Weekly S&P 500 ChartStorm: Oversold; Breadth; Commodities Top Returns

2022.06.26 08:26

Welcome to the Weekly S&P500 #ChartStorm — a selection of 10 charts which I hand pick from around the web and post on Twitter.

These charts focus on the S&P 500 (US equities); and the various forces and factors that influence the outlook—with the aim of bringing insight and perspective.

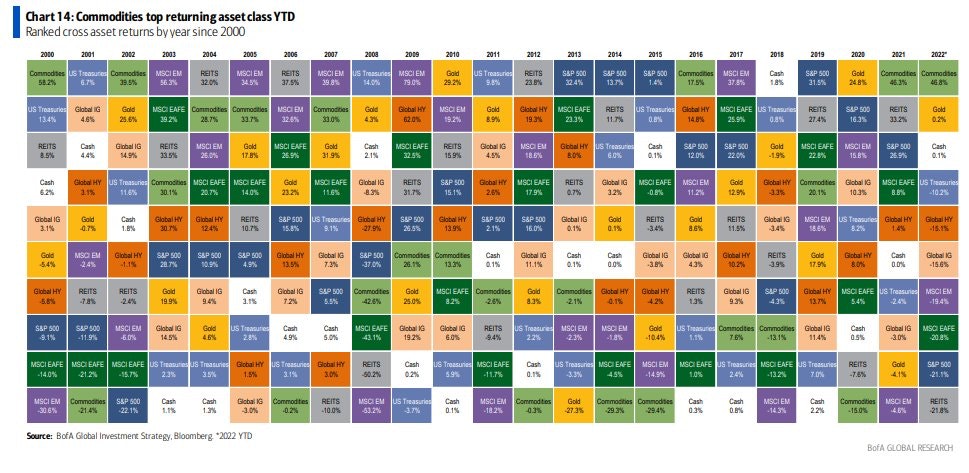

1. Asset Return Quilt YTD: Well, we’re almost at the half-way point for 2022 (and what a year it has been (so far!)), basically: cash & commodities good, everything else bad. Raises the question if H2 will be more of the same or something entirely different…

