Weak retail sales of Australia weakened the currency

2023.01.31 11:37

Weak retail sales of Australia weakened the currency

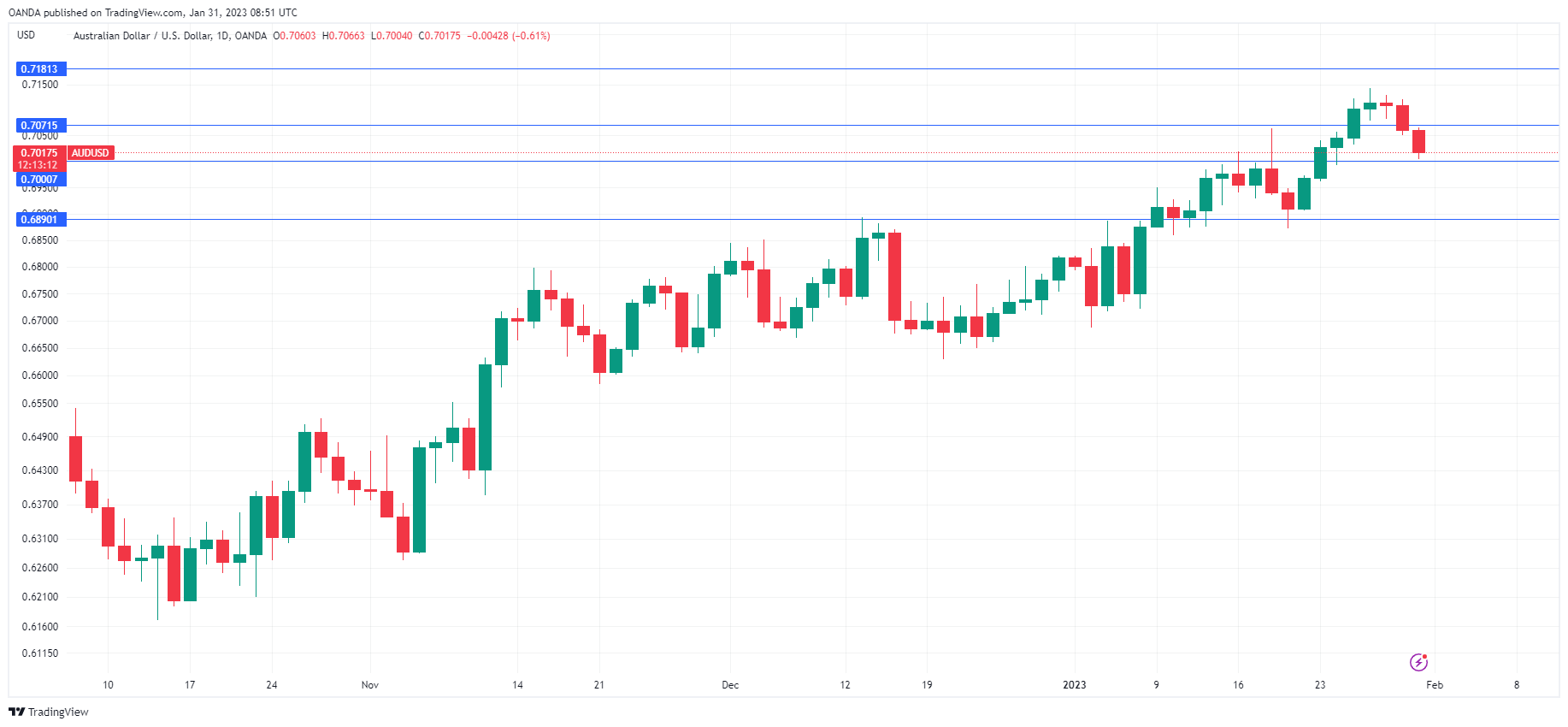

The Australian dollar has had a bad week so far this week. decreased 0.68 percent on Tuesday and is down 1.36 percent for the week. The Australian dollar is trading just above the 0.70 line during the European session.

December’s retail sales were disappointing, coming in at -3.9% m/m, well below the consensus of -0.3%. This was the third decline in four months after a gain of 1.7% in November. The Australian dollar has responded with substantial losses because this was the first decline in 2022.

The good news is that retail sales typically fall in December. Consumers did their Christmas shopping early in order to take advantage of Black Friday discounts, according to the strong November reading.

Another indication that consumers are feeling the effects of rising living costs is the sharp decline in their spending. The Reserve Bank of Australia has been able to maintain its tame rate hikes thanks to robust consumer spending. The most recent retail sales data will not please the RBA, but it is still expected to proceed with a modest 25-basis point increase next week.

The markets anticipate that the peak rate will rise to somewhere between 3.6% and 3.85%, with the cash rate currently at 3.10 percent. This indicates that after February, there will be additional rate increases, but the rate of these increases will depend on data, particularly inflation reports.

On Wednesday, the Federal Reserve’s two-day meeting comes to an end, and a 25-bp increase is valued at close to 100%. A hawkish stance from the Fed—whether in the rate statement or in Jerome Powell’s remarks—could boost the US dollar, which does not rule out volatility in the currency markets.

Due to the weakening US economy, the markets continue to speculate about a rate cut late in the year. However, if the Fed reiterates that high rates are here to stay and that it has no plans to cut them, the markets could be in for a rude surprise.

Technical Analysis

AUD/USD is putting pressure on support at 0.7000. The next support line is 0.68900

0.70700 and 0.71800 are the next resistance lines