When The Trend Is Not Your Friend – A Trading Plan

2022.06.20 07:45

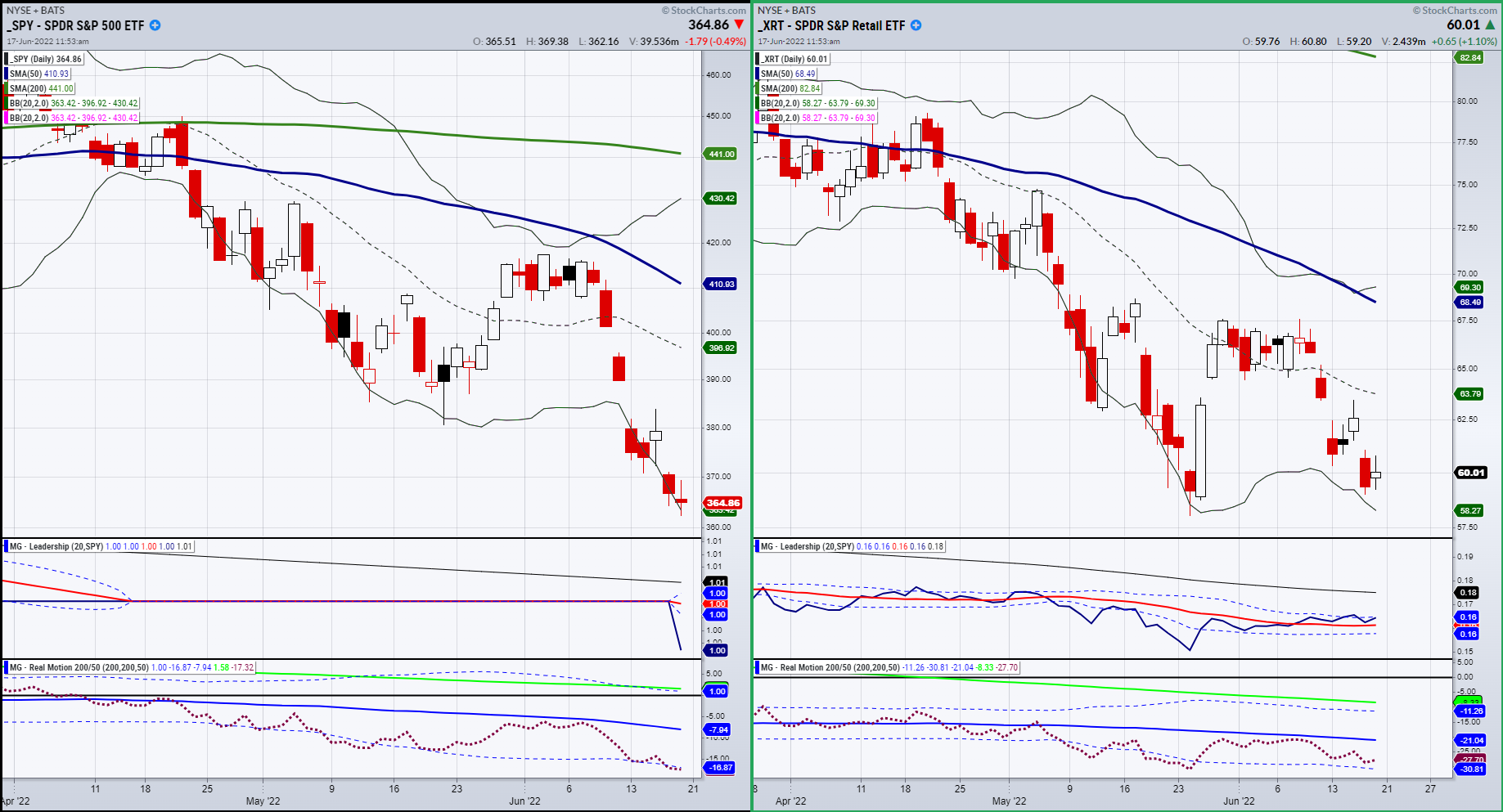

SPY-XRT-Daily Chart

SPY-XRT-Daily Chart

Currently, if we look at the S&P 500 and the Retail Sector through the SPDR® S&P Retail ETF (NYSE:XRT), our foregone conclusion is that for the most part, equities are a distraction.

The obvious trend is down, but is it that so obvious at current levels?

Looking at the SPY chart, we could be setting up for a mean reversion trade (bear market bounce that can take SPY back up to 380.) So, selling right now? Maybe, but SPY has to break 360 first.

Granny Retail XRT, also in a downtrend, has some good bottoming action, and is outperforming the SPY. Plus, the momentum on the Real Motion indicator is holding up.

That makes it fairly simple.

Either XRT holds here and clears back over the 200-week moving average and the 62.50 level to rally more bringing the SPY up along with it….

Or, SPY fails 360 and drags XRT down further with it, causing XRT to potentially break harder below the 200-WMA or close to 50.00.