Asset Return Quilt YTD

Asset Return Quilt YTD

Source: @MikeZaccardi

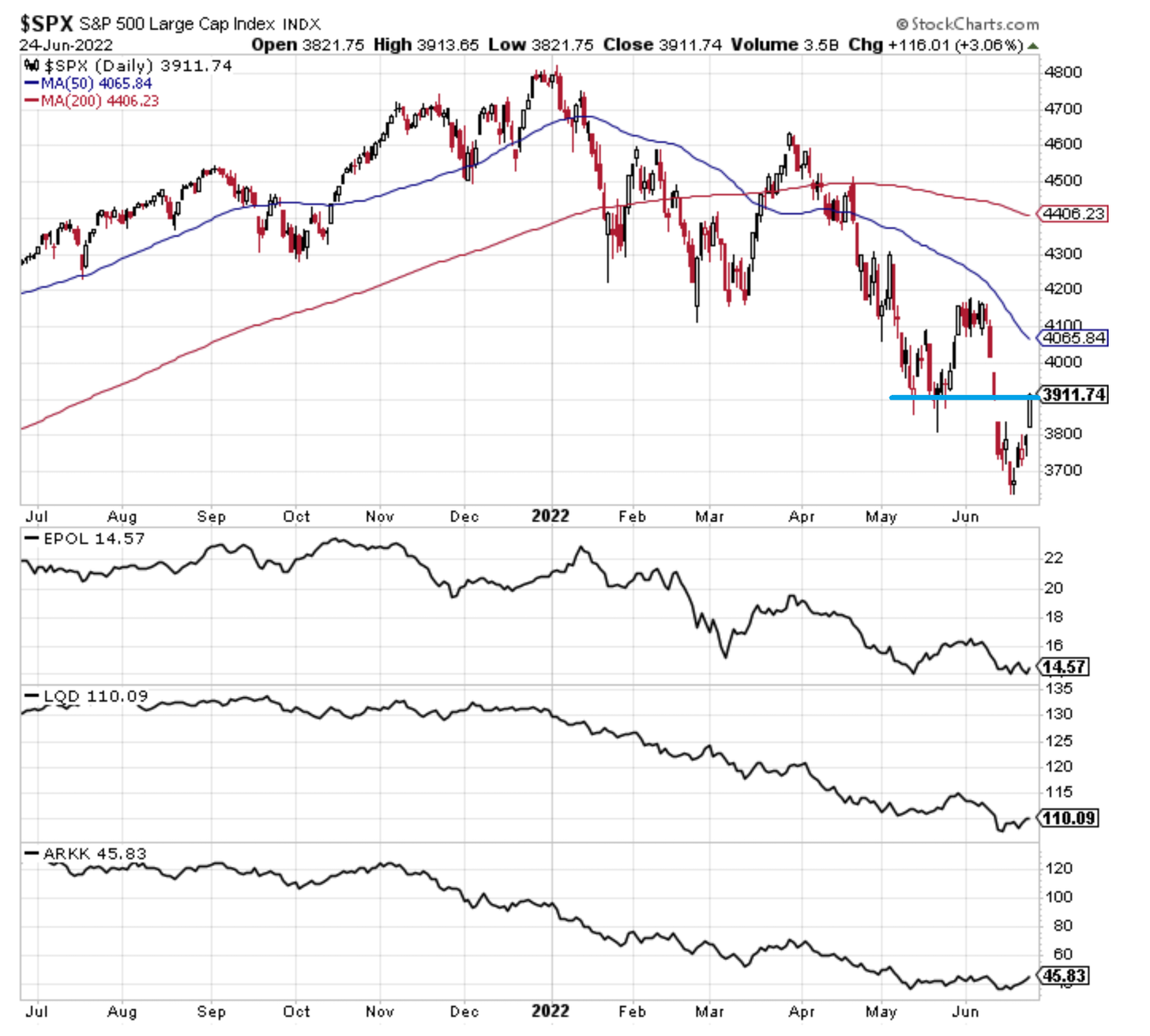

2. S&P SitRep: Gap closed, but a key test for the current rally lies plain to see overhead…

Meanwhile, we’ve seen improvement in the correction/risk driver proxies (geopolitics via iShares MSCI Poland ETF (NYSE:EPOL), bond yields via iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSE:LQD), tech burst via ARK Innovation ETF (NYSE:ARKK))—but not very convincing at this stage

S&P 500 Daily Chart

S&P 500 Daily Chart

Source: @Callum_Thomas

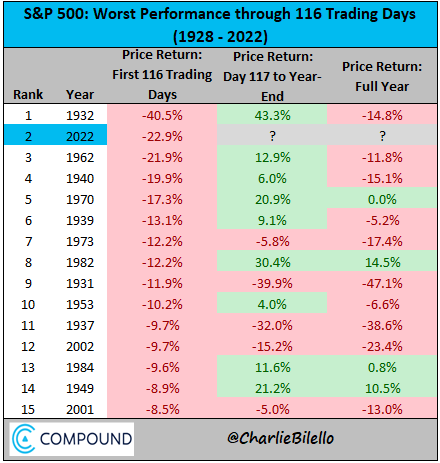

3. First Half Reflections: What happens when the market is down big in the first half of the year? …something ¯_(ツ)_/¯ (no real pattern, except perhaps you could say it’s easier to rebound big in % change if you’re down big to begin with!)

