Week Ahead – ECB Headed Towards Another Cut, CPI on the Agenda Elsewhere

2024.10.11 17:16

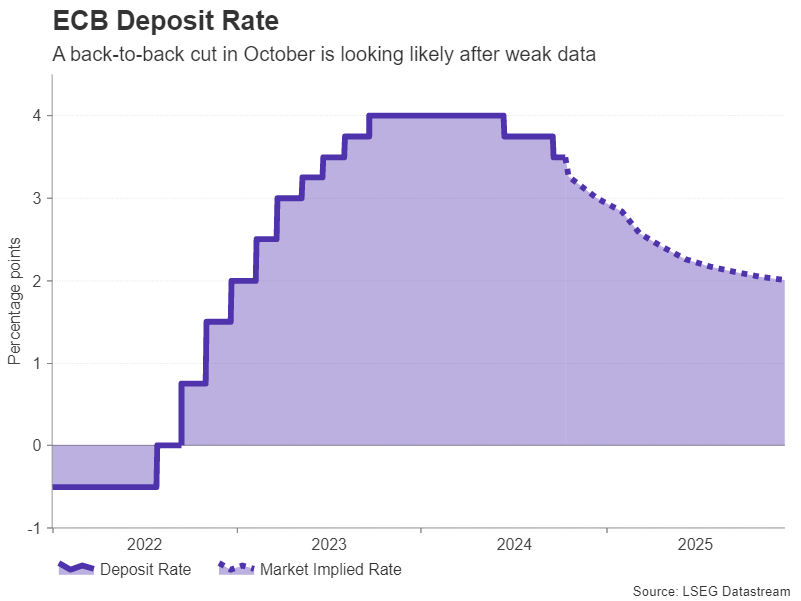

Following the RBNZ, which cut interest rates by 50 basis points this Wednesday, the central bank torch will be passed next week to the ECB. Although last time, President Lagarde and her colleagues did not back an October rate cut, their stance started to shift following the disappointing PMIs and the slide in headline inflation below 2%, prompting market participants to increase bets of such an action.

Currently, investors are nearly fully pricing in a quarter-point reduction at Thursday’s gathering, while expecting another one in December. Thus, a quarter-point reduction on its own is unlikely to shake the euro, and if it is indeed delivered, the spotlight will quickly turn to President Lagarde’s press conference.

This is one of the meetings that are not accompanied by updated macroeconomic projections but Lagarde is bound to receive questions on how the economic and inflation outlooks have changed since the September gathering. Recently, she said that their confidence about inflation returning to target will be reflected at the upcoming gathering, reinforcing expectations of further easing in both October and December.

Therefore, if a 25-bps rate cut is delivered and Lagarde keeps the door open to another one in December, the euro is likely to extend its latest slide. Following the robust US jobs report for September, euro/dollar fell below the round number of 1.1000, completing a double top formation. A dovish ECB decision may allow the slide to continue towards the low of August 8 at 1.0880.

Having said all that though, a rate cut at this gathering could be less obvious than market pricing suggests. A couple of weeks ago, a Reuters report noted the doves will fight for a rate cut, but they might face resistance from the hawks. Some sources talked about a compromise solution in which rates are kept on hold in October but reduced in December if the data doesn’t improve.

Adding to the uncertainty were comments by ECB Vice President de Guindos that it is too early to claim victory on inflation. The flash estimates showed that inflation fell to 1.8% in September. If confirmed in Thursday’s final readings, this would nevertheless be in line with the ECB’s own projections, while the latest rebound in oil prices due to the Middle East tensions poses upside risks to the outlook.

Therefore, if policymakers indeed agree to wait until December, euro/dollar is likely to rebound strongly as investors get caught off guard.