So if it is that simple, why do we think equities are more of a distraction right now?

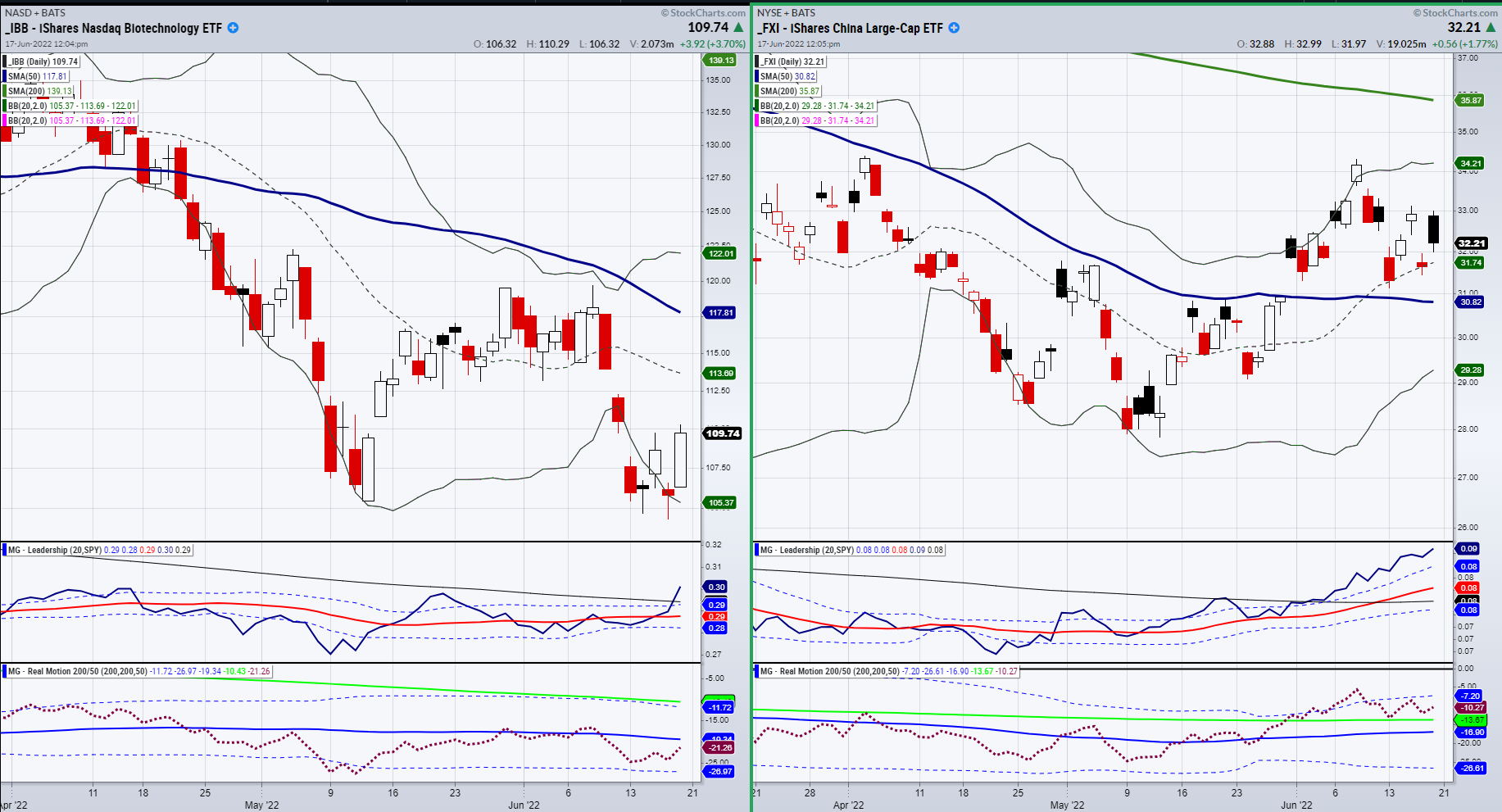

IBB-FXI-Daily Chart

IBB-FXI-Daily Chart

Trends are supposed to be your friend. But right now, the trend feels a bit treacherous for both the bears and the bulls.

Biotechnology IBB, the first to bottom in 2009 after the mortgage crisis, has been in a strong downtrend and is well under the 200-WMA. However, IBB is also outperforming the SPY and showing some balance in momentum.

Can it hold up if SPY fails 260? Doubtful.

So, what do we like right now?

China, Commodities and Cannabis.

