Which Industries Benefit Most After A Hurricane?

2022.10.03 15:19

[ad_1]

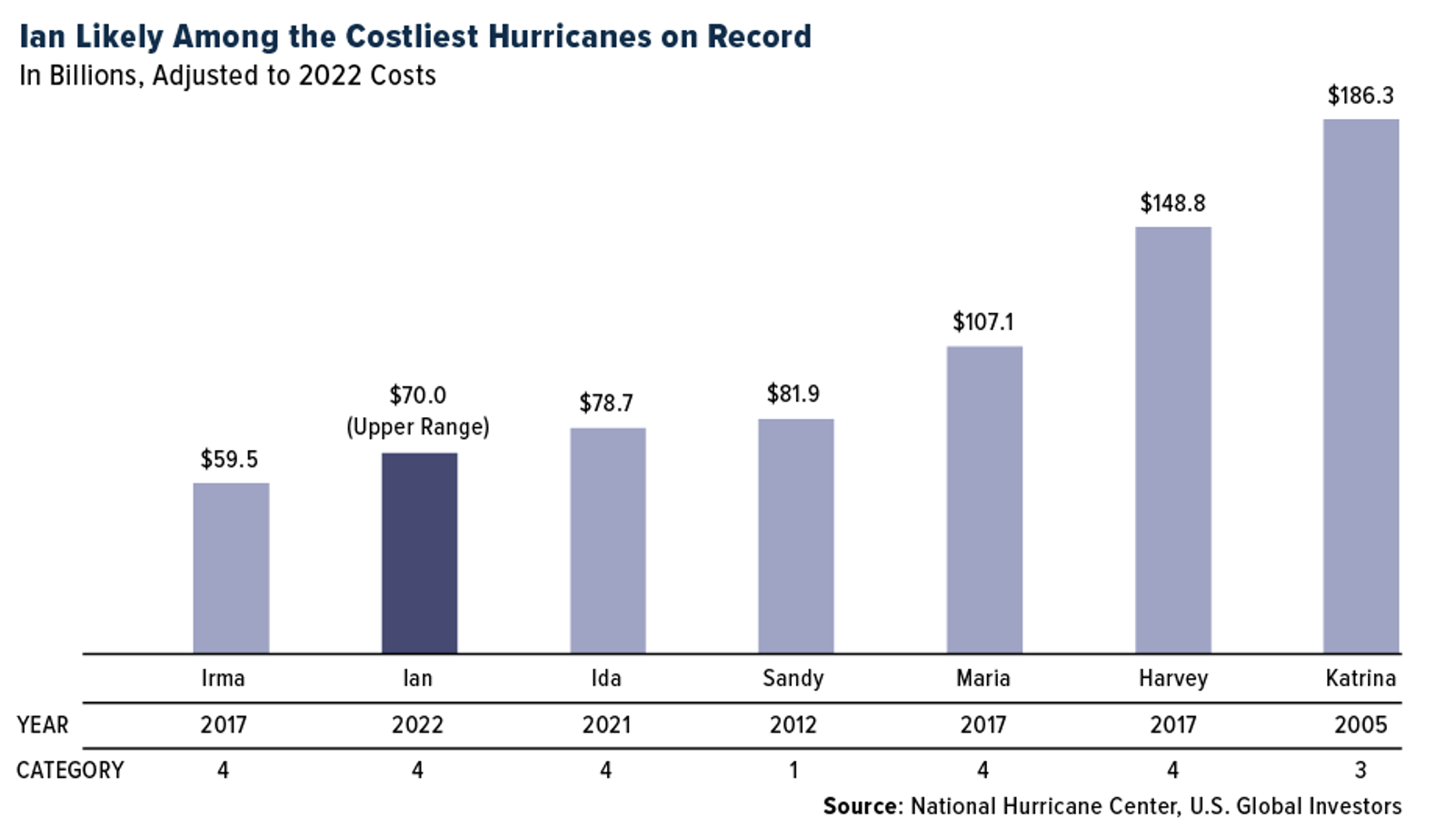

Hurricane Ian is already believed to be among the costliest hurricanes in U.S. history, with the upper range forecast at $70 billion in damages. That would put it in at least the top 10 costliest storms, adjusted for inflation.

The Cost Of Various Hurricanes.

The Cost Of Various Hurricanes.

Of particular concern is Florida’s systemic lack of flood insurance. Just 18.5% of homes in Florida counties that were told to evacuate have coverage through the National Flood Insurance Program (NFIP), which is administered by the Federal Emergency Management Agency (FEMA).

Most regular homeowners’ insurance policies don’t cover flood damage, which is why Congress created the NFIP in 1968. But at an average cost of $995 a year, according to Forbes, the insurance may be out of reach to many households.

