Why the ‘New Safety Trade’ in Tech Might Not Be So Safe After All

2023.05.04 03:35

There has been a lot of talk in recent months about the narrowness of the rally in stocks so far this year. It’s no secret that the majority of the gains for the index have come from just a handful of stocks, while many smaller names have performed much more poorly in comparison. To wit, together, Microsoft’s (NASDAQ:) and Apple’s (NASDAQ:) share of the Index just rose to a new record high while the Russell Microcap Index just fell to a new multi-year low.

Some have explained the phenomenon by noting that investors now see Big Tech as the “new safety trade.” “People are looking for safety and comfort given the cross-currents in the market, and tech gives them plenty of ease,” as JP Morgan) sales trader Jack Atherton tells the Financial Times. That ease comes from the belief that Big Tech offers, in the words of Glenmede’s Jason Pride, “downside protection during more difficult times.”

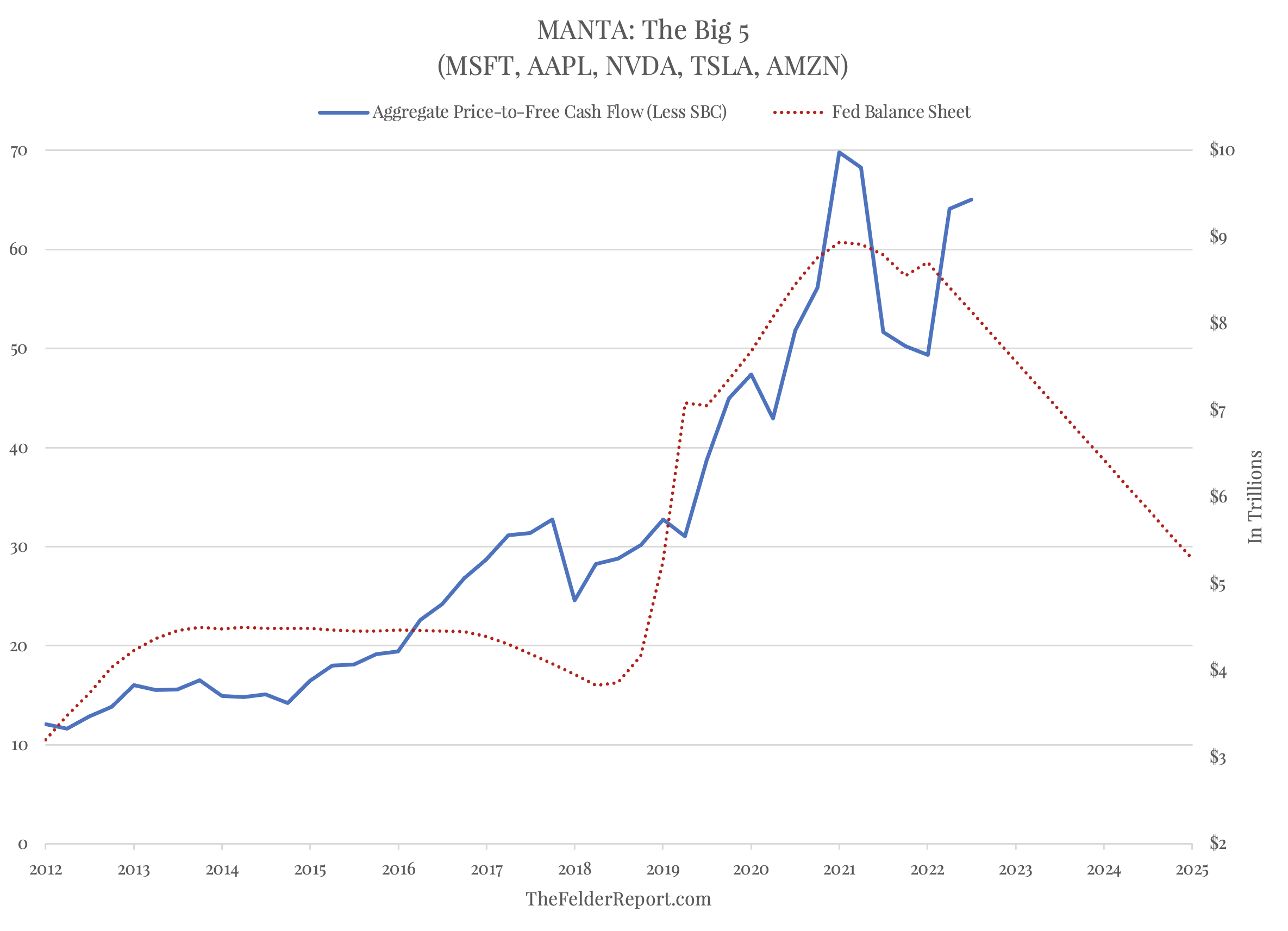

Investors crowding into these names better be right because they are clearly making a major bet that these companies’ financial performance will not only hold up through the economic “cross-currents” to come, it will actually benefit from them. How else can you explain that they are willing to pay 65 times aggregate free cash flow (less stock-based compensation) for the five largest stocks in the Nasdaq (as of last year)?

Over the past decade, their average valuation has been less than half the current level. So it would appear there is a genuine risk that if the economy enters recession and these companies are not immune to its effects, their collective valuation could revert to some degree or another, a process that could prove inordinately painful given the extreme valuations they trade at today. Even assuming the economy manages to avoid recession, allowing the Fed to maintain its current policy of “normalizing” the balance sheet, that reduction of liquidity alone could exert downward pressure on valuations.

Either way, the “new safety trade” appears to be priced for perfection – and by perfection, I mean a return to ultra-low interest rates (supporting extreme valuations) along with a return to rapid top-line growth while maintaining fat profit margins (supporting the figures those valuations are based on). Absent such a pristine outcome, investors may be disappointed to realize that Big Tech isn’t so safe after all.