Where Next For BP Stock?

2022.11.02 01:14

[ad_1]

BP (NYSE:) releases its latest earnings report today. A conference call will be held at 5:00am ET.

Wall Street forecasts that BP will report a 62% year-on-year rise in revenue in the third quarter to $58.5B and the underlying replacement cost (RC) profit will rise 86% to $6.2B ($0.32/share).

As my colleague Josh Warner noted earlier:

“The oil and gas sector is expected to deliver the strongest profit growth of any industry this earnings season thanks to higher prices. However, having delivered record profits in the last quarter, the question is whether we have reached the peak and how long prices can remain elevated.”

When it comes to BP though, tightening refining margins may cap any positivity around the results. On refining margins, BP noted in its Q2 that it expected refining margins to remain “elevated due to ongoing supply disruptions”… but a quicker-than-anticipated recovery in global supply may prove the proverbial fly in the ointment for that prediction, similar to the disappointing we saw from Shell (NYSE:) last week.

Another key storyline will be the firm’s ongoing operational issues. The Freeport LNH plant in the US remains shuttered since June and a fire at its Toledo refinery in September is poised to leave that site offline until 2023. Traders will be keen for an update on these facilities to see when BP will be back to operating near full capacity.

Finally, shareholder distributions will impact how the stock trades in the aftermath of its earnings report. BP’s $4.1B cash purchases of US biogas company Archaea could limit buybacks and dividends this quarter, with analysts expecting roughly $3.2B in buybacks in Q4 after $3.5B in Q3. Notably, the company hiked its dividend in Q2, so readers shouldn’t expect another increase there yet.

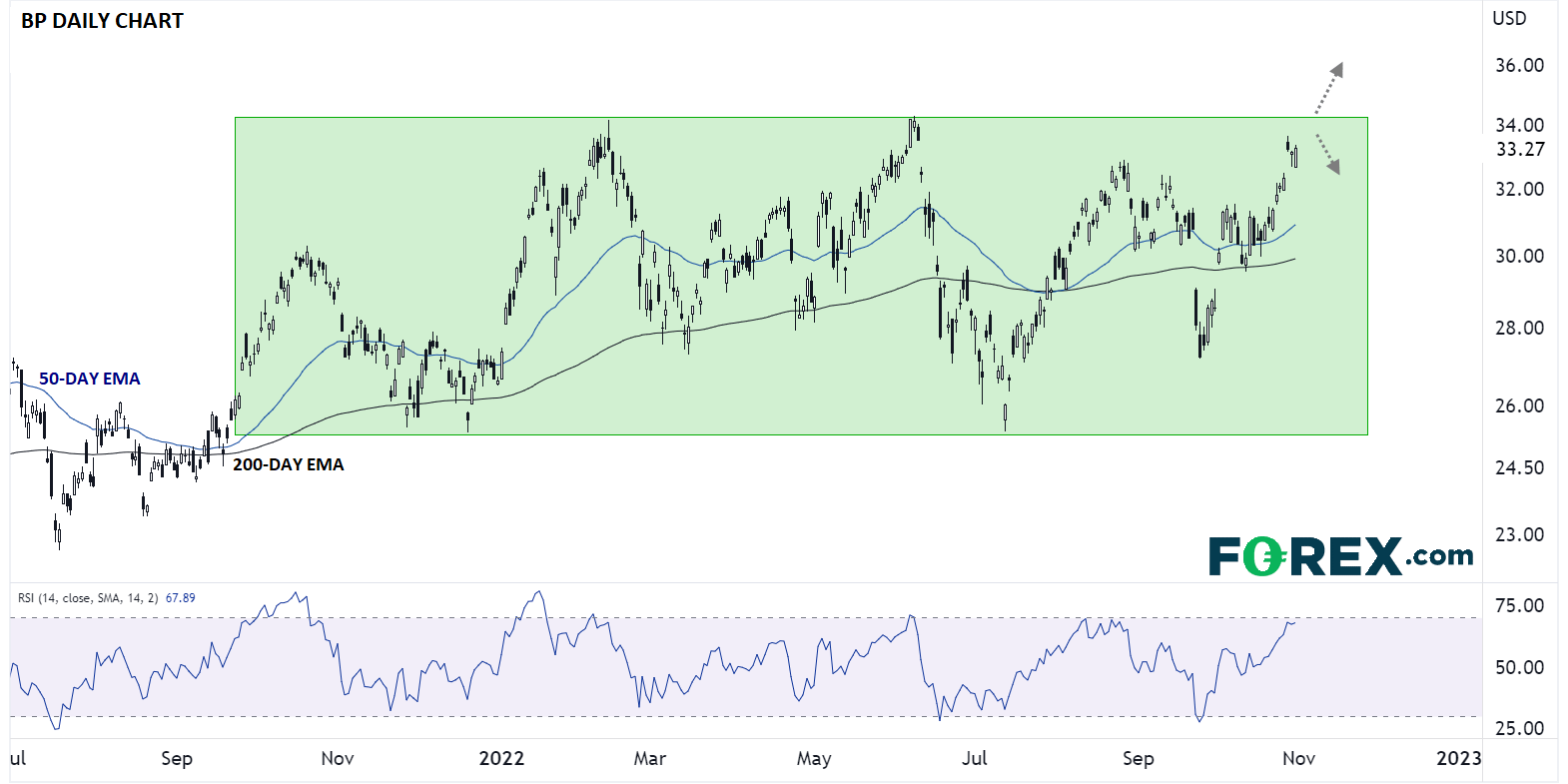

Where next for BP stock?

As the chart below shows, BP has spent the entirety of the year so far trapped in the broad range between 25.00 and 34.00. With the stock testing the top of the range ahead of a potentially strong earnings report, traders will be watching for a confirmed break and close above 34.00 to clear the way for a move up to previous-support-turned-resistance at 36.00 and the Q4 2019 highs around 40.00. Meanwhile, a disappointing report could take the stock back toward the middle of the year’s range near the 30.00 level as traders turn their attention to clearer trends.

Source: TradingView, StoneX

Original Post

[ad_2]

Source link