I can’t stress how important it is to have this type of coverage, though, especially if you can afford the premiums and live in regions where flooding is possible.

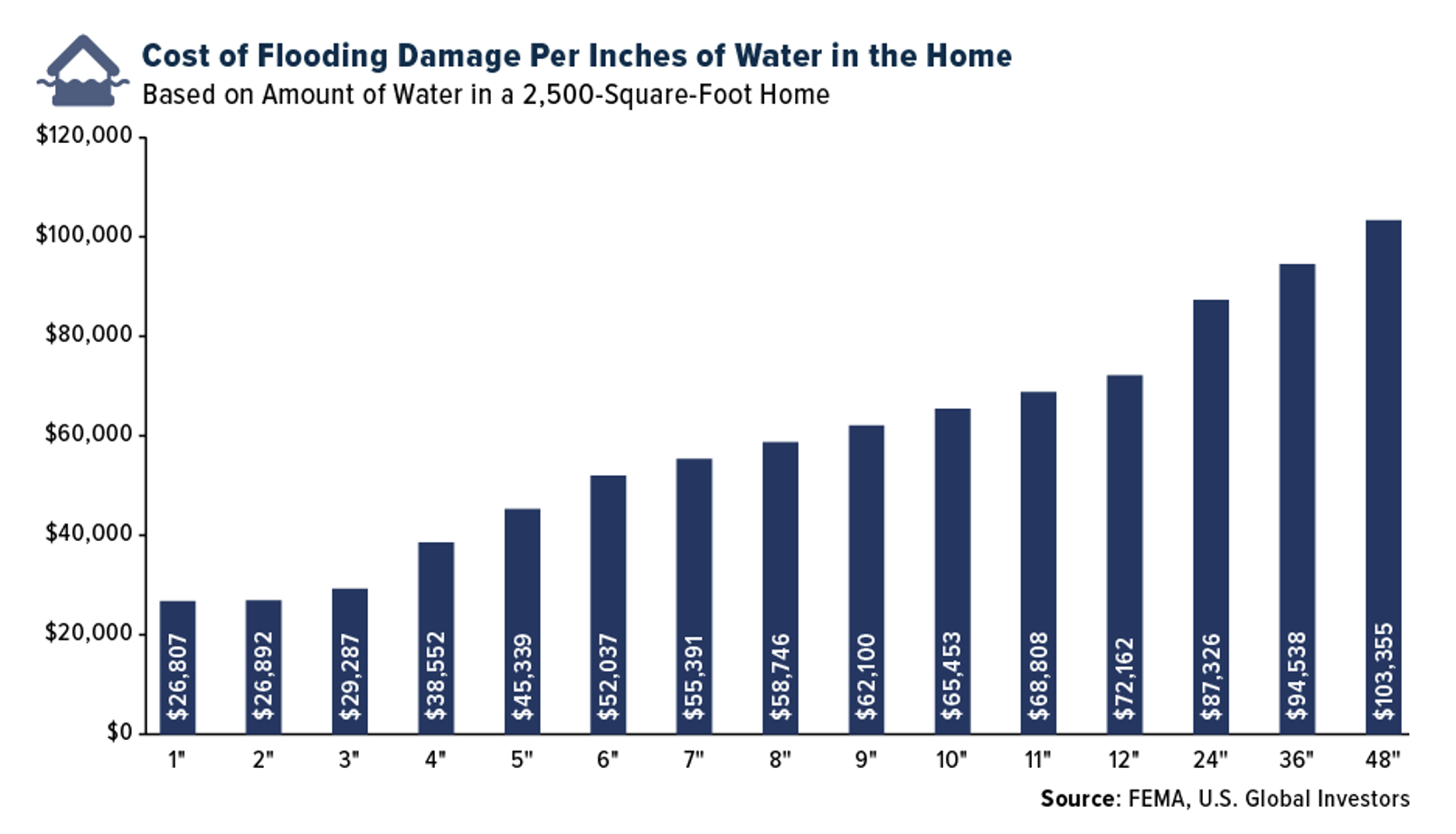

I’m sure many of you have seen the videos of entire first floors of some Florida homes completely inundated with floodwater. According to FEMA, each additional inch of water that floods a home or business increases the total repair cost by a shocking multiple. Even one inch of water in a typical 2,500-square-foot house can carry a price tag approaching $27,000. That $995-per-year NFIP payment starts to look a lot more attractive.

As an investor, you may have hedged your securities to reduce the risk of loss in your portfolio. Some typical strategies include buying put options, futures contracts and other financial instruments, or investing in assets such as gold that have a negative correlation to stocks. It might be helpful to think of flood insurance as a hedge on the investment you’ve made in your home.

