What is Driving Retail Sales Growth?

2022.11.18 00:51

[ad_1]

The Commerce Department’s report showed solid consumer spending. Yet, robust retail sales data failed to boost the market.

Consumption accounts for approximately 70% of our economy. SPDR® S&P Retail ETF (NYSE:), is a large, diversified ETF representing broad market consumption.

Although various factors are at play, is the current driver of consumer spending and retail sales growth. This trend is likely to continue.

XRT was nearly crossing the 200-day moving average and looking to regain this key technical price level, but it dropped almost 4% yesterday.

XRT was overbought on Real Motion and Price and subject to mean reversion today. More continued pain is possible with support around 60 USD near the 50-day moving average.

While overall retail sales remain strong, it’s clear that the sector is being squeezed.

Investors should keep an eye on this trend to avoid companies struggling to adapt.

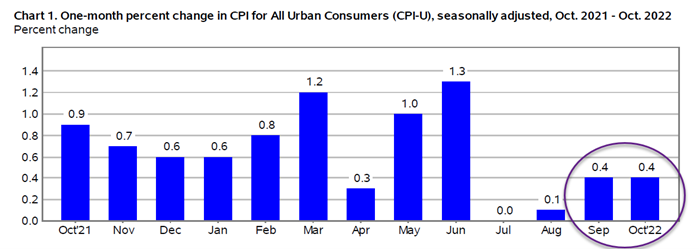

Change In 1-Month CPI For All Urban Consumers

Change In 1-Month CPI For All Urban Consumers

Consumption has been squeezed from all sides – wages are stagnant, while rents and other living costs continue to increase – so any sign that the Fed will continue raising interest rates could lead to less retail sales.

Shelter which makes up one-third of CPI, rose from 6.6% in September to 6.9% in October, the largest percentage increase in the shelter component since August 1990. Keep in mind that 6.9% number is still lagging.

Regardless of the inflation debate, US CPI is 7.7% year over year and US is 8.0% year over year.

Suppose you take the last two months’ percent change in CPI above, which was 0.4% in September and a 0.4% increase in October, and multiply 0.4% (monthly change) x 12 (months), this equals 4.8% of annual inflation.

Retail consumption is being squeezed by inflation, and certain retailers like Walmart (NYSE:) are well-positioned to take advantage of this trend. The company’s stores are seen as a place for value amidst a tough economy.

While there are some concerns about inflationary pressures pushing the economy into recession, for now, at least, select retailers can enjoy the benefits of margin expansion and continued consumer demand.

While strong headwinds still face the US consumer, prices are rising, and now retailers are raising their prices too.

Retailers offering value and additional services have pricing power and can pass increased costs to consumers.

How long can we expect CPI to moderate when Home Depot (NYSE:), Walmart, and other leading retailers increase prices to maintain profitability?

All of this suggests that inflationary pressures are still present in the economy, and this trend is likely to continue as prices rise.

ETF Summary

S&P 500 () 392 support and 398 resistance

Russell 2000 () 182 support and 186 resistance

Dow () 333 support and 339 resistance

Nasdaq () 282 support and 289 resistance

(Regional Banks) 61 support and 65 resistance

(Semiconductors) 214 support and 222 resistance

(Transportation) 223 support and 227 resistance

(Biotechnology) 132 support and 136 resistance

XRT (Retail) 61 support and 66 resistance

[ad_2]

Source link