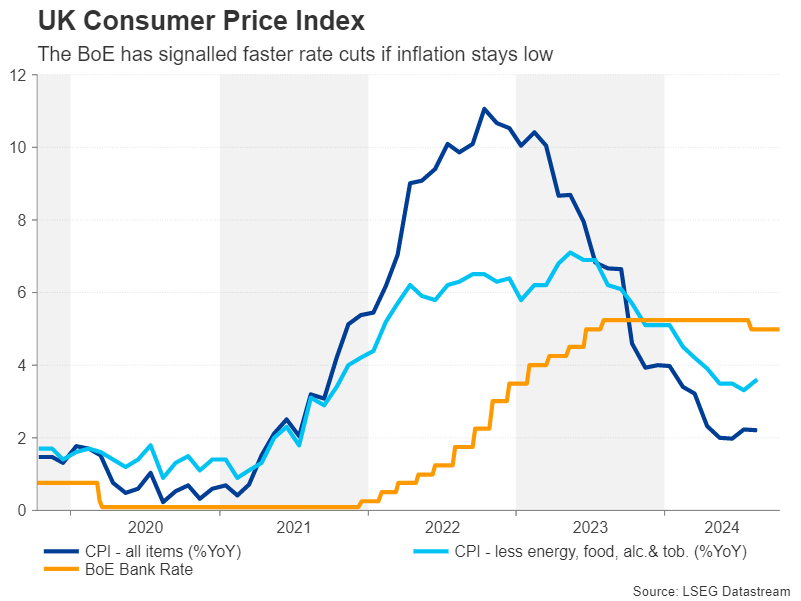

UK CPI awaited as pound struggles

The has been consolidating over the past week, pausing the selloff that was triggered by BoE Governor Bailey’s remarks that they may need to be more active with regards to interest rate cuts if the data continues to suggest progress in inflation.

With that in mind, pound traders are likely to pay extra attention to next week’s releases, particularly Wednesday’s CPI numbers, as they try to figure out how the Bank of England will proceed from here onwards. According to the UK Overnight Index Swaps (OIS), investors are assigning a strong 75% chance for a 25-bps cut on November 7, with the probability of another one in December resting at around 60%.

The September PMIs revealed that price pressures across the private sector eased to a 42-month low in September, pointing to a decline in both headline and core CPI, especially the former, as the year-on-year change in oil prices dipped further into negative territory. A further cooldown in inflation may prompt traders to add to their BoE rate cut bets and thereby push the pound lower.

The employment report for August and retail sales for September will also be published next week, on Tuesday and Friday respectively. Investors will be watching to see how much further wage growth moderated over the period and if consumers kept spending last month.

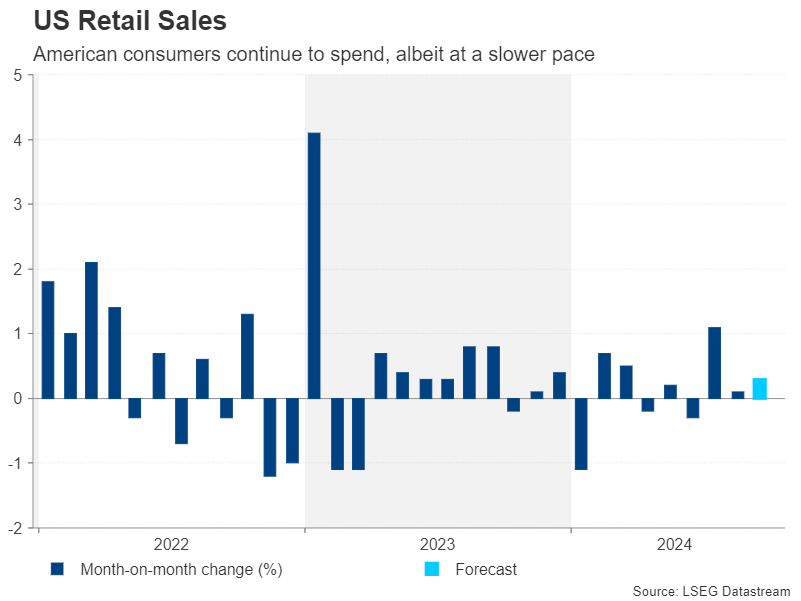

Quieter US data week makes way for earnings

Across the Atlantic, both the Fedspeak and data schedule will quieten down, potentially keeping dollar traders on the sidelines. September retail sales due on Thursday will be the main highlight. But manufacturing gauges by the New York Fed (Monday) and Philadelphia Fed (Thursday) will also be important. Coming up on Thursday too is industrial production for September, while on Friday, building permits and housing starts might attract some attention.

With investors becoming jittery about the possibility of the Fed easing policy at a somewhat slower pace than what is priced in right now, a stronger-than-expected retail sales report might not be greeted too positively by the markets as it would further dampen rate cut bets. Analysts are forecasting a month-on-month increase of 0.3% in September, after a 0.1% rise the prior month.

For Wall Street, however, corporate earnings will probably be a bigger focus as the Q3 season gets underway. Netflix (NASDAQ:) will be among the first of the Big Tech to report its earnings on Thursday.

Canadian and NZ CPI may decide size of next rate cuts

North of the border, Canadian inflation numbers out on Tuesday will be crucial for the Bank of Canada’s policy decision on October 23. Investors have priced in around one third probability that the BoC will slash rates by 50 bps, while a 25-bps cut is fully baked in. Any surprises therefore in the CPI readings for September may sway policymakers either way.