also n.b. updated YTD as of Friday close = -18.45%

S&P 500 Worst Performers

S&P 500 Worst Performers

Source: @charliebilello

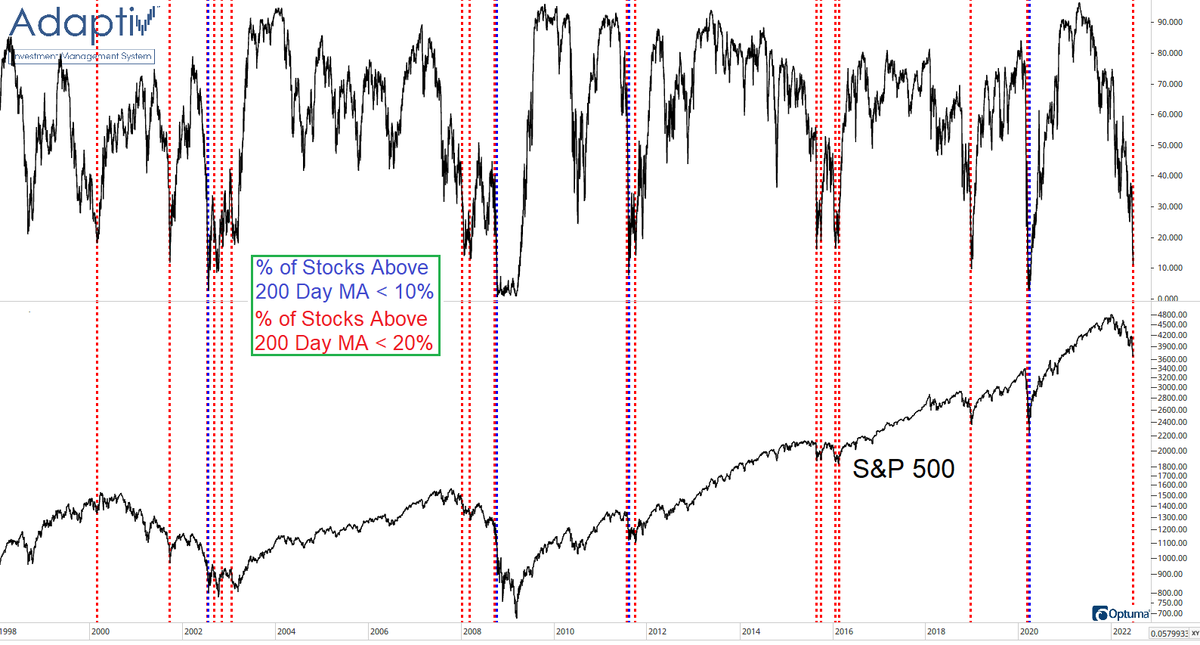

4. Bad breadth…

…sometimes good buy, sometimes goodbye.

S&P 500 Breadth

S&P 500 Breadth

Source: @the_chart_life

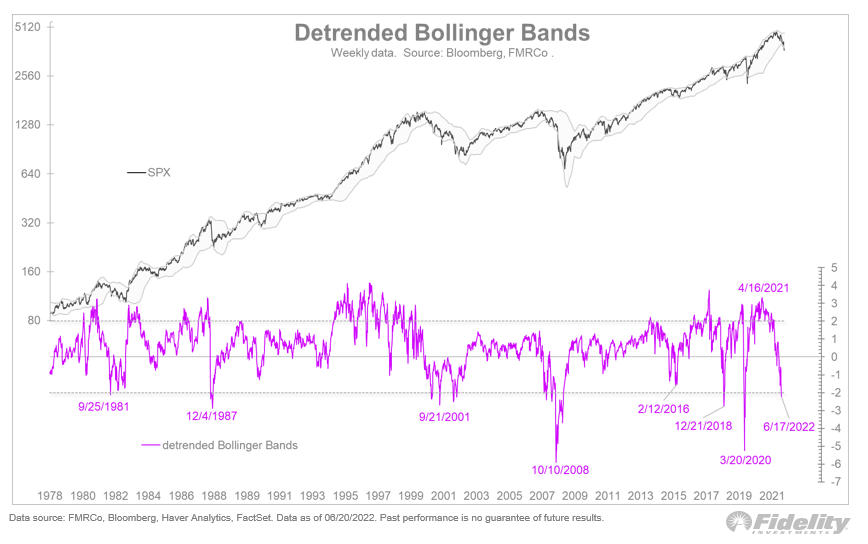

5. Oversold? Market is oversold on this metric.

All else equal (and it rarely is), this raises the odds of a rally — but also n.b. that the condition of the market being oversold (i.e. bearish momentum) is a natural characteristic of a bear-market/down-trend…

SPX Weekly Data

SPX Weekly Data

Source: @TimmerFidelity

6. On the Future(s): Do the futures tell the future? Asset manager equity futures positioning has dropped to a new record low (again though, this condition helps pick a bottom in an uptrend, but in a downtrend/bear market this is actually where positioning would habituate)

