Week Ahead – RBNZ, Fed minutes, UK & US inflation, flash PMIs on tap

2023.05.19 08:56

The RBNZ looks set to raise rates for a 12th time in the coming week, while inflation figures out of the United Kingdom and United States will be crucial in shaping rate hike expectations. After some shockingly bad data recently, Germany’s PMI readings will likely capture the most attention from S&P Global’s flash surveys for May. With sentiment still fragile, the PMIs could set the tone for equity markets, but will they aid the US dollar’s advance or will the Fed’s May meeting minutes rein in the bulls?

RBNZ to hike again, but will it be the last?

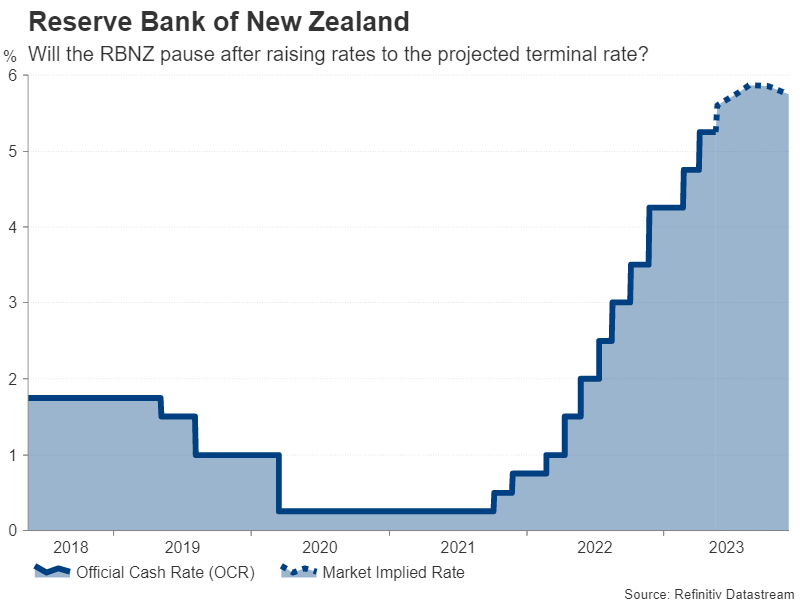

The Reserve Bank of New Zealand will be the only major central bank holding a policy meeting next week. It is widely tipped to hike borrowing costs by 25 basis points when it meets on Wednesday. That would make it the 12th straight increase since the cycle began last October, taking the cash rate to 5.50% – the highest among advanced nations.

However, investors don’t think the RBNZ will stop there as a further 25-bps hike is priced in over the summer. This is more hawkish than the RBNZ’s own forecast of where rates will peak, which was projected at 5.50% back in February. The Bank will publish its updated forecasts in the quarterly Monetary Policy Statement on Wednesday and so the local dollar could gain if policymakers up their terminal rate to match or exceed the markets’.

The latest employment report supports the case for more tightening as the jobless rate remained low at 3.4% and wage growth accelerated slightly in the first quarter. Retail sales data due the same day as the policy decision could show that consumer spending bounced back in Q1.

However, there is also an argument to stop at 5.50% as in the RBNZ’s latest expectations survey, inflation expectations for two years ahead fell within the Bank’s 1-3% target band to 2.79%. Hence, there is some downside risk too for the from the meeting.