The Canadian dollar has taken quite a beating against the US dollar this month so traders might react more strongly to a hotter-than-expected report given the oversold conditions.

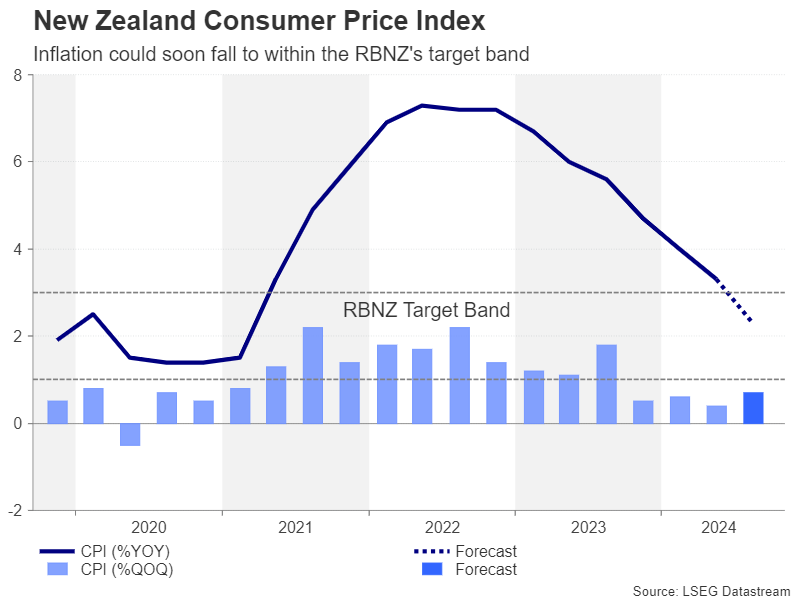

New Zealand will be another country getting an inflation update. CPI figures for the third quarter are due on Wednesday and could determine the size of the next cut by the Reserve Bank of New Zealand. Policymakers reduced borrowing costs by 50 bps at their October meeting and a further such reduction is projected for November.

However, with a long gap between the RBNZ’s November and February meetings, investors might start to price in a larger 75-bps cut if the Q3 stats show a larger-than-forecast drop in inflation, which looks set to fall within the Bank’s 1-3% target band.

Will Chinese GDP matter after stimulus blitz?

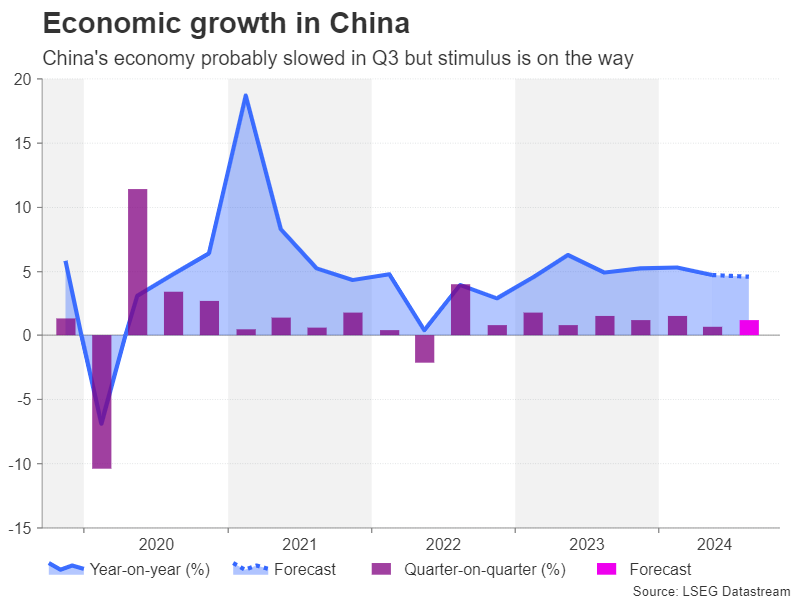

China will publish Q3 GDP numbers on Friday where growth is forecast to have slowed slightly from 4.7% to 4.6% y/y. Industrial production and retail sales prints for September are also due the same day, while ahead of all that, CPI and PPI figures will be released on Sunday, followed by trade indicators on Monday.

Following the stimulus measures unveiled recently by Beijing, a disappointing GDP print might not spur much panic in the markets. Furthermore, with a further announcement expected on Saturday and Monday, the upcoming data might be overlooked unless the slowdown in Q3 was far worse than feared.