S&P 500 Futures Levels

S&P 500 Futures Levels

Source: @MacroCharts

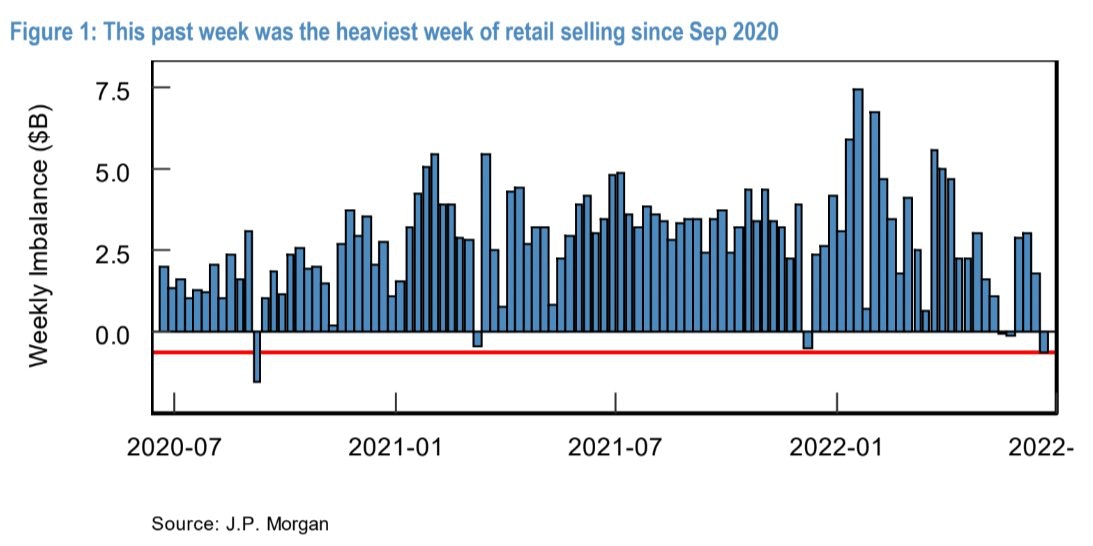

7. Retail Set Sail: Some signs of capitulation…

Retail Selling

Retail Selling

Source: @SethCL

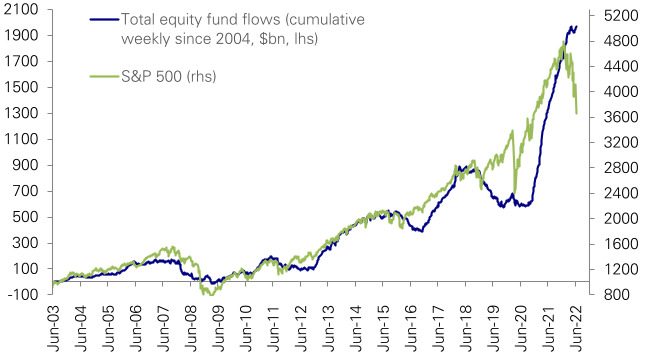

8. What Capitulation? But then again, on this metric (cumulative equity fund flows) there doesn’t appear to be much or any capitulation at all… in fact that memeish “DCA“ rallying cry comes to mind.

