Which U.S. Bank Stock Is the Best Post-Earnings Bet?

2023.07.20 05:46

- U.S. banks reported earnings this week

- Results were mixed, with some banks doing better than others

- Let’s try and find out which bank would be the best pick post earnings

Markets anticipate a challenging quarter for U.S. equities, with a projected 7.3% dip in EPS across the board. However, there’s a glimmer of hope on the horizon as analysts predict this period to serve as a low point, paving the way for a potential earnings growth rebound.

Major U.S. Banks’ Latest Quarterly Results and Potential Picks

The recent quarterly reports from major U.S. banks have been released, showing varied performance in net income and turnover. Here are the results:

Net income (% change YoY):

- JPMorgan Chase & Co. (NYSE:): +35%

- Bank of America Corp. (NYSE:): +11%

- Morgan Stanley (NYSE:): +2%

- Citigroup Inc. (NYSE:): -1%

- The Goldman Sachs Group, Inc. (NYSE:): -8%

- Wells Fargo & Company (NYSE:): +21%

Which Bank Stock Stood Out?

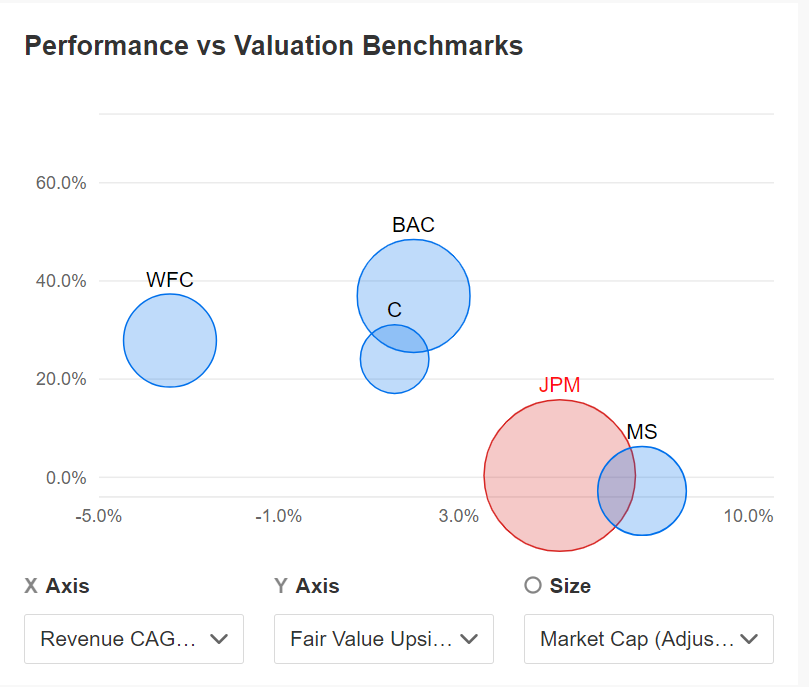

According to InvestingPro’s updated Fair Values, the chart below highlights two crucial aspects:

- Revenue Growth (horizontal axis)

- Upside potential compared to Fair Value (vertical axis)

Source: InvestingPro

Based on the updated Fair Values and a comparative chart available on InvestingPro, some important insights emerge:

- Morgan Stanley has shown significant growth in recent years, but it is not accompanied by as much upside potential on the price side (based on fundamentals).

- Wells Fargo & Company and Bank of America Corp. are the two institutions with the greatest potential upside based on fair value.

- Goldman Sachs did not appear on the chart.

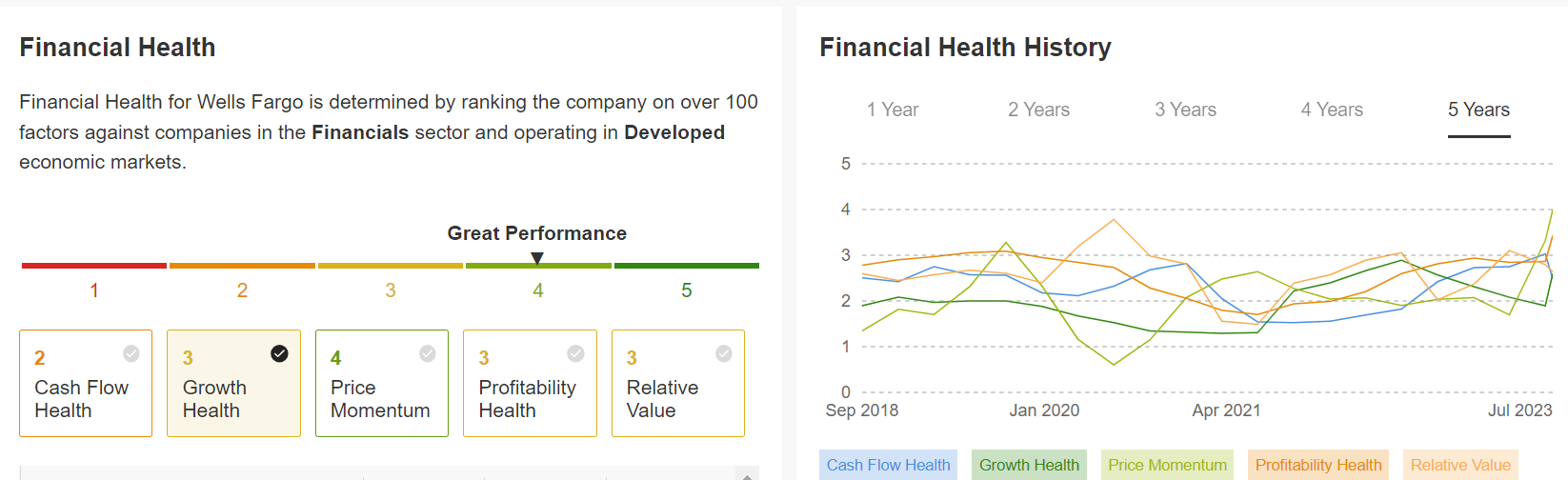

Considering all factors, Wells Fargo & Company appears to be in the best health among the major banks (earning a 4/5 score on InvestingPro). Notably, it has shown an increase in revenues on the investment banking side, a distinction among its peers.

Moreover, given its market size (5.7% compared to other banks’ 15-20%), there seems to be more room for growth.

Source: InvestingPro

Source: InvestingPro

I’m gearing up to conduct a similar analysis of big techs soon, with a keen focus on Apple’s (NASDAQ:) and Alphabet’s (NASDAQ:) turnovers as the main topics.

***

Access first-hand market data, factors affecting stocks, and comprehensive analysis. Take advantage of this opportunity by subscribing and unlocking the potential of InvestingPro to enhance your investment decisions.

And now, you can purchase the subscription at a fraction of the regular price. Our exclusive summer discount sale has been extended!

InvestingPro is back on sale!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Don’t miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the summer sale won’t last forever!

Summer Sale Is Live Again!

Summer Sale Is Live Again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky and, therefore, any investment decision and the associated risk remains with the investor. The author owns the stocks mentioned in the analysis.