Ian Could Cost Insurance Industry $20 Billion Or More

As for the insurance industry, Hurricane Ian will be an “historic event,” potentially costing it upwards of $20 billion, says Andrew Siffert, senior meteorologist with global insurance broker BMS. “This does not count litigation amplification that could result,” he writes.

Though you may disagree, Siffert asserts that Florida is a “textbook for disaster by design.” In the city of Cape Coral, for instance, many homes and businesses have been built along canals. This raises their value as expected, but it also raises the cost to repair or replace them. What’s more, a large percentage of these homes are owned by snowbirds who may not have had the chance to make the appropriate preparations before the storm made landfall.

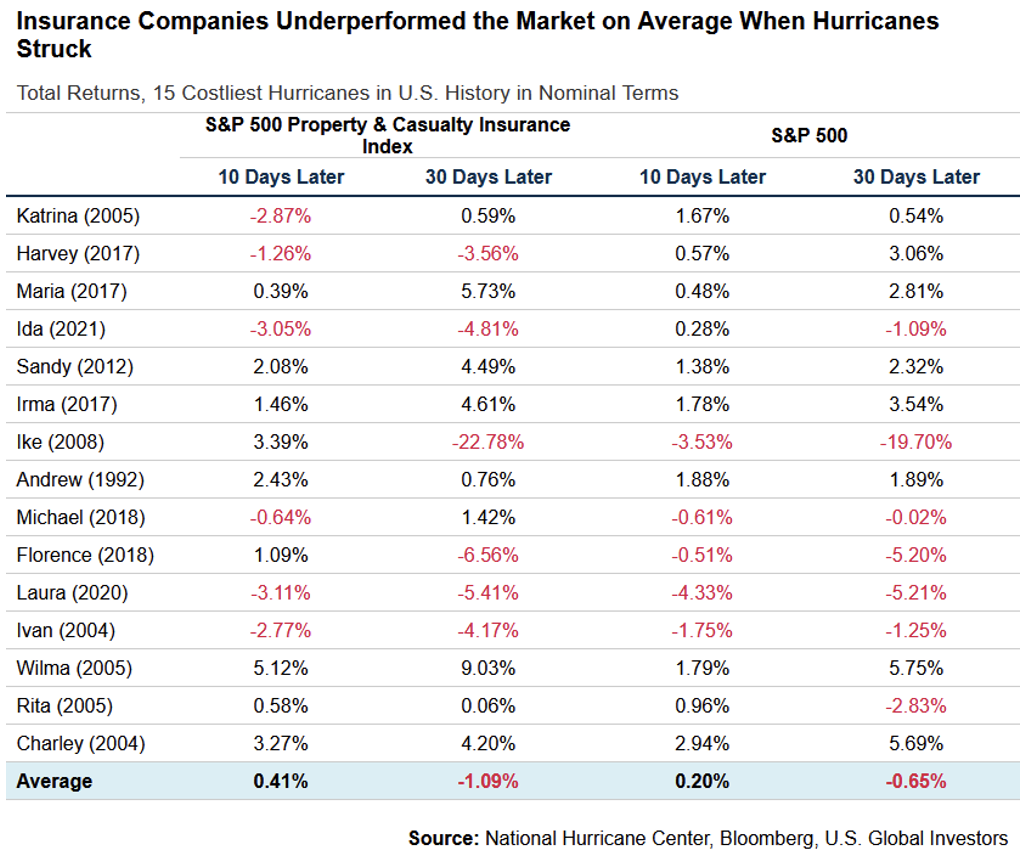

Insurance Companies Have Underperformed On Average, But Not By Much

After learning that the insurance industry could be on the hook for $20 billion or more, you may well believe that shares of property and casualty insurance companies will crater in the coming days and weeks. Indeed, conventional wisdom says to avoid insurance stocks until after hurricane season, which can last between June and November.

The truth is that some industries have historically seen a greater negative impact from hurricanes. A 2018 analysis by Morgan Stanley found that the industry with the highest exposure to hurricanes was, believe it or not, “branded apparel and footwear.”

The reason for this may be that many retailers like to build along popular, heavily trafficked coasts and beaches frequented by affluent residents and tourists. Nearly a quarter of stores owned by PVH Corp (NYSE:)., parent company of Calvin Klein and Tommy Hilfiger, can be found in hurricane prone areas.

I was curious to see the hurricane season’s impact on the performance of property and casualty companies—think Progressive, Travelers (NYSE:), Allstate (NYSE:) and others. I looked at the 10-day and 30-day performance of the seven-member S&P 500 Property & Casualty Insurance Index following the 15 costliest hurricanes in U.S. history, and I compared this to the over the same periods. What I found is that, while the insurance group underperformed on average, it wasn’t by much. In fact, for the 10-day period, insurance companies outperformed slightly, by as much as 21 basis points (bps). For the 30-day period, insurance issuers underperformed the market by some 44 bps on average.