S&P 500 Find Flow

S&P 500 Find Flow

Source: @GunjanJS

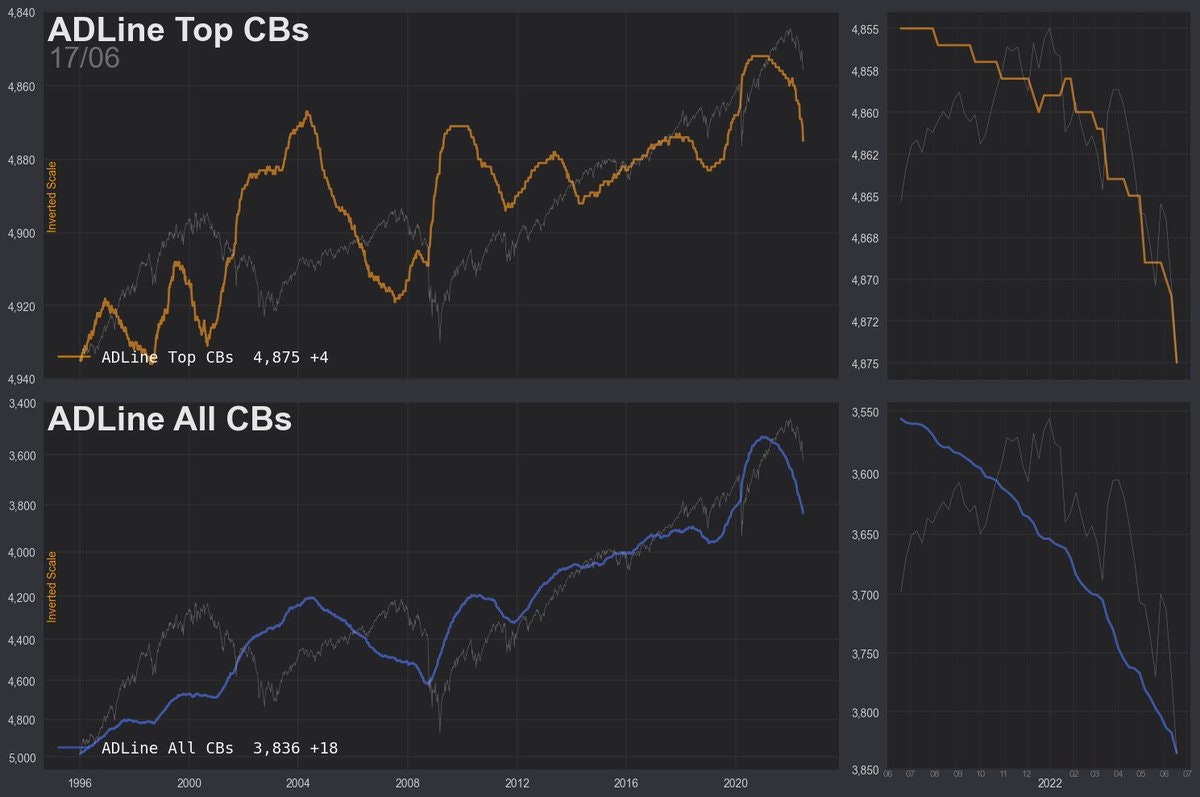

9. Rate-Hike-Ructions: Rate hikes coming in thick and fast. (chart shows cumulative global interest rate cuts minus hikes vs stockmarket)

I’ve said it before, and I’ll say it again: rate cuts helped on the way up—so it’s only logical that rate hikes hurt on the way down…

