We Are In Eye Of The Storm Of Earnings Mega-Sweep

2022.10.26 12:31

[ad_1]

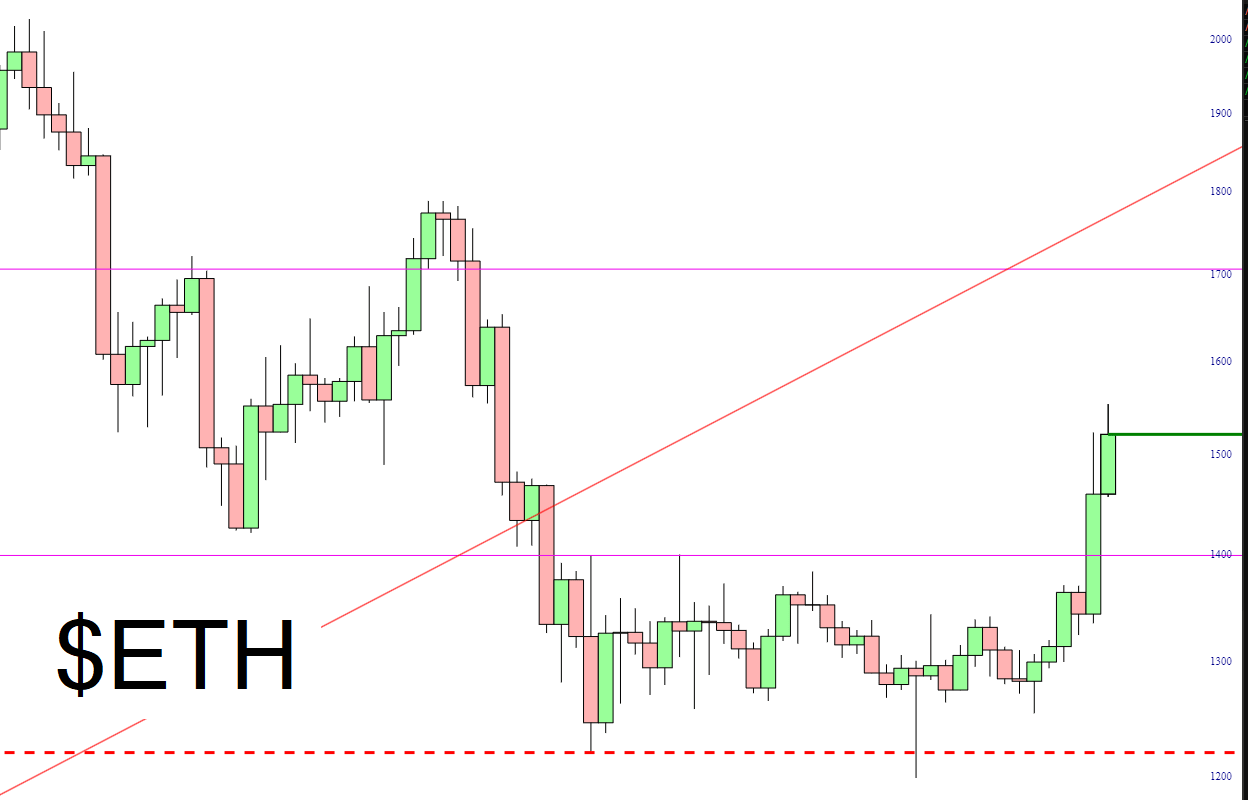

In case anyone needing convincing that, in recent days, just about everything with a ticker symbol has been zipping higher, they need look no farther than crypto, which only two weeks ago looked like it was tumbling into oblivion and has instead become red hot once more.

:

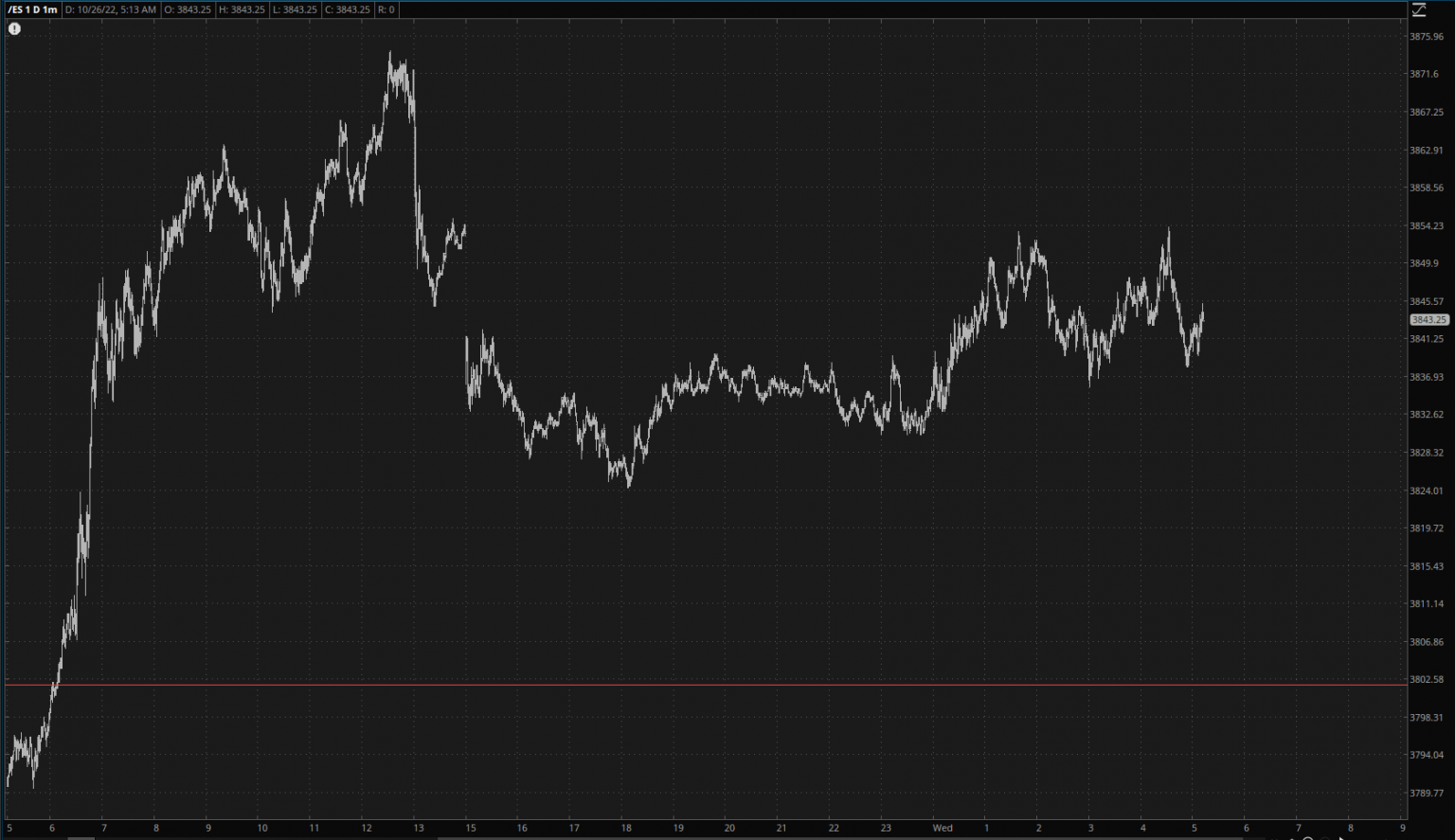

As for equity futures, the big news was, of course, the earnings from Microsoft (NASDAQ:), Texas Instruments (NASDAQ:) and Alphabet (NASDAQ:), which actually managed to produce a little red. Although the is well off its lows, it’s still down more than 30 points as I’m typing this (although God knows how long it’ll last; you saw how instantly the exploded higher yesterday the millisecond the cash market opened).

S&P Futures 1-Minute Chart.

S&P Futures 1-Minute Chart.