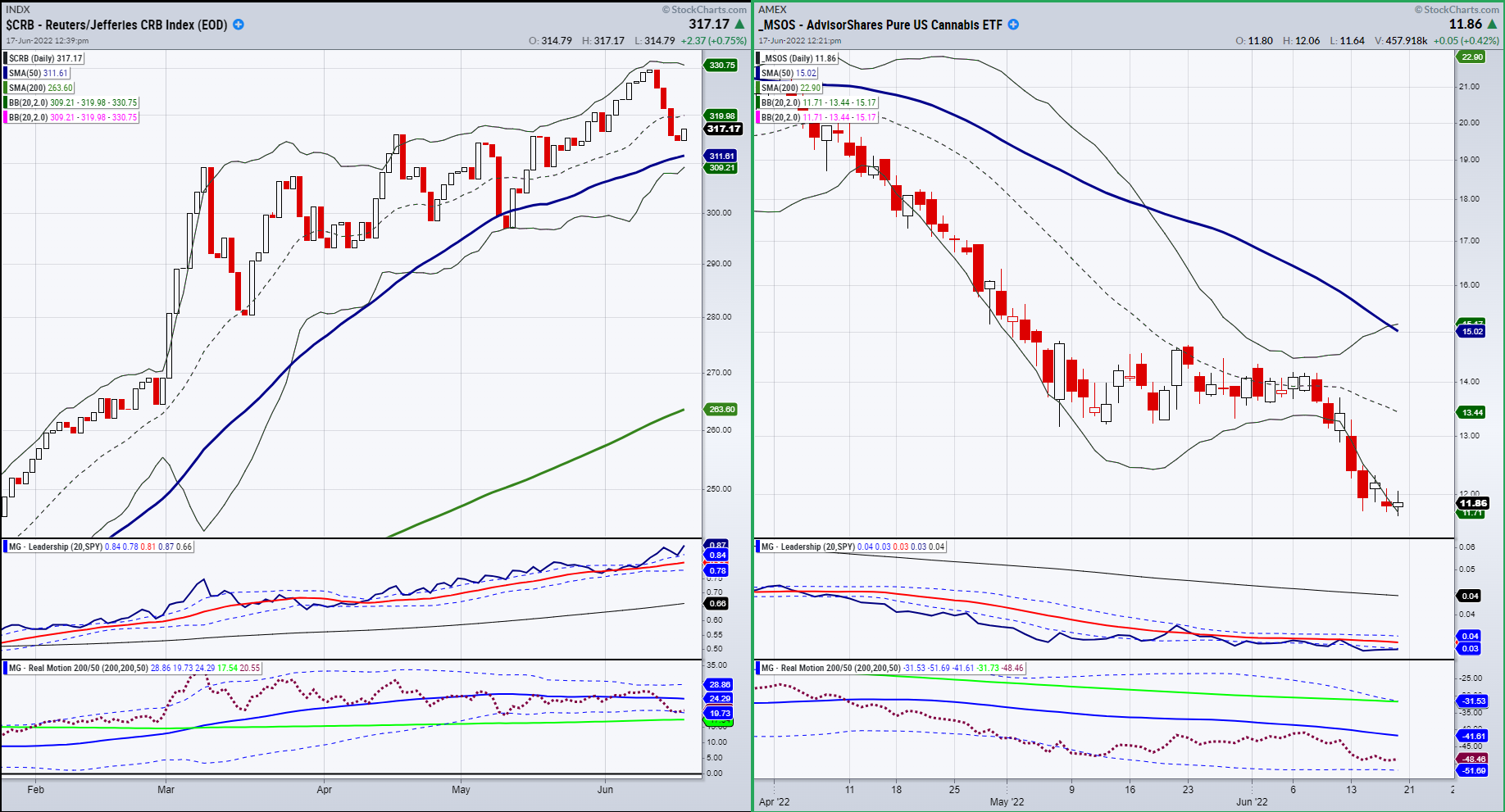

CRB-MSOS-Daily Chart

CRB-MSOS-Daily Chart

We are all about trading opportunities with the best risk.

China, via iShares China Large-Cap ETF (NYSE:FXI), a position in our portfolio, could be something to add to. As the U.S. does QT, China is doing QE.

Commodities (CRB) have been in an uptrend and are correcting into support. With the worst global inflation rates in 40 years and stagflation on the horizon, we will continue to add to our tactical positions in commodities.

Cannabis, via AdvisorShares Pure US Cannabis ETF (NYSE:MSOS), which we are aside in right now, continues to intrigue us. If equities rise, so will that sector. And if equities fall, the momentum indicates that the selling there has pretty much dried up.

Our portfolio remains in the black and for those individuals underwater, stay tuned for more ways to inflation-proof YOUR portfolio and mitigate inflation. We see attractive sectors and are waiting for the right time to execute. –

ETF Summary

S&P 500 (SPY) 380 resistance 374 pivotal support 360 major support

Russell 2000 (IWM) 159 support 175-177 big resistance

Dow (DIA) 294 support

NASDAQ (QQQ) 290 resistance 263 big support

KRE (Regional Banks) 56 the 200 WMA 60 resistance

SMH (Semiconductors) 195 some minor support with 220 resistance

IYT (Transportation) 211.87 the 200-WMA resistance 192 support

IBB (Biotechnology) Still potential double bottom-110 pivotal-112.50 resistance

XRT (Retail) 60.62 the important 200-WMA support closed just below-a gap up Tuesday would look compelling for a rally