ADline Top CB’s vs All CB’s

ADline Top CB’s vs All CB’s

Source: @BarnabeBearBull

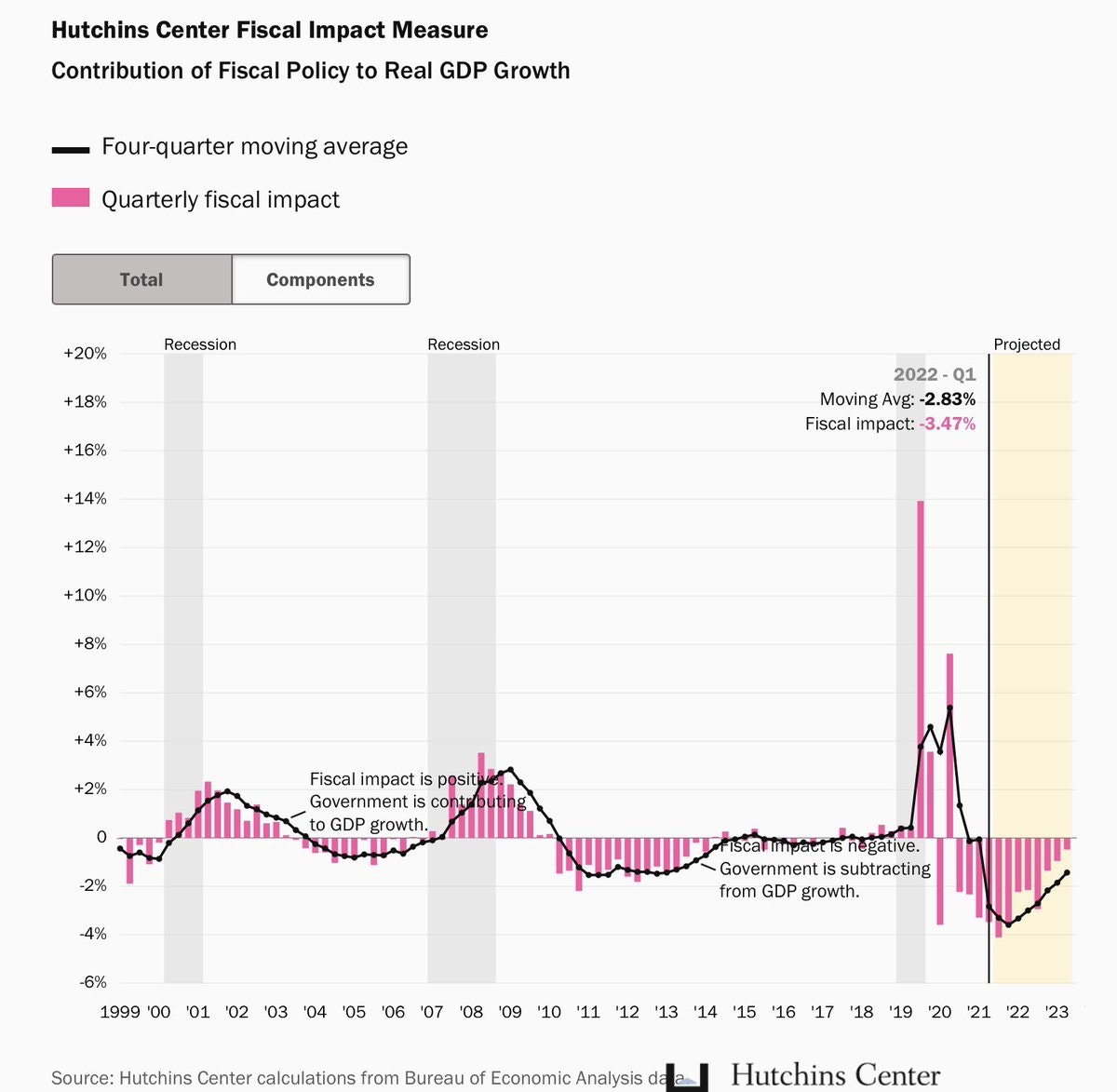

10. Fiscal Drag Too: You could say that Yellen is helping her old mates at the Fed fight inflation via demand destruction with a bunch of fiscal tightening too!

Economy being squeezed every which way: look out below for earnings…

Quarterly Fiscal Impact

Quarterly Fiscal Impact

Source: @albertedwards99

got to include a goody for the goodies who subscribed.

