What Can We Expect From Stagflation?

2023.04.28 03:42

The rises (although far from the 8% peak). The falls.

is the contraction of the economy over?

Meanwhile, stagflation persists along with the trading ranges in indices and many sectors.

Plus, the theory we have been expounding on (a 2-year business cycle within a longer 6–8-year business cycle) gets more relevant every week.

How long can this trading range continue?

Looking at the , the range has been from $31,4239.82 to $34,342.32 in 2023.

Historically, we have seen the Dow remain rangebound for years (1968-1982). In current times though, things move much faster.

The 23-month moving average is a shorter-term cycle within a longer-term cycle.

The DJIA is sitting right on the monthly MA-teasing investors during a tough time predicting the next major moves.

With April about over, it will be fascinating to see if the DJIA closes above or below the blue line or 33,600.

It could be that the economy has contracted enough for now and will grow marginally.

It could also be that inflation peaked at 8% but could still have more upside.

There are many factors to consider, such as geopolitics. For now, we are accepting that stagflation remains the theme.

If so, we look at sectors outperforming the 2-year cycle, showing expansion.

Interestingly, some growth stocks (META APPL MSFT), defense sectors (Raytheon (NYSE:) RTX), consumer staples (PG, Walmart (NYSE:)), global streaming stocks (FWONA) and as few commodities (GLD (NYSE:), SLV, Sugar) fit that bill.

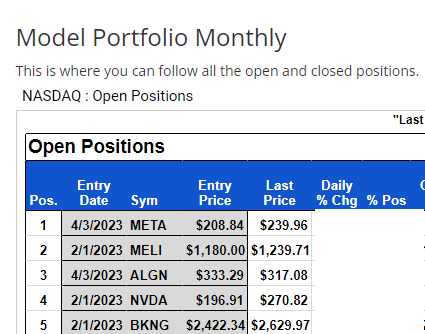

Model Portfolio Monthly

Our NASDAQ All-Stars model has picked up on these growth stocks.

Now that Meta Platforms (NASDAQ:) has wowed (and handily cleared the 23-month moving average), perhaps we will see the others join in as they get ready to report.

Here are the other positions relative to the 23-month MA.

MELI-ALGN-NVDA-BKNG Monthly Charts

MELI-ALGN-NVDA-BKNG Monthly Charts

ETF Summary

- (SPY) 23-month MA 420

- Russell 2000 (IWM) 170 support – 180 resistance

- Dow (DIA) Over the 23-month MA

- Nasdaq (QQQ) 329, the 23-month MA

- Regional banks (KRE) 43 now pivotal resistance

- Semiconductors (SMH) 246, the 23-month MA

- Transportation (IYT) 202-240 biggest range to watch

- Biotechnology (IBB) 121-135 range to watch from monthly charts

- Retail (XRT) 56-75 trading range to break one way or another