Insurance Company Performance Following A Hurricane.

Insurance Company Performance Following A Hurricane.

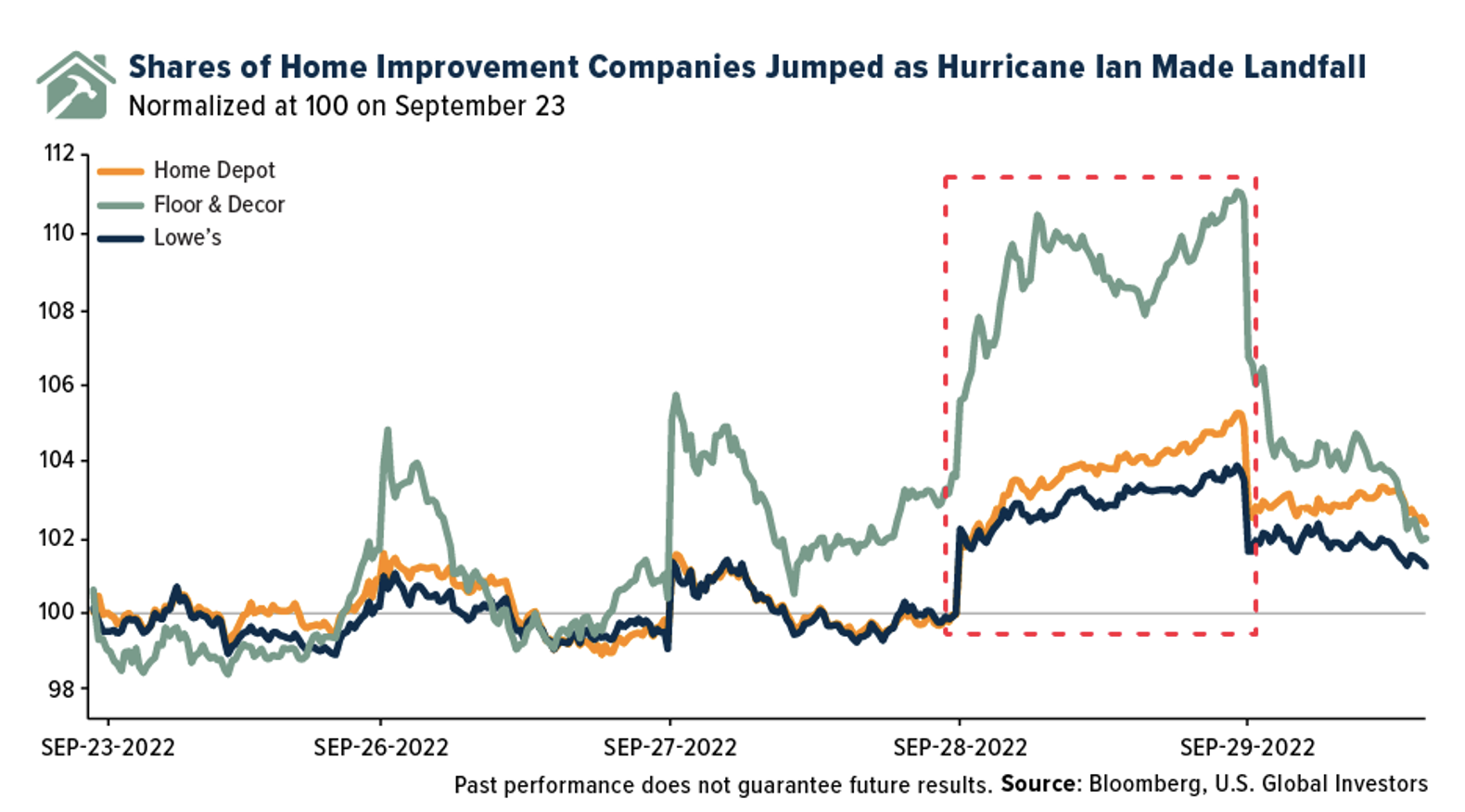

Home Improvement Companies Could Benefit

On the other end of the spectrum are companies that could see increased sales as a result of hurricane season. These include hotel chains, construction companies, like Masco (NYSE:) and C.H. Robinson, and used-vehicle retailers, like CarMax (NYSE:) and Carvana (NYSE:).

Home improvement companies also stand to benefit. Shares of Home Depot (NYSE:), Lowe’s (NYSE:) and Floor & Decor (NYSE:) all jumped last Wednesday as Ian made landfall along the southwestern coast of Florida.

Home Depot, one of our favorite stocks, was on track to close the week up nearly 3%, even as it’s set to record its second straight month of negative returns.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

[ad_2]

Source link