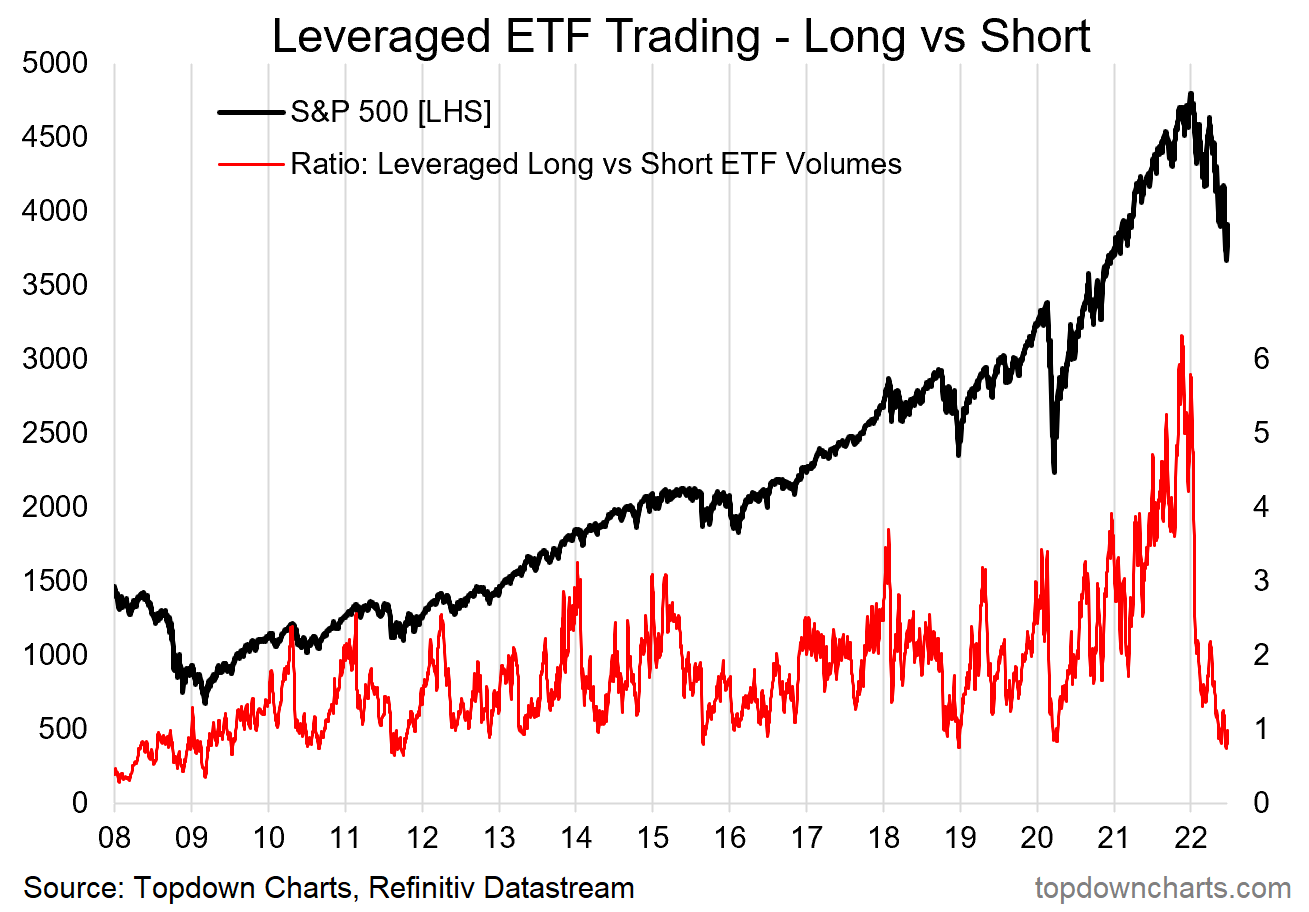

here’s a return-appearance from a favorite chart showing the rise and collapse in bullish speculation via ETFs.

The red line tracks the relative trading activity in leveraged long vs short US equity ETFs. The higher it is, the more traders are getting into leveraged long relative to short equity ETFs.

So peaks = pique in bullish speculation, while troughs = transition to bearish bets.

Leveraged ETF Trading – Long vs Short

Leveraged ETF Trading – Long vs Short

With a 10-year low chalked up, clearly the mood has changed (and this is actual trading activity vs surveyed sentiment). Unfortunately the data only goes back to 08 (these products only really took-off after the financial crisis), but in that time – typically readings around these levels were at least short-term bullish.

But again, this is an extremely unusual market environment relative to the post-financial crisis experience.

