What a Weakening U.S. Dollar Means for Large-Cap Tech Stocks

2022.12.27 03:12

[ad_1]

The broader aspects of the recent weakening will be saved for further down the article, but one thing that struck me reviewing the Q3 ’22 earnings results for large-cap and mega-cap technology was the impact the dollar strength was having on revenue in general, and the technology sector in particular.

Here’s a recap of the tech sector’s year-over-year (y.y) EPS and revenue growth since 2019:

- Q4 ’22 est: -8.7% EPS gro and -0.7% revenue gro;

- Q3 ’22 actual: -0.2% EPS gro and +7.2% rev gro;

- Q2 ’22 actual: +1.5% EPS gro and +7.3% rev gro;

- Q1 ’22: actual: +14.6% EPS gro and +12.4% rev gro;

- Q4 ’21 actual: +24.6% EPS gro and +13.8% rev gro;

- Q3 ’21 actual: +38.2% EPS gro and +19.8% rev gro;

- Q2 ’22 actual: +49.6% EPS gro and +22.2% rev gro;

- Q1 ’22 actual: +44.9% EPS gro and +22.1% rev gro;

- Q4 ’20 actual: +20.4% EPS gro and +11.4% rev gro;

- Q3 ’20 actual: +9.9% EPS gro and +4.4% rev gro;

- Q2 ’20 actual: +5.6% EPS gro and +4.8% rev gro;

- Q1 ’20 actual: +7.2% EPS gro and +3.8% rev gro;

- Q4 ’19 actual: +9.2% EPS gro and +5.7% rev gro;

- Q3 ’19 actual: -1.7% EPS gro and +1% rev gro;

- Q2 ’19: actual: -.2.2% EPS gro and -0.3% rev gro;

- Q1 ’19: actual: -1.1% EPS gro and -0.8% rev gro;

Readers typically only care about the future (as you should), but Technology (NYSE:) and the Energy (NYSE:) sectors could be mirror images of one another for 2023. Technology faces much easier compares after Q1 ’23, while Energy faces much tougher compares for most of 2023, given the surge in energy EPS after November ’20.

Technology suffered badly from compares to 2021 results, and you can see it in the numbers above. Q4 ’21 and Q1 ’22 still show hard compares for the tech sector in Q4 ’21 and Q1 ’23, but note what’s happened in late 2022 in terms of tech results, which should help the tech sector as we move through calendar ’23. Remember that technology is still 26% of the S&P 500’s market cap as of Friday, Dec. 23, 2022.

Note the tech slowdown in 2019, after Jay Powell completed the rate hikes that Janet Yellen started in Q4 ’16 after President Trump’s election.

The point is tech has really been walloped with tough 2021 compared to a far more restrictive monetary policy by Jay Powell (i.e., PE compression, but that’s an effect of EPS and revenue slowdown, not a cause) and record strength in the dollar in 2022.

So how important is the dollar to the tech sector?

- IBM (NYSE:) in Q3 ’22 reported “fx” as a 700 basis point headwind;

- Oracle (NYSE:) FX or “constant currency” headwind expected to be 500 – 600 bp’s in fiscal ’23 (ends May ’23);

- Meta Platforms (META) saw a 600 bp headwind to revenue growth in Q3 ’22;

- Apple (NASDAQ:): saw a 600 bp headwind to revenue in fiscal Q4 ’22 (ends Sept ’22);

- Microsoft (NASDAQ:): saw a 500 bp headwind from the currency in their fiscal Q1 ’23 9Sept ’22 qtr);

- Alphabet (NASDAQ:): 500 bp headwind in Q3 ’22

- Tesla (NASDAQ:): no impact that was readily discernable from Q3 ’22 results. One analyst noted a small negative EBIT variance from FX, but that was it;

- Amazon (NASDAQ:): 400 bp headwind in Q3 ’22;

- Nike (NYSE:): Not tech, but since Nike just reported their Q2 ’23 financial results, showing a 1,000 bp headwind from fx in their fiscal Q2 ’23 (ended Nov ’22), I thought it was worth including;

Two caveats from the above detail: the headwind is being calculated from the difference between the reported revenue growth on the income statement (in dollars) and the “constant currency” growth as reported by the company, e. g., Nike reported +17% y/y revenue growth in the November ’22 quarter, and also reported (per Morningstar) +27% “constant currency” revenue growth for the November ’22 quarter, resulting in the 1,000 basis point difference between the two.

