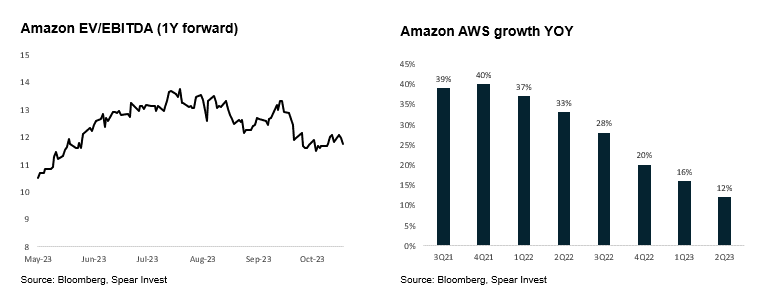

Big tech is kicking off earnings season this week with Microsoft (NASDAQ:) (10/24) and Amazon (NASDAQ:) (10/26) as the most relevant companies for assessing B2B spending and AI momentum.

Both companies have been going through customer spend optimizations driven by tough macro with 2Q/3Q 23 growth likely marking a bottom.

- Microsoft’s Azure grew 27% last quarter on a ~$60bn base. Investors are expecting Azure to grow 26% (cc) in C3Q23. We will be looking to learn about the company’s AI initiatives (Office 365 Co-pilot, GitHub co-pilot), the contribution from AI to growth (previously pointed to 2pts from AI services), and the potential for an in-house GPU.

- Amazon’s AWS grew 12% in 2Q23 on a ~$90bn base. Investors are expecting Azure to grow 11-12% (cc) in 3Q23. We will be looking to learn more about the progress in Amazon’s internal chip development (Inferentia & Trainium), traction with Bedrock (foundational AI model platform), and benefits/plans for its Anthropic investment.

Interestingly despite the potential for trough earnings, these stocks are trading on trough multiples implying solid valuation support.

We expect bottoming in cloud spend to bode well for the entire ecosystem of cloud vendors. The two companies that provided the most conservative guides going into 3Q23 are Datadog (NASDAQ:) and Hashicorp (NASDAQ:). The company that is the biggest battleground among investors is Cloudflare (NYSE:).

Divergence in Consumer vs. B2B Technology

We expect the fundamentals for consumer and B2B technology to start diverging this quarter. Our channel checks have been indicating that while pressures for the consumer continue to mount (interest rates, inflation), there are some early signs of stabilization in enterprise spending.

The consumer drove the past tech cycle with ample credit availability and rapid innovation. However, tightening credit conditions and a surge in inflation are limiting the pace of the recovery despite positive demographic and cyclical trends. The area of the consumer hit the hardest continues to be big ticket items that require financing (autos, appliances).

As an example, Tesla (NASDAQ:) reported very poor earnings driven by lower volumes and pricing. But despite lowering prices several times (~25% price cut), the company was unable to boost demand as the monthly cost of a vehicle (after incorporating higher interest rates) remained roughly unchanged.

The same dynamic does not apply to B2B. Large enterprises are generating record cash flows and are looking to invest in technology to (1) enhance their products and services and (2) further optimize their operations. This trend is amplified by developments in artificial intelligence (AI) that require significant investment as companies don’t want to get left behind.

Tesla is a good example of this as, despite macro conditions weighing on results, the company is planning to spend in excess of $9bn in capex (revised up from ~$7bn). The investments are focused on AI with several hundred million invested in Nvidia GPUs.

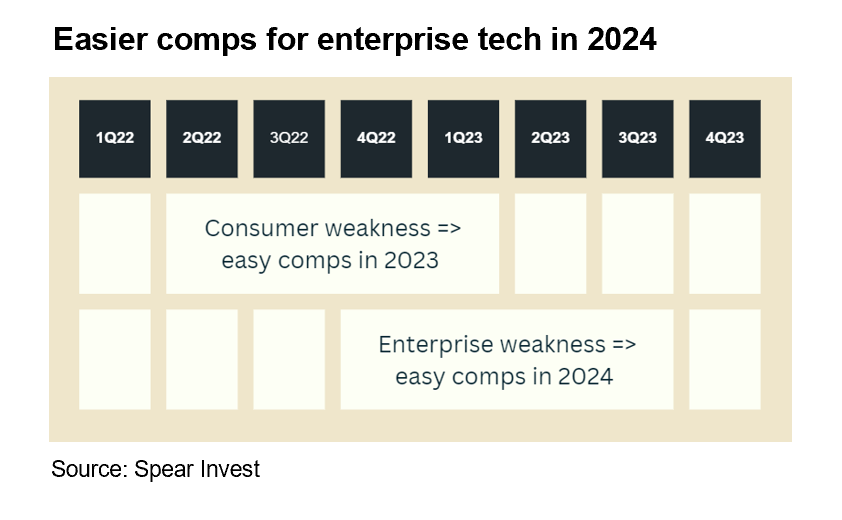

In addition to divergent fundamentals, enterprise technology is facing much easier comparables going into 2024. The downturn in enterprise spending started in 4Q22 compared to the rest of the economy which experienced a downturn 6 months prior.

Canaries in the Coal Mine

There are two interesting observations that came out of the 2Q23 earnings that we believe are relevant to this quarter.

1. Companies that provide monthly color pointed to strong July trends:

What we’re seeing in the quarter is that those cost optimizations, while still going on, are moderating, and many may be behind us in some of our large customers. And now we’re seeing more progression into new workloads, new business. So those balanced out in Q2. We’re not going to give segment guidance for Q3. But what I would add is that we saw Q2 trends continue into July.” – Andy Jassy, Amazon CEO

The sentiment really seemed to change in July with customers really reengaging with us. And so — and I think we’ll have good bookings. But that doesn’t equate to consumption. It takes time for the consumption to come in. – Frank Slootman, Snowflake CEO

2. Companies that have a July quarter end reported significantly stronger results. Both Zscaler’s and Crowdsrike’s results stood out and the tone was notably more optimistic across the board.

The caveat with these data points is that sentiment could have worsened post the recent move in the 10Y, but budgets were already cut dramatically ahead of an expected recession in 2023 limiting the potential for more cuts.

***

Disclosure:

Views expressed here are for informational purposes only and are not investment recommendations. Spear may, but does not necessarily have investments in the companies mentioned.

For a list of holdings click here. All content is original and has been researched and produced by Spear unless otherwise stated. No part of Spear’s original content may be reproduced in any form, without the permission and attribution to Spear. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence. Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on Spear’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice.

All statements made regarding companies or securities or other financial information on this site or any sites relating to Spear are strictly beliefs and points of view held by Spear or the third party making such statement and are not endorsements by Spear of any company or security or recommendations by Spear to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that Spear’s objectives will be achieved.

Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. Click here for our Privacy Policy.