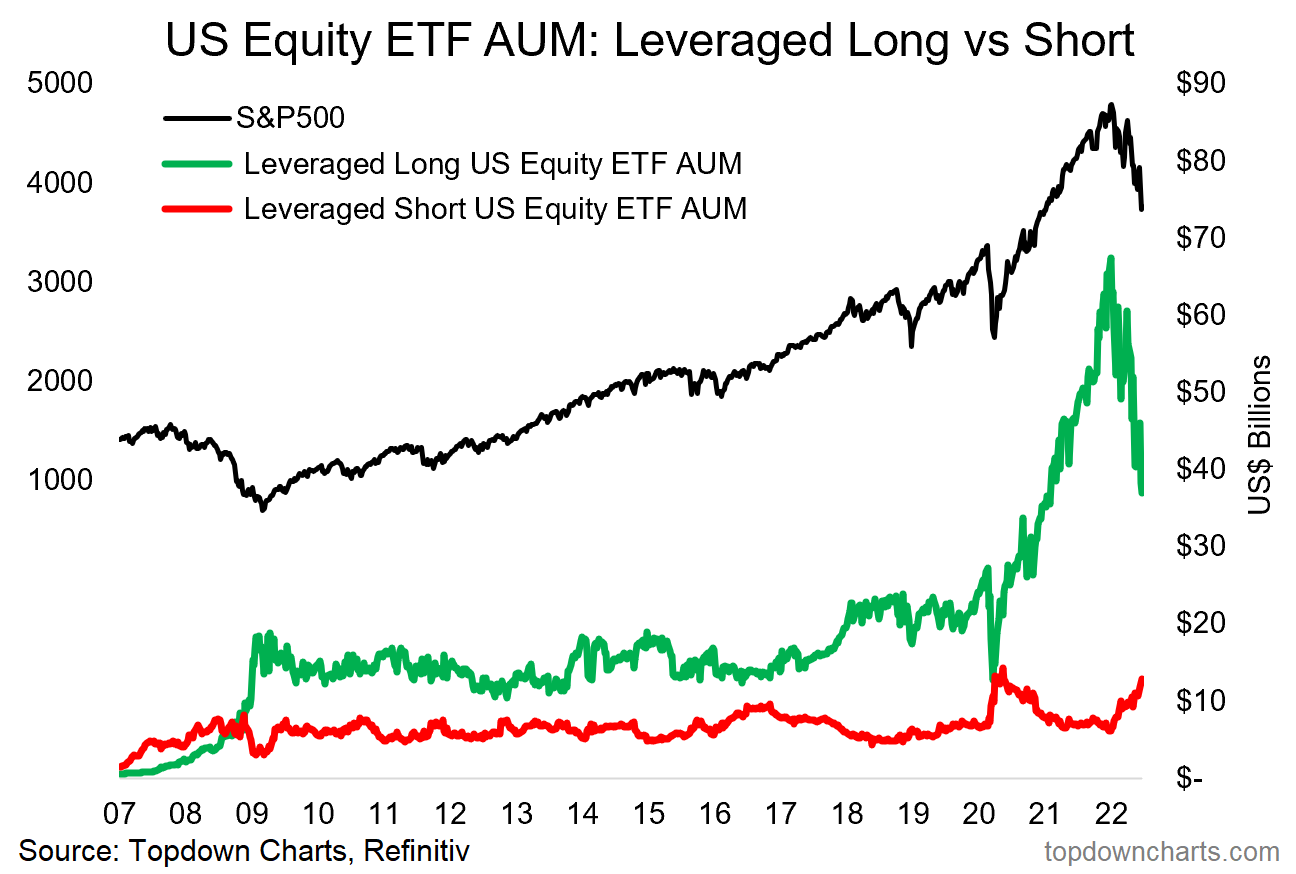

Looking at Assets Under Management aggregated across leveraged long vs short ETFs, it’s interesting to note that short/inverse equity ETF AUM has basically doubled since the start of the year, and levered long has almost halved.

Leveraged Long vs Short

Leveraged Long vs Short

Again, some big shifts, but also… leveraged long is still well above pre-pandemic levels, and despite all the bearishness (with surveys saying more bearish than 2020), the short ETF AUM is still only about on-par with March 2020 levels.

So in terms of what people are doing vs saying, they are clearly making some moves here, but again there hasn’t really been an full capitulation… or perhaps yet even a fulsome pivot to outright bearish speculation.

Basically, to wrap-up I would say these two charts are consistent with the idea that you could get a short-term bottom in the market based on how seemingly one-sided sentiment is, but also that there is still work to be done in terms of deleveraging and capitulation.

Mixed signals, murky times.