The other aspect of the currency that readers must consider for multi-national companies is the currency’s impact on expenses. Although I haven’t quantified it, currency can impact expenses and revenue, and that translation impact on expenses is not always detailed or quantified in an earnings release.

My boss at a mutual fund firm in the early 1990s was the Director of Research, and I could walk into his office and ask him about anything investment-related. I asked him about the dollar’s importance – and you have to remember this was from 1992 to 1995 – and he stated that its importance was probably overestimated in the financial media.

However, Factset, which does its own earnings work and publication, has noted that, within the technology sector, non-US revenue is now slightly greater than 50% within the last ten years.

The Dollar From a Broader Perspective

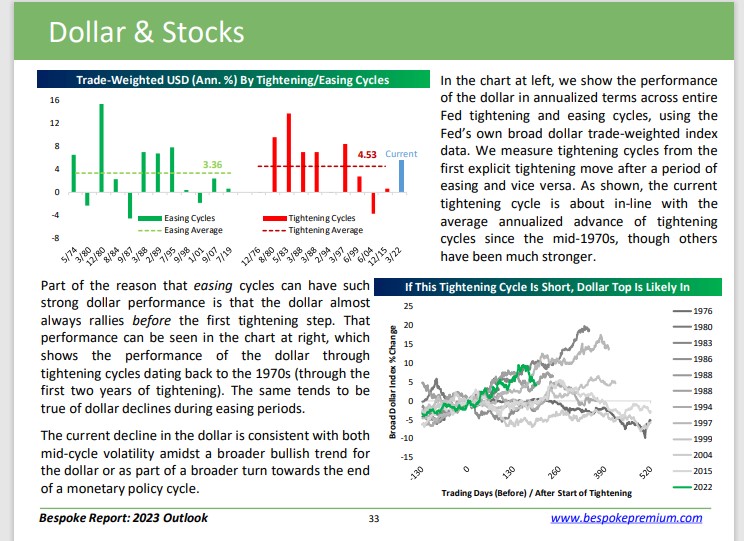

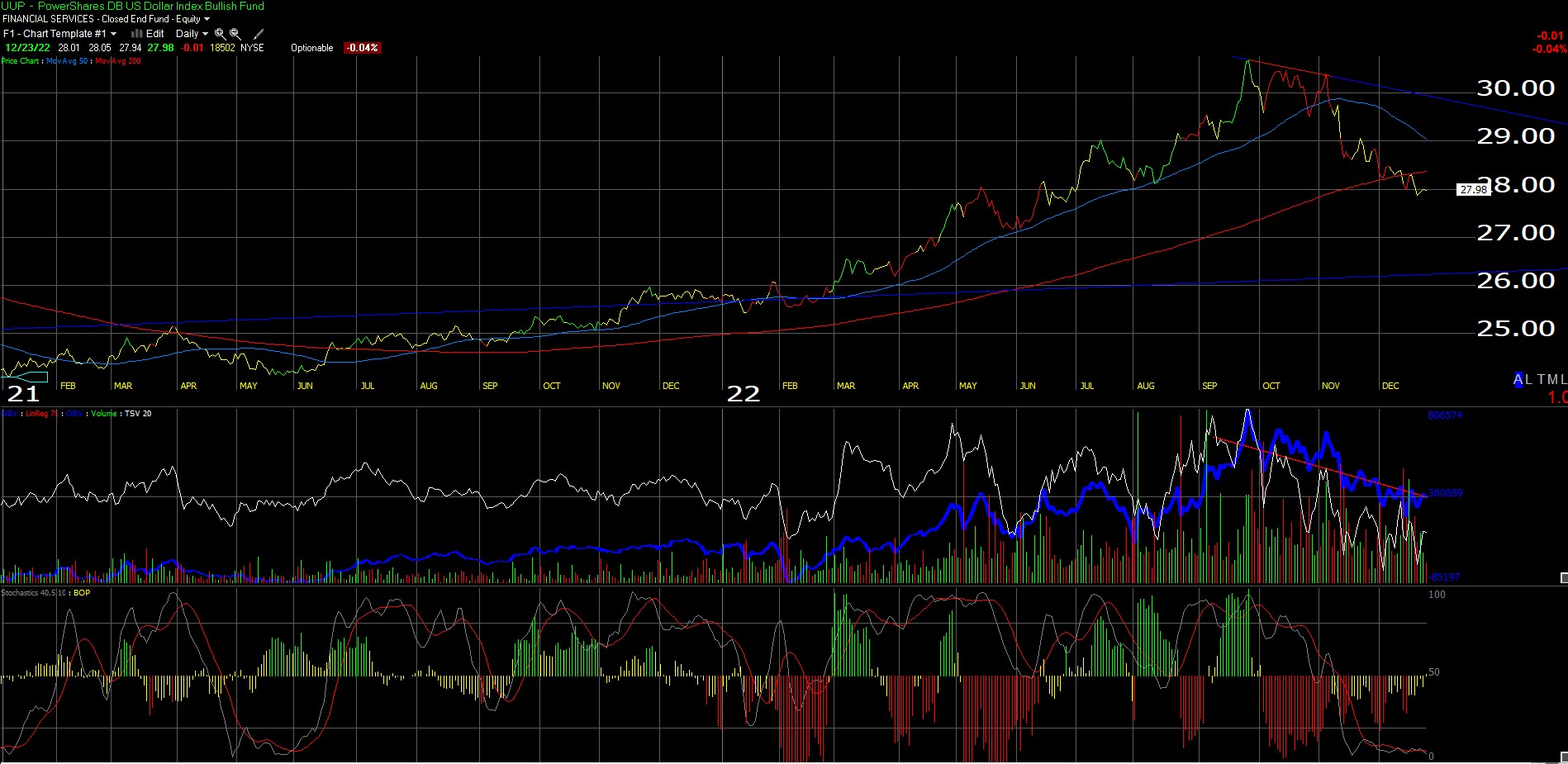

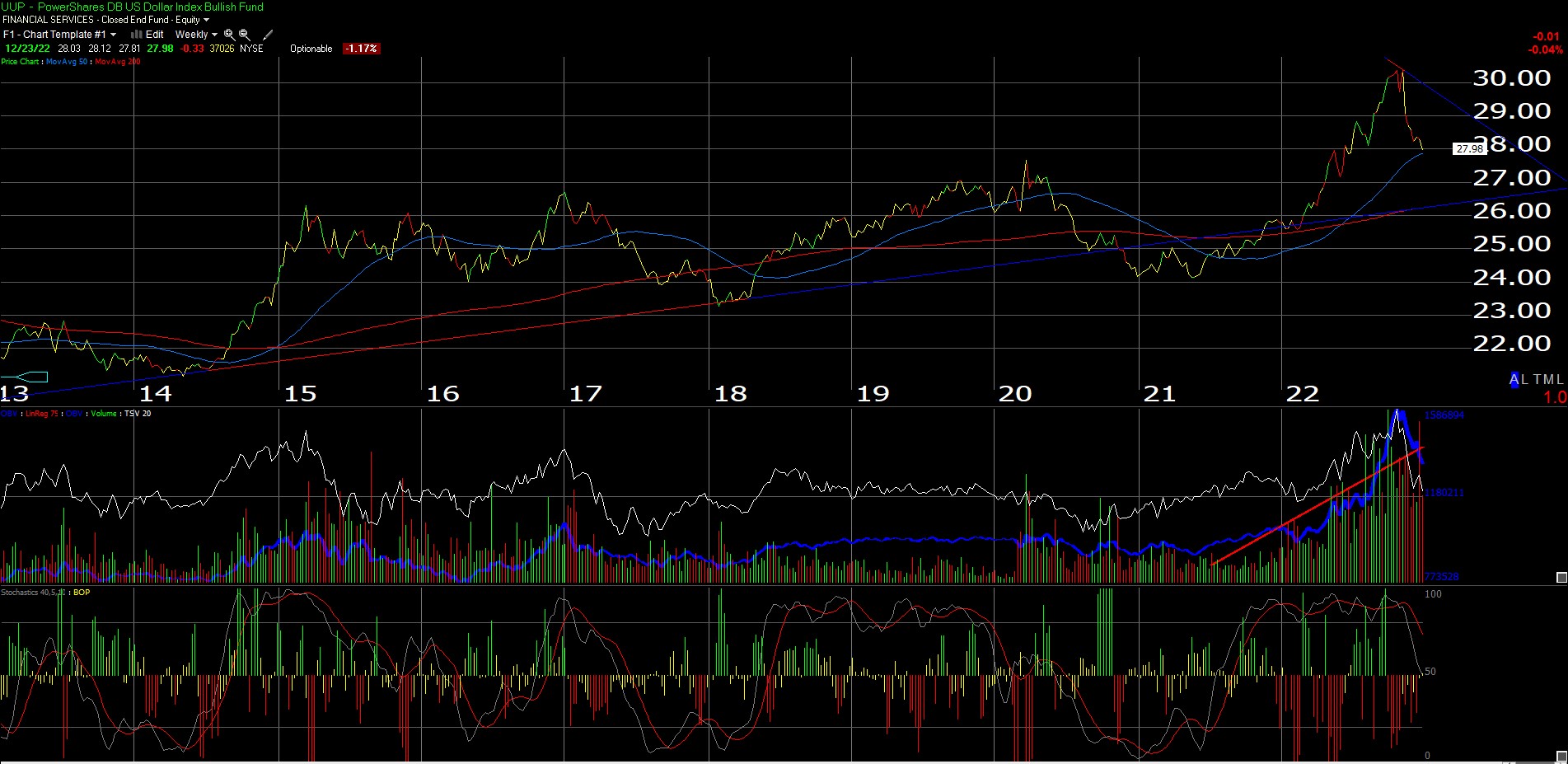

Readers know this blog’s affinity for Bespoke’s research, which is the first chart or bar graph listed above, but also, after reading the Bespoke notes, quickly click on and expand the daily chart (first chart with dark background) and then the UUP weekly chart (2nd chart with dark background) found at the bottom.

There is no question that the US dollar has started to weaken and that the daily Invesco DB US Dollar Index Bullish Fund (NYSE:) chart shows the buck trading below its 200-day moving average, which is a big positive per the technicians this blog uses for technical analysis. However, the next catalyst would be the UUP falling below its 50-week moving average on the weekly chart and seeing the UUP return to the mid $20’s or uptrend line and get very oversold again.

