Why Gold Stocks Tend to Underperform Gold Bullion

2023.11.28 02:57

bullion could be viewed as insurance, a portfolio hedge a long-term investment or a long-term store of value, but a gold mining stock is none of these.

Gold mining stocks always should be viewed as either short-term or intermediate-term trades/speculations. During gold bull markets, you scale into them when they are oversold or consolidating and you scale out of them when they are overbought.

The scaling in/out process obviates the need for accurate short-term timing, which is important because, as anyone who has followed the sector for many years will know, gold mining stocks tend to go down a lot more and up a lot more than initially expected.

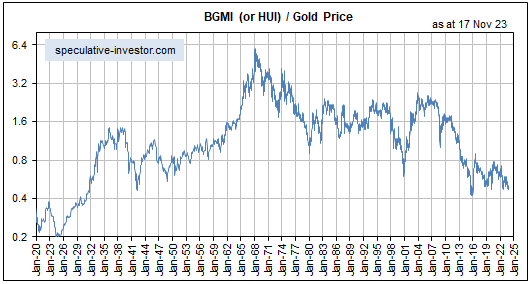

We include the following chart in a TSI commentary about once per year to remind our readers why gold mining stocks always should be viewed as trades. The chart shows more than 100 years of history of gold mining stocks relative to gold bullion, with gold mining stocks represented by the Barrons Gold Mining Index (BGMI) prior to 1995 and the thereafter.

The overarching message here is that gold mining stocks have been trending downward relative to gold bullion since 1968, that is, for 55 years and counting.

BGMI/Gold Price

We’ve explained in the past that the multi-generational downward trend in the gold mining sector relative to gold is a function of the current monetary system and therefore almost certainly will continue for as long as the current monetary system remains in place. The crux of the matter is that as well as resulting in more mal-investment within the broad economy than the pre-1971 monetary system, the current monetary system results in more mal-investment within the gold mining sector.

Mal-investment in the gold mining sector involves ill-conceived acquisitions, mine expansions, and new mine developments that turn out to be unprofitable, building mines in places where the political risk is high, and gearing up the balance sheet when times are good. It leads to the destruction of wealth over the long term. Physical gold obviously isn’t subject to value loss from mal-investment, hence the long-term downward trend in gold mining stocks relative to gold bullion.

The difference between the gold mining sector and most other parts of the economy is that the biggest booms in the gold mining sector (the periods when the bulk of the mal-investment occurs) generally coincide with busts in the broad economy, while the biggest busts in the gold mining sector (the periods when the ‘mal-investment chickens come home to roost’) generally coincide with booms in the broad economy.

The developed world, including the US and much of Europe, currently is in the bust phase of the economic cycle, meaning that we are into a multi-year period when a boom is likely in the gold mining sector.