Where Are We Going? A Few Positive Ways To Deal With Your Investments

2022.10.17 23:10

[ad_1]

This past week almost every economist, talking head and journalist was asking “Where are we going?”

The unknown about where we are going in the economy and the bond and stock markets is creating anxiety, trepidation, uncertainty, and extreme volatility.

Let’s look at this past week. Monday-Wednesday, we were down about 2.5%, then the hotter than expected news about was released on Thursday morning.

Inflation for September came in more elevated and hotter than expected and the markets dropped by 2% from the opening bell.

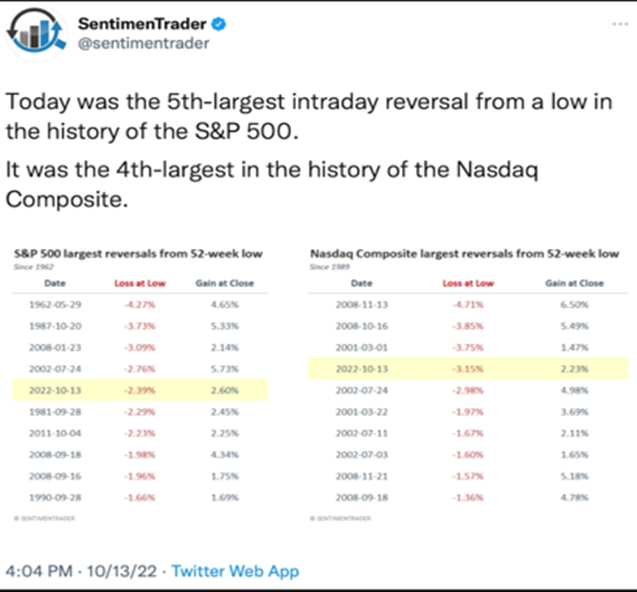

But by the end of the day, the stock market did one gigantic reversal and we ended up almost 3% in most of the indices. It was one of the largest intraday reversals. See chart below:

S&P 500 Intraday Reversal

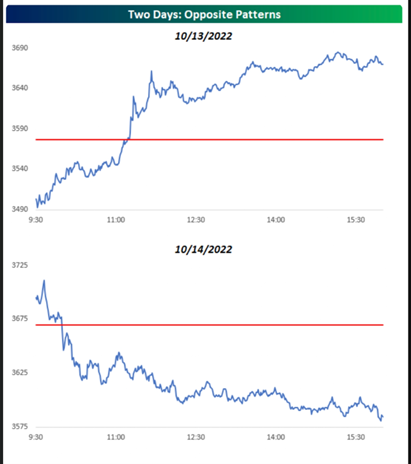

Thursday’s huge rally was followed by an equal (and opposite) reaction to the downside on Friday. It provided more emotional turmoil to a market that many had hoped would see positive follow thru. Clearly, there was none.

Two Days: Opposite Patterns

After rising almost 3% on Thursday, the declined by 2.4% on Friday. That marked the 53rd decline of 1% or more this year. That’s already the most volatility we have seen since 2009 and there are more than two months of this year remaining.

So, Where Are We Going?

The simple answer is we have no idea. Everyone has an opinion and at least half differ from the others, especially on where the market is headed next.

We can assure you that we are in for a much more volatile ride. Why?

As we have consistently been pointing out since earlier this year, there are several dominant themes playing out. They will continue to plague this stock (and bond) market. This could easily continue into midyear 2023 or even beyond.

Here are the main themes to be aware of:

Inflation: (yes, I said the dirtiest of words)

The Producer Price Index (PPI) on Wednesday gave us a good indication that inflation was not cooling anytime soon. It showed higher, not lower readings. The market continued its sell off from the beginning of the week.

This was followed by Thursday morning’s news that the Consumer Price Index (CPI) was also higher than expected. Total CPI was up 8.2% year-over-year, versus 8.3% in August. More concerning however (and damaging) was that Core CPI, which excludes food and energy (do you know anyone who does not use food/energy?—me neither) was up 6.6% versus 6.3% in August. This was the highest level for core CPI since August 1982.

Interest Rates:

We have commented on rising interest rates in great detail the past few weeks. The interest rate charts show the 10-year going up the past 10 weeks thru last week.