2022’s recent strength in the US dollar resembled that of President George Bush’s (Bush 43’s) first term from 2000 to 2002. That period of dollar strength also coincided with the 80% drop in the from March 2000 to late 2002. 2022 resembles 2001 – 2002 without the severity or drama: value stocks outperformed during this period, the Nasdaq declined precipitously, and the dollar was very strong.

Conclusion

As this was written on Dec. 26, 2022, I noticed JC Parents, a good technician out of New York who runs “All-Star Charts,” put out an article on the dollar.

JC’s thesis is that the US dollar is a “wrecking ball,” thus being the catalyst for the Nasdaq selloff and the market stock market weakness, and I’m not sure I agree with JC’s level of influence the dollar exercises.

Rather than being a cause of the above, I think the dollar’s strength is more “effect,” meaning – at least this year – the tech weakness and higher Treasury yields are resulting in strength in the dollar as non-US capital flows into the buck, particularly as non-US equity investments like international and emerging markets remain very weak.

In evaluating sector and market fundamentals, there is no question the dollar’s strength is playing a role, particularly in the tech sector’s financial results. Still, a weaker dollar in and of itself probably isn’t helping Google’s advertising or Meta’s shift to the metaverse or sell more hybrid cloud for IBM.

Technology demand is still the most important driver for the sector. The dollar and “compares” help at the margin and might influence an enterprise-wide purchase (the dollar, that is), but ultimately, the product is the product that drives demand and revenue growth.

That being said, the headwinds, like tough compares and the dollar, are aggravating an already weaker tech sector, and as these two influences ebb, the tech sector should look better in terms of year-over-year growth.

Q4 ’22 and Q1 ’23 are still tough “comps” for technology, but as this Christmas Eve blog post detailed, the S&P 500 EPS estimates for Q3 ’23 and Q3 ’24 – at least for the last six months – are starting to reflect an improvement in S&P 500 EPS. Is it dollar-related? Possibly. Is it “easier comps” related? Possibly. It could also be about faster growth and eliminating the pandemic and post-pandemic yoyo we’ve been on since March 2020.

Again, let’s see what happens in early ’23. It’s still all about the Fed and , but if the market senses the Fed will stop raising rates, and if bond yields start to fall, the S&P 500 should find a bottom, and that likely means a relatively weaker dollar, and all this spells “good news” for a beaten and battered tech sector.

Bottom-line, the dollar matters, but maybe not to the full extent that the mainstream financial media will squawk about, and it probably matters a little more to the technology sector today than it did 10 – 20 years ago.

Take everything you read here with great skepticism, and note that past performance is no guarantee of future results. Capital markets can change quickly, positively and negatively, so assess your risk and appetite for volatility.

[ad_2]