Who Says You Can’t Time the Market?

2023.04.06 03:57

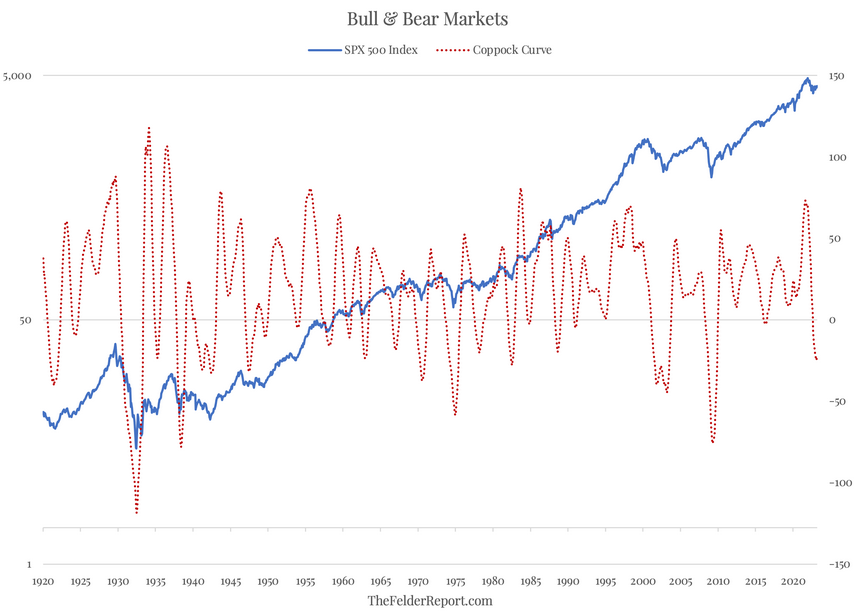

A few months ago, I wrote a post about using the Coppock Curve as a market timing . Well, the Coppock Curve for the Index did turn higher in March (even if you need a magnifying glass to see it). Other trend-following measures are positive for the index, too: it remains above its 200-day moving average, as does the 50-day moving average.

These sorts of signals suggest this index is currently in an uptrend. However, it is also true that the Coppock Curve did turn higher prematurely in December of 2001 before the S&P 500 Index fell another 30% or so into the fall of 2002. Like any other indicator, this one is not perfect.

SPX Index and Coppock Curve Chart

SPX Index and Coppock Curve Chart

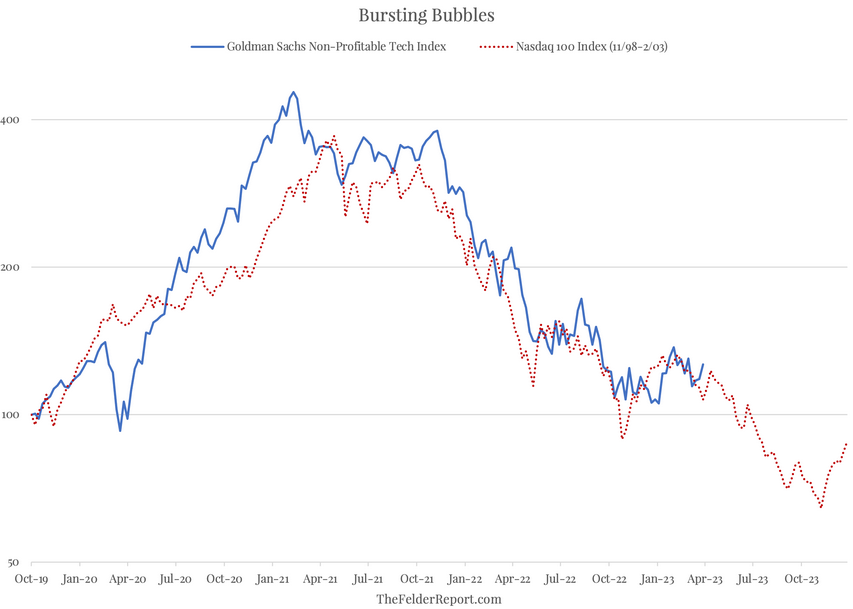

Moreover, the late-2001/early-2002 time frame makes for a very interesting price analog. During the bursting of the Dotcom Bubble, there were many spectacular rallies, very similar to the one we have seen in Big Tech stocks to start the year, that gave investors hope the bottom was in and that it was time to get greedy.

However, these proved to be false dawns as prices went on to make lower lows. If the collapse of SVB is a harbinger of increasing financial distress among non-profitable start-ups over this year, then there is a very good chance these stocks, which were the focus of the mania in 2021, have significantly more downside ahead of them which will have consequences for both the broader economy and risk appetites in general.

GS Non-Profitable Tech Index

GS Non-Profitable Tech Index

Pure trend-followers will pay no mind to this sort of analysis, simply focusing on the fact that their indicators suggest the downtrend is over, at least for now. Those using a more holistic approach may place less weight on those trend signals in favor of a weight of the evidence approach, which likely urges a bit more circumspect view of this year’s rally.

Passive investors will pay no mind to any of it and remain fully invested regardless. In each case, investors make an implicit market-timing decision (sometimes called a forecast); because any decision to invest represents a forecast, there’s just no avoiding it. So what is your preferred market-timing technique?