Our expectations is that the Fed’s only ammunition to fight this insidious and punishing inflation affecting every American is to continue raising rates. Furthermore, the bond market (2 year and 10-year treasuries) are forecasting a potential recession in the next 6-12 months. Here is the chart of the 2/10 year spread which is experiencing the greatest inversion gap since the 1980’s:

US 10-Year Treasuries

We have pointed out to our clients that there are many economists, including Larry Summers, Art Laffer, and others (reputable ex-government financial gurus) that continue to predict that rates must go up much more to combat inflation. There is even talk that the 5 year will soon see at least 5% and the 10-year Treasury should go up to 4.5% before there is any kind of Fed pivot.

This will continue to put pressure on Corporate America and compress earnings. (See more below).

Earnings

Inevitably what drives stock prices (and the market) is earnings. Analysts have already predicted that earnings have slowed and we are likely to see flat earnings growth rates the next few quarters (after predicting 4-7% earnings growth earlier in the year). We suspect that at some point with Inflation staying elevated and the Fed continuing to raise rates aggressively while selling their bond holdings (and liquidating their balance sheet to contract money supply), there will be increasing pressure on earnings.

Earnings will contract as the economy slows down, as consumer demand is destroyed from higher borrowing costs and much higher consumer prices (food, energy, goods, and services). We would go out on a limb and suggest that with heating costs doubling or tripling this winter, we will see a dramatic slowdown in consumer spending in the next few months.

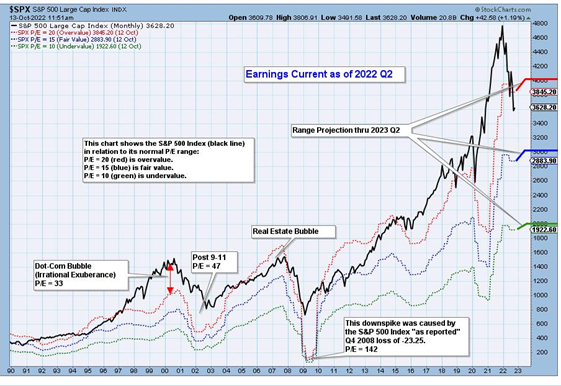

We have given ranges for earnings in the past few Market Outlooks. Through a friend and market expert of ours, Decision Point, we offer you the following chart to show the ranges of earnings and the effect it would have on the S&P 500. If you look closely, they have offered up 3 targets based on earnings expectations or possible disappointments. The high mid and low estimates on the S&P 500 for 2023 are as follows: 3845, 2884 and 1923, respectively. Other than the high estimate a little above where we currently reside, the other estimates are substantial drops which might come.

SPX Monthly Chart

We take no ownership in how accurate these projections may turn out. MarketGauge has built long-term successful quant-algo based investment strategies that are unique, adaptive and have produced investment returns well above their respective benchmarks over time.

This Is Getting Old

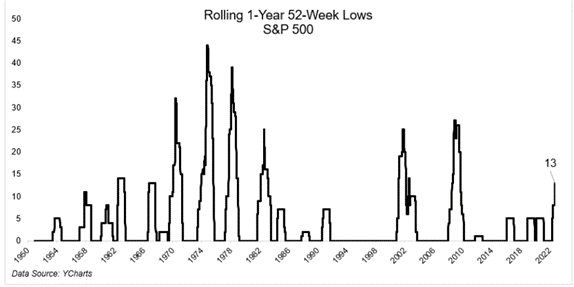

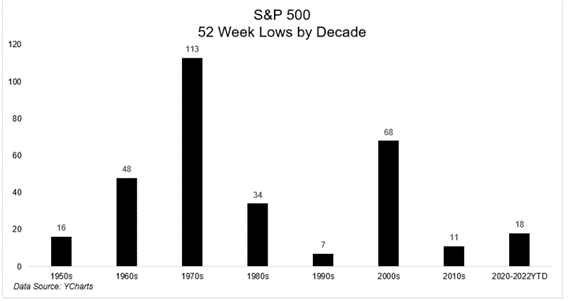

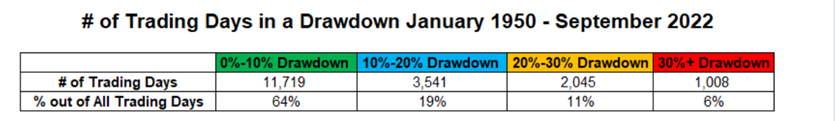

Starting in 2020, this decade has seen more 52-week lows on the S&P 500 index in the past two decades ago (2000-2010). We continue to remain underwater for a much longer period than since the great financial crisis of 2008-2009). Only 11% of the time has the market stayed under a negative 20% return this long. See meaningful charts below:

52-Week Lows On The S&P 500 Index

S&P 500 52-Week Lows By Decade

No Of Trading Days In A Drawdown

No Of Trading Days In A Drawdown

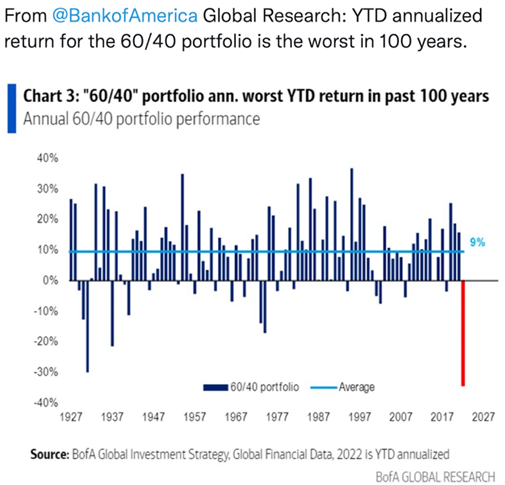

The Real Damage

We know that a lot of the above information is theoretical. Perhaps you are one of our current subscribers and have taken our ongoing guidance to move to cash, use some of our investment strategies which may be using inverse ETFs (short the market), or you are just waiting it out (hopefully you have sought some shelter). If you thought that bonds/fixed income was going to help, they have not. As you know, it has not been pretty in 2022. Please see the chart below:

60/40 Portfolio

Here are some additional observations from our BIG VIEW:

Risk On

- The four key indices closed down on the week but had a bullish engulfing reversal pattern that is still intact. (+)

- Volume Patterns have improved in the indices, with a growth in the number of accumulation days vs. distribution days across the board and the leading the pack. (+)

- Risk Gauges improved to a weak bullish reading, indicating the potential for a short-term rally. (+)

Neutral

- Despite the nasty price action this week, the only major index to close on new lows was the . (QQQ) (=)

- Market internals are improving slightly according to the McClellan Oscillator (MO) which created a divergence with a higher low this week despite price making a lower low for both the S&P 500 and . (=)

- The New High / New Low ratios for the S&P 500 and Nasdaq Composite remain in deeply oversold territory. However, they’re stabilizing if not slightly improving. (=)

- The short vs long-term volatility ratio (VIX/VXV) is basing out and starting to potentially wake up. (=)

- The number of stocks above their 10-day moving averages remains above longer-term moving averages, a slightly positive divergence. (=)

- The only two members of Mish’s Modern Family that continue to hold up are Biotech (IBB) and Regional Banks (KRE), outperforming the market on a relative basis. (=)

- Greece, France, Italy, and Sweden were all positive for the week outperforming countries in Asia and Latin America. (=)

Risk Off

- All four key indices closed below their respective 200-week moving averages. (-)

- Sector performance is giving a classic risk-off reading, with Consumer Staples (XLP) performing the best while Semiconductors (SMH) and Consumer Discretionary (XLY) were the worst. (-)

- China (FXI) and Semiconductors (SMH) were the clear underperforming hotspots this week, leading to the downside. (-)

- Interest rates continue to rise, with new highs all the way across the yield curve forcing new lows in bonds. (-)

- Value stocks (VTV) continue to outperform Growth stocks (VUG) on a relative basis, with Value stocks pushing higher this week. (-)

- Emerging markets underperformed sluggish returns of US and European equities for the week and China’s continued market meltdown has only dragged down the divergence in EEM returns, due to China’s large weighting in EEM. (-)

- Gold and oil both sold off with the market and are under pressure due to high rates and continued strength in the US dollar. (-)

[ad_2]

Source link