Walt Disney Q3 Earnings Preview: Long-Term Bottom Could Be in Ahead of Report

2023.08.08 09:09

- Walt Disney is set to reportQ3 earnings on Wednesday after market close

- The long-term outlook for the stock seems promising

- Technically, the stock is testing a long-term bottom currently

Walt Disney (NYSE:) is all set to release its fiscal Q3 earnings right after the market closes tomorrow, August 9th. Back in May, the

Burbank, California-based giant caught the market’s attention when it earnings per share below expectations. While its revenue fell in line with predictions, the stock price took a bit of a tumble, dropping nearly 10%.

