We Are Still in Early Stages of Tech Recovery

2023.06.21 08:23

- We believe earnings for technology companies have bottomed and expect more upside from here

- What gives us confidence in a 2H23 tech recovery

- 1Q23 earnings takeaways: hardware bottomed, software to follow

What gives us confidence in a 2H recovery

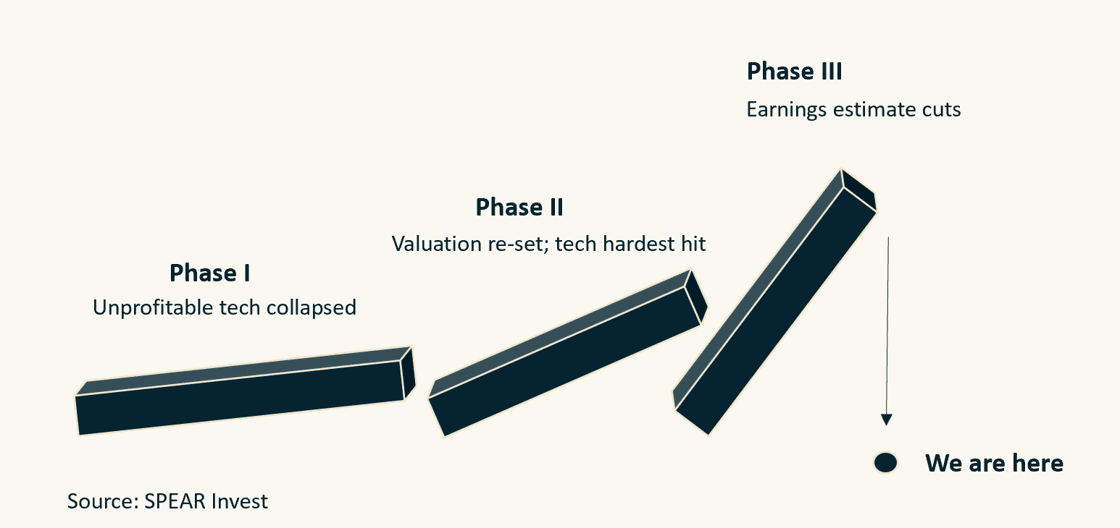

A downturn follows a typical pattern where valuations get hit first, followed by a broad-based economic weakness that impacts the earnings of most sectors and companies. Earnings estimates usually take several quarters to re-set and we believe that 1H23 marked the bottom for earnings for the technology sector.

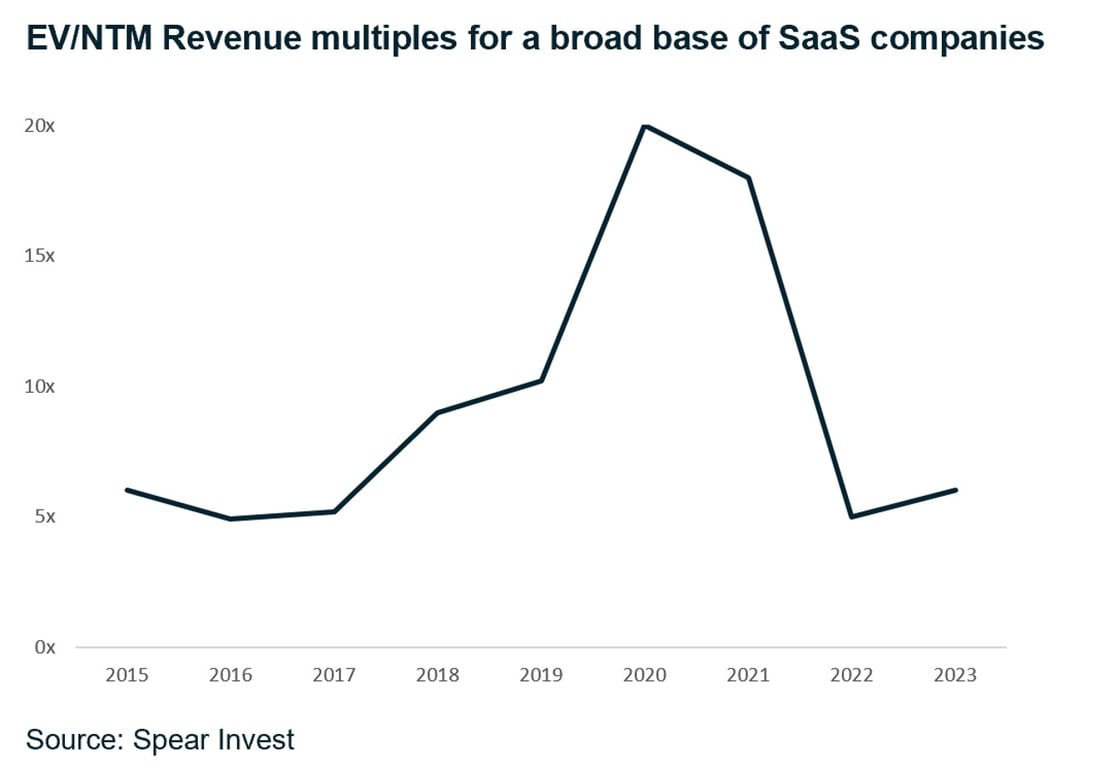

As interest rates stabilized this year (range bound between 3.5-4% for 10Y), valuations bottomed. Despite the sharp move off the lows for many technology companies and the media noise of a “new bubble,” the average software multiple is only up to ~6x EV/NTM Revenues vs. 5x at the bottom last year, and ~8x historical (10-year) average.

This is in line with our expectations as interest rates are higher than the historical average (4% vs. 2%), and NTM growth estimates are lower (15% NTM vs. 25% 10Y median). While we don’t expect a meaningful upside from interest rates in the near term, as we assume that rates will stay elevated for a longer period of time, we believe that earnings estimates are at an inflection.

Hardware earnings bottomed in 1Q23; software to follow

Semiconductors are considered to be the “canaries in the coal mine” due to the early-cycle nature of the business. As soon as there were signs of economic weakness in May of 2022, distributors started reducing inventories, which exacerbated the impact from weak demand. Nvidia (NASDAQ:) reported two quarters of dismal results and wrote off>$1bn of inventory (Apr/Aug 22). Consumer-levered semi companies such as Advanced Micro Devices (NASDAQ:), felt the impact early on, and data center-focused ones, such as Marvell (NASDAQ:), slightly later.

As we get into 2H23, comps get significantly easier, and companies are starting to be able to beat lowered expectations. In addition to the cyclical upturn, we expect a significant boost to demand from investments in artificial intelligence (AI). This is not a one-quarter hype but a multi-year investment cycle. Per Nvidia, there is 1 trillion of data center hardware that is not accelerated and will need to be upgraded to accommodate AI workloads.

1Q23 Earnings Highlights:

Most semiconductor stocks that reported pointed to confidence in a 2H23 recovery (AMD, Marvell, Broadcom (NASDAQ:)), and the strongest (fundamental) result in this quarter was from Nvidia, which is uniquely positioned in AI with 80%+ market share in data center GPUs. Highlights from the reported earnings below:

- Nvidia guided to 2Q24 (Aug 23) revenues that were 50% above consensus. Analysts raised their forward estimates by 40% in the current and out-years. The company pointed to a substantial increase in capacity in 2H23.

- Marvell reported an in-line result but guided to AI-driven revenues to double in 2024 and 2025; $200M in AI sales for FY23; $400M+ for FY24; $800M+ from FY25 (on a run-rate of ~$5bn).

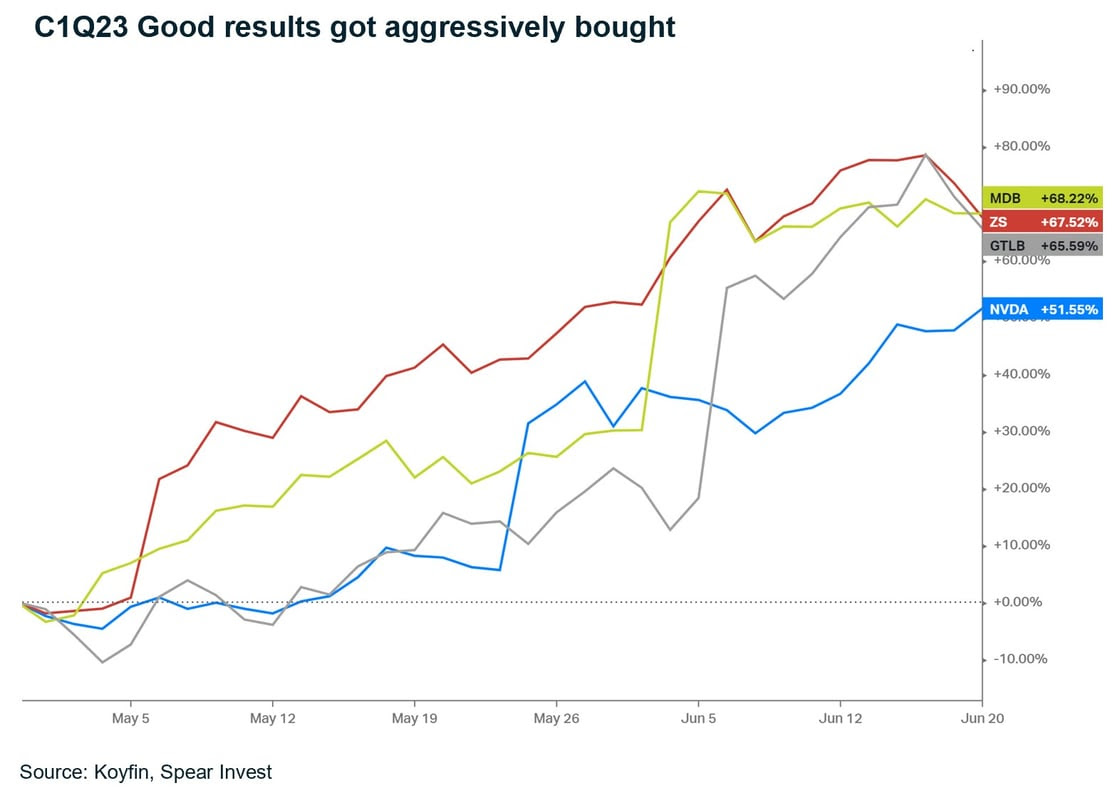

Interestingly, despite posting (by far) the strongest result, Nvidia was not the best performer in our coverage universe for the month of May (not even in top 5). This was because “the idea of semiconductor bottoming” set a floor for the rest of technology, and consequently, investors rushed into the areas of tech that could drive the next leg up.

But, if we step back, Nvidia was the only company that raised estimates commensurate with the stock price movement (+50%) which we believe provides a solid fundamental support and therefore remains a top idea in industrial technology (see our report Nvidia: The One Stop AI Shop).

Software (enterprise + cloud + cybersecurity)

Software earnings generally lag semis by 6 months. There are different areas of software that bottom at different times depending on the end-market and business model (consumption vs. subscription-based).

Revenue estimates for our software universe continued to decline, with the median NTM growth estimate now at only 15% vs. a 10-year average of ~25%. Hyper-growth companies are now growing at only ~30% vs. 70%+ previously. Companies are still citing elongates sales cycles, smaller and staggered deals, execution challenges, etc. Reported earnings were far from stellar, with many companies reporting negative net-new ARR.

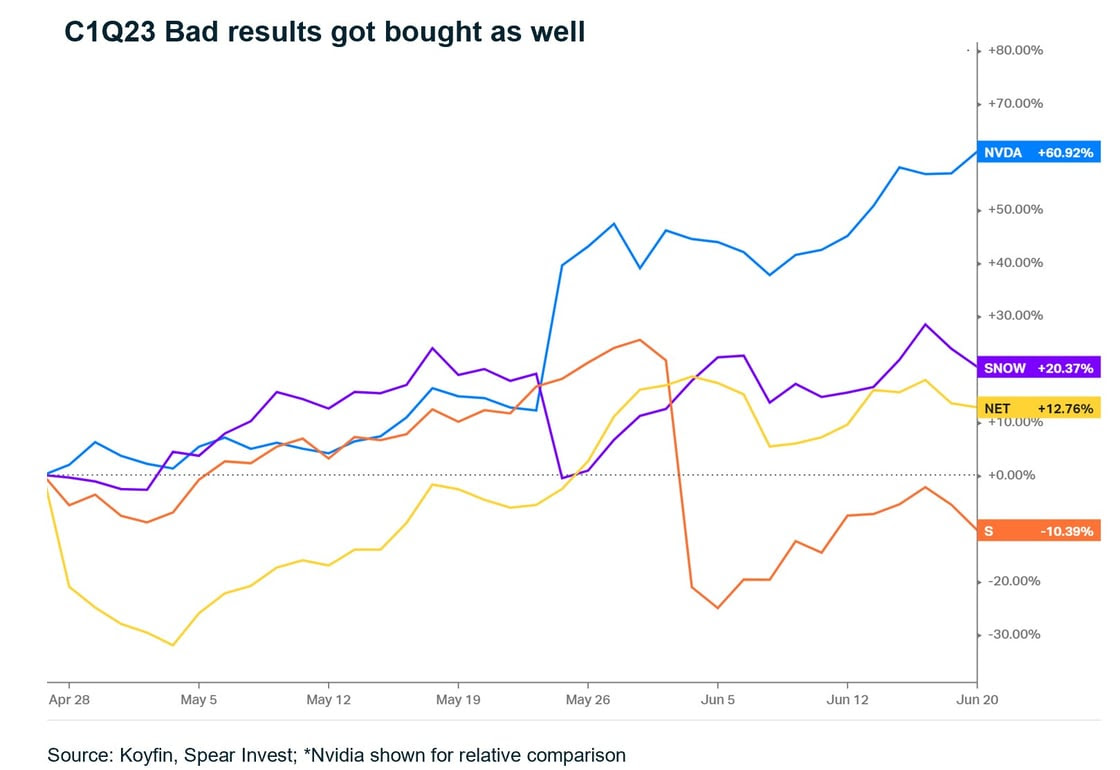

But, the interesting development was that relatively small surprises got aggressively bought, and big misses were able to re-trace losses. This is usually a sign of a bottom as investors are willing to look out past this quarter if they can get confidence that we are at a bottom.

Strong results:

- Zscaler (NASDAQ:) – reported 40% billings growth in a tough macro after a difficult last quarter

- GitLab – guided to revenue growth of +27-28% above consensus of +25%, following a 15%+ guide down last quarter

- MongoDB (NASDAQ:) – beat/raised post a very conservative guide (+19% from +17%)

Weak results from Cloudflare (NYSE:), Snowflake, SentinelOne (NYSE:) citing a tougher macro than originally expected, were brushed off. Cloudflare and Snowflake were able to re-trace losses. SentinelOne remains TBD, but bounced significantly off the lows.

In addition, companies have been postponing spending in anticipation of a recession for several quarters, creating potential pent-up demand.

But what about the recession?

Most of the companies we cover went through significant earnings cuts in anticipation of a recession. We, therefore, don’t expect that small changes in economic growth (+/-1%) will drive a meaningful difference in earnings results for technology companies.

However, the severity and duration of the recession (if it ever comes) could affect the slope of the recovery. We therefore look to invest in well capitalized businesses with strong fundamentals.

Disclosure: Views expressed here are for informational purposes only and are not investment recommendations. Spear may, but does not necessarily have investments in the companies mentioned.

For a list of holdings click here. All content is original and has been researched and produced by Spear unless otherwise stated. No part of Spear’s original content may be reproduced in any form, without the permission and attribution to Spear. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence. Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on Spear’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice.

All statements made regarding companies or securities or other financial information on this site or any sites relating to Spear are strictly beliefs and points of view held by Spear or the third party making such statement and are not endorsements by Spear of any company or security or recommendations by Spear to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that Spear’s objectives will be achieved.

Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. Click here for our Privacy Policy.