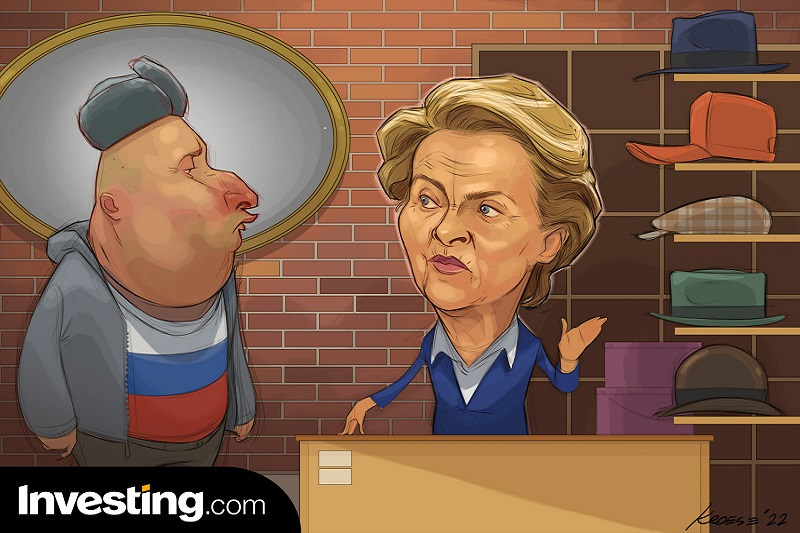

Weekly comic: putting a cap on Russian oil

2022.12.01 22:11

[ad_1]

© Investing.com

By Geoffrey Smith

Investing.com — After six months of haggling and prevaricating, the European Union’s embargo on Russian oil is finally about to come into force – and neither Europe nor the rest of the world still really knows what effect it will have.

With some limited exceptions, companies in EU member states will no longer be able to buy Russian from Monday, a measure aimed at cutting the revenue flowing to President Vladimir Putin’s treasury and restricting his ability to pursue his war in Ukraine.

Given that Russia has until recently still exported around 1 million barrels of oil a day to Europe, this is a significant move.

Its effects are already visible in world spot markets, where the discount on Russia’s key export blend, Urals, relative to has widened sharply in recent days and weeks: industry specialist Argus Media reported that Russian exporters had been forced to sell for as little as $45.31 a barrel this week, compared to a Brent price of over $80.

This should not be construed as a sign that the rest of the world shares North American and European disgust at the Kremlin’s war of aggression, which has degenerated from a lumbering failed Blitzkrieg into a systematic attempt to freeze the Ukrainian population into submission. .

Rather, it is a consequence of the history and geography of Russia’s oil system. Its export pipelines lead to port terminals that were built to serve European markets. Oil coming out of Primorsk on the Baltic, for example, would typically take the short hop across the sea to refineries in Sweden, Poland or the Netherlands. However, from Monday, those markets are all closed, leaving its nearest hypothetical buyer in Morocco. Buyers have to pay freight costs, so are less willing to spend on the commodity itself. For Primorsk to compete with Algeria in the Moroccan market, it thus needs to sell at a price well below Algerian blends.

Such dynamics have already depressed the Russian government’s take from its oil exports considerably. The crude export duty, which accounts for the single biggest part of the Kremlin’s oil revenue, is usually calculated to a formula that allows producers a certain return on their investment, after transportation fees, and takes what is left for the state. This duty peaked in 2018 at $152 per metric ton – the equivalent of around $20.70 a barrel. However, it had already fallen to around $60/ton by the time of the invasion and has fallen by another quarter to $43.30 this month.

Its revenue from gas exports to Europe, meanwhile, has already dwindled to nearly nothing from nearly $50 billion last year. Anti-Russian hawks in central and eastern Europe might protest that the squeeze could be a lot harder, but the numbers are already significant.

So much so, in fact, that the notorious and probably unworkable plan to stop other countries paying above a certain maximum level for Russia crude seems almost a distraction.

Reports out of Brussels at the time this article was due to be published suggested that the EU’s Commission had proposed a cap of $60 a barrel. Poland, however, was holding out for a new sanctions package to be added to the latest measure, preventing a definitive agreement.

As of Monday, crude buyers will no longer be able to buy European insurance or shipping services if they cannot show that they are paying $60/barrel or less for the cargo. Given western dominance in such services, this amounts to a near-prohibition for anyone violating the cap.

Experience from the U.S. sanctions on Iraq and Iran over the last two decades suggests that Russia will find ways to work around that, but it nonetheless adds to the difficulties of getting Russian oil to market. Moscow is sufficiently concerned that it has said it won’t sell to any countries observing the cap.

That puts a lot of poorer countries in an awkward position. Pakistan, devastated by floods earlier this year as well as by a surge in global grains prices (caused by you-know-what), is not officially signing up to the cap, but asked for a Russia to give it a voluntary 30%-40% discount on its crude exports. According to Pakistani media, the request was not granted.

The uncertainty over how the effects of the embargo and the price cap will play out is a strong argument for the so-called OPEC+ bloc to avoid any more changes in its oil output quotas this weekend. But its effects will be felt before too long, especially if Russia has to choose between shutting wells down for lack of offtake, or continuing to pump in order to preserve well integrity during the cold winter – which would frustrate any efforts by OPEC to cut supplies to balance the market.

[ad_2]

Source link