All eyes on US data as June Fed decision in the balance

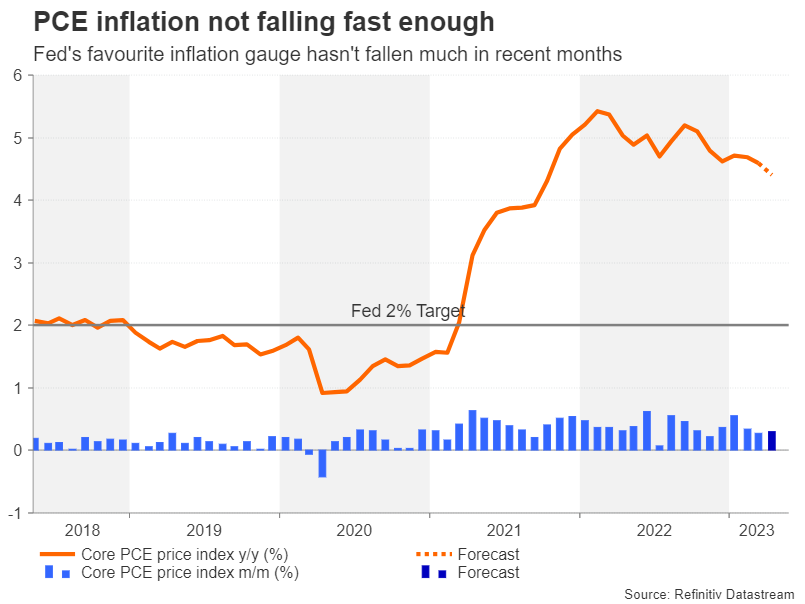

With pause speculation also intensifying for the Fed, PCE inflation and the May FOMC meeting minutes will be watched across the Pacific next week. US economic indicators have been somewhat mixed lately, yet that underlying strength seems to be holding up even after 500-bps worth of rate increases and a mini banking crisis. From the recent Fedspeak, most officials appear to be swaying towards another hike in June and if there is a pause, it will likely be a conditional one. Wednesday’s Fed minutes could reveal more.

However, the reality is that policymakers haven’t quite made up their minds about the June decision yet and one of the reasons for that is there are still three major reports on the way before then, the first of which is Friday’s PCE inflation numbers.

The core PCE price index – the Fed’s preferred price metric – is forecast to have moderated 0.2 percentage points to 4.4% in April. This would be a sign of progress after being stuck in the 4.6%-4.7% range for the past few months. The personal income and spending readings will be important as well, as US consumers do not appear to have turned significantly more cautious. In fact, personal consumption is expected to have risen by 0.4% m/m in April.

Ahead of Friday’s releases, the flash PMIs will be grabbing some attention on Tuesday. Investors will be scrutinizing the subcomponents of the PMI indices for an early look at new orders, employment and input prices in the first half of May.

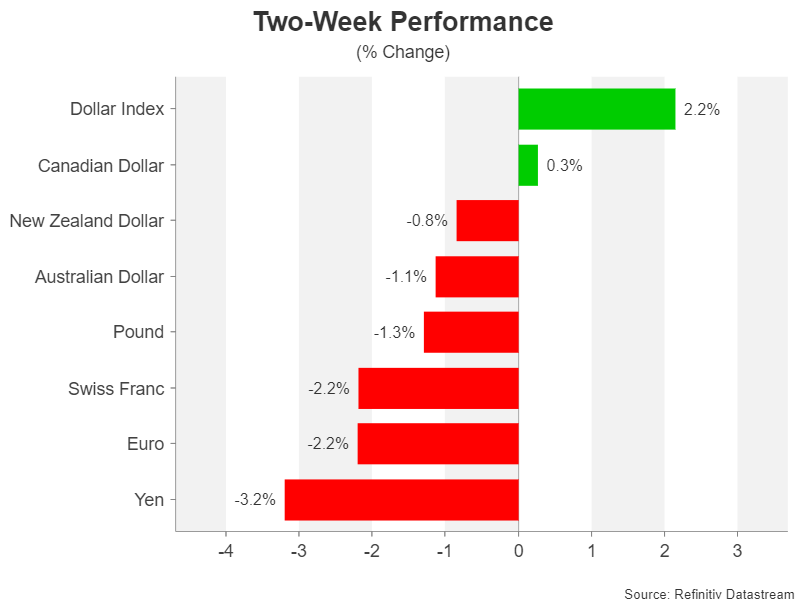

After two weeks of strong gains, the US dollar could be in line for a negative correction should the incoming numbers disappoint and rate cut expectations for the Fed are ramped up again. But if they reinforce the view that inflation and the broader economy are not slowing fast enough, the greenback’s upswing could turn into a rampage.

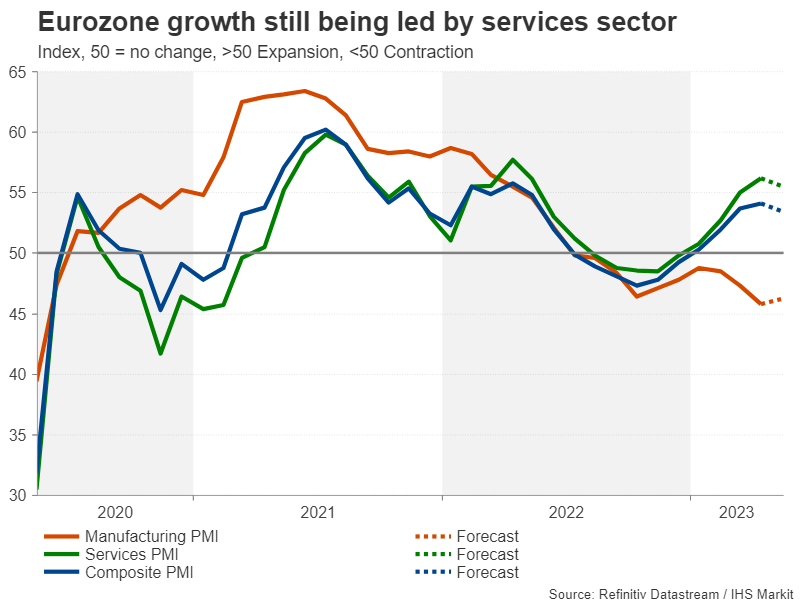

Can Eurozone PMIs lift the euro?

The euro, along with the yen, has been the biggest casualty of the dollar’s comeback efforts even though there’s been no dramatic repricing of rate hike probabilities for the European Central Bank. The recent batch of worrying German data has instilled a downward bias to the euro amid the greenback’s revival and the single currency has had to surrender some key levels.

Tuesday’s flash PMIs could play a vital role in either putting a floor under the euro’s slide or deepening its losses. The forecasts don’t point to much of a change in the economic picture in the Eurozone. The manufacturing sector is expected to contract again, with growth being propped up by services industries.

A surprise rebound in manufacturing output, especially in Germany, could help allay concerns about waning economic momentum. For the same reason, investors will also be watching Germany’s Ifo business climate gauge and the detailed Q2 GDP print on Wednesday and Thursday, respectively.

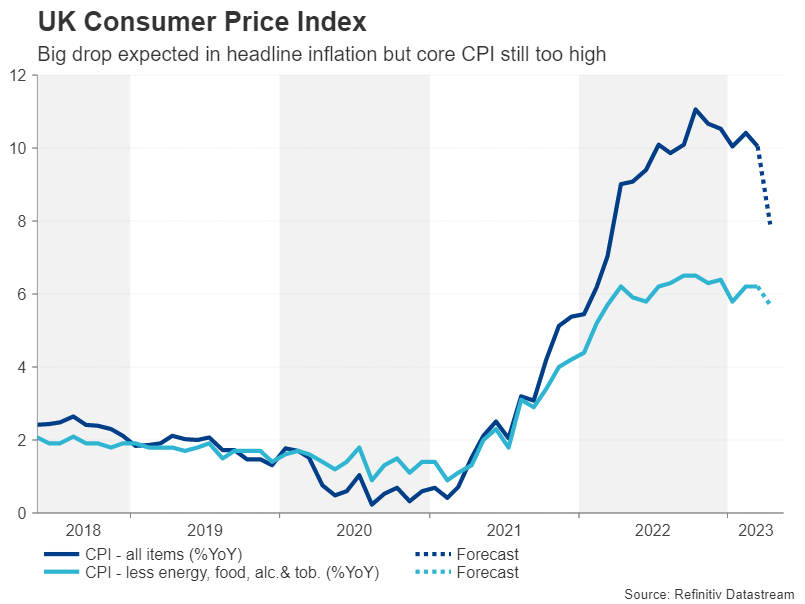

Some good news from UK CPI, but maybe not for the pound

The pound has been able to withstand the dollar’s resurgence somewhat better than the other majors. With the Bank of England recently saying it no longer anticipates a recession and inflation remaining in double-digit territory, investors think rate hikes have more room to run in the UK, versus rate cuts being priced in for the Fed.

But the consensus view that inflation in the UK will be more persistent than in other countries could begin to lose some clout on Wednesday when the consumer price index for April is released. The headline rate of CPI is expected to have finally dropped below 10% last month, easing to 7.9% from 10.1% in March. The core figure is forecast to fall to 5.7%.

A day earlier, the May PMIs will be eyed for clues on how economic activity fared amid the extra public holiday to celebrate King Charles’ coronation. On Friday, the spotlight will fall on the April retail sales stats.

The overall strength of the data could determine whether or not sterling is able to maintain its relative outperformance against the dollar.