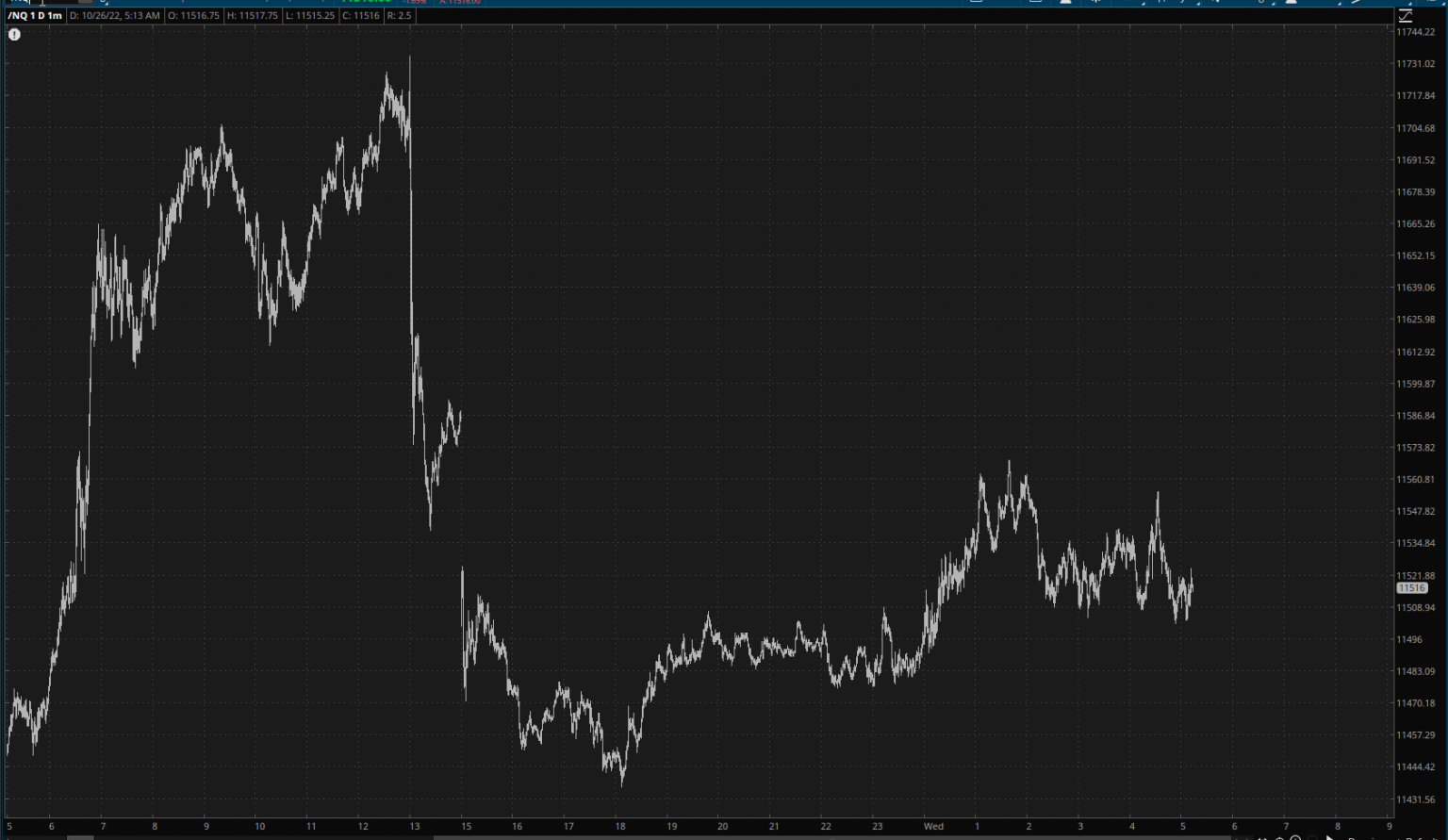

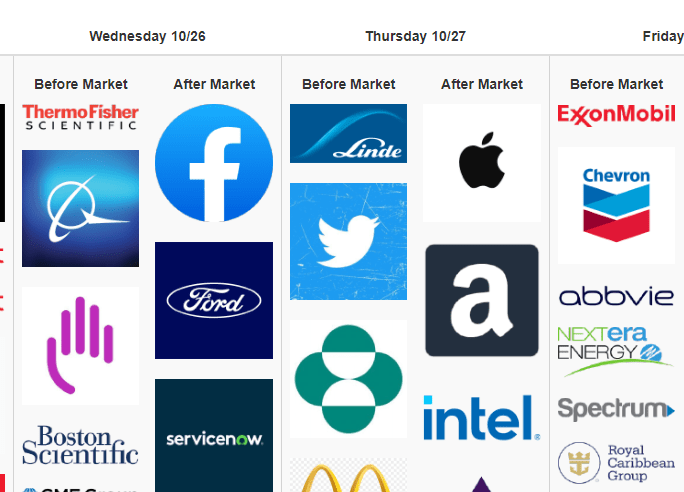

The is down more deeply, a little over 200 points and nearly 2%. We are going through, of course, the mega-sweep of earnings this week, with today being a bit of the eye of the storm (I mean, seriously, who cares about Meta (NASDAQ:), which reports this afternoon, as opposed to the likes of Apple (NASDAQ:) and Amazon.com (NASDAQ:)?) Anyway, the /NQ has held on to most of its shave from yesterday evening:

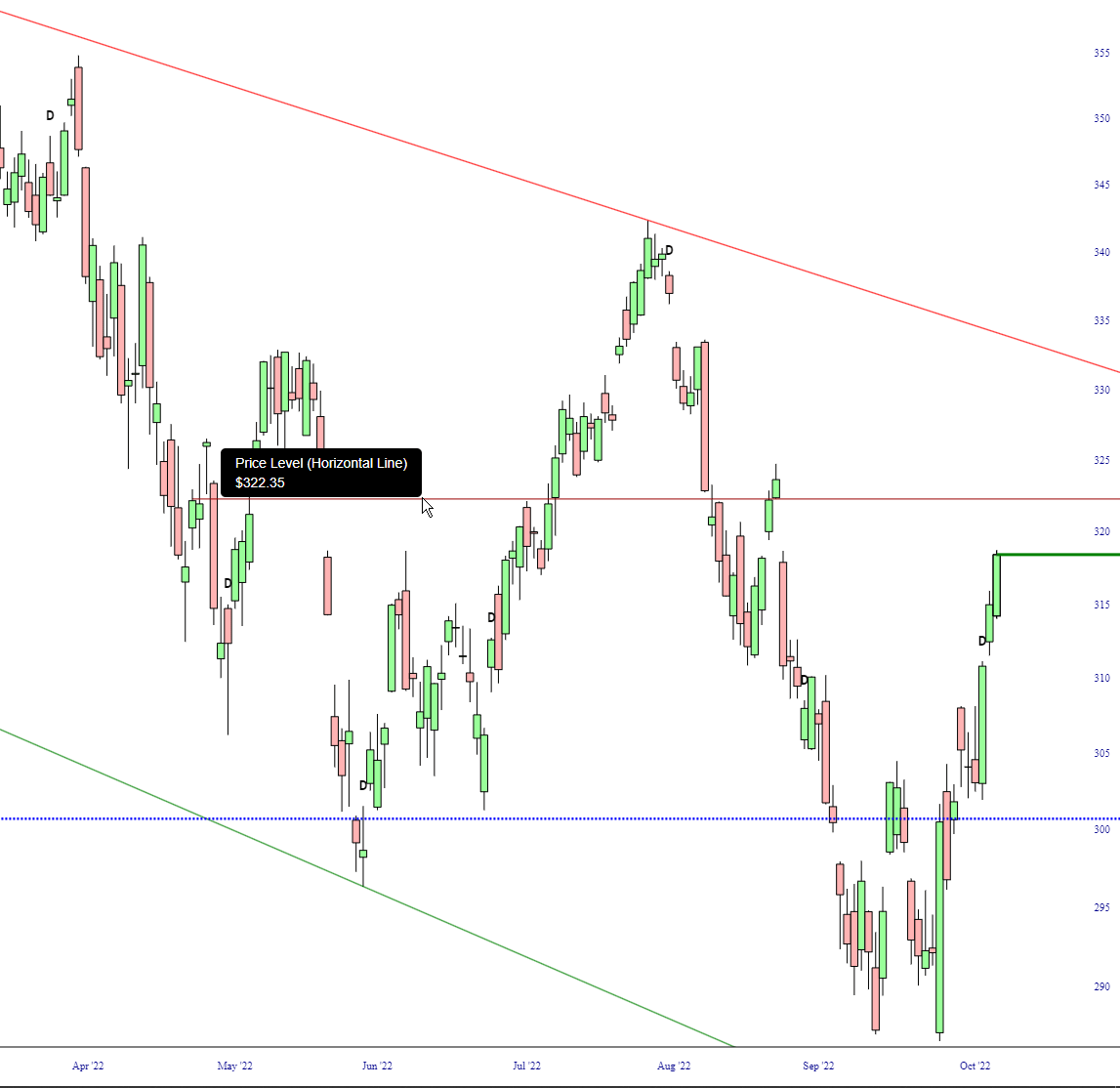

What intrigues me most is what’s going on with the Dow Industrials, which have been relatively strong for many weeks. We are within spitting distance of a major price gap.

Dow Jones Industrials Chart.

Dow Jones Industrials Chart.

The market’s tone, however, won’t really be decided until AAPL and AMZN report tomorrow afternoon. The bulls have, understandably, acquired massive amounts of bravado and confidence over the past seven trading days, and it’s entirely possible this little nick from last night is just a forgettable bump in the road. I sure hope not, of course. I can’t take much more of this, to be honest.

Companies Still To Report Earnings This Week.

Companies Still To Report Earnings This Week.

I remain sickeningly long cash, although I’ll probably timidly re-enter a few positions today if the market stays relatively weak. As long-time readers know, I have a perfectly negatively-correlated relationship between what the market is doing and how I’m feeling, so you should probably take my utter lack of confidence with an appropriate sense of gravitas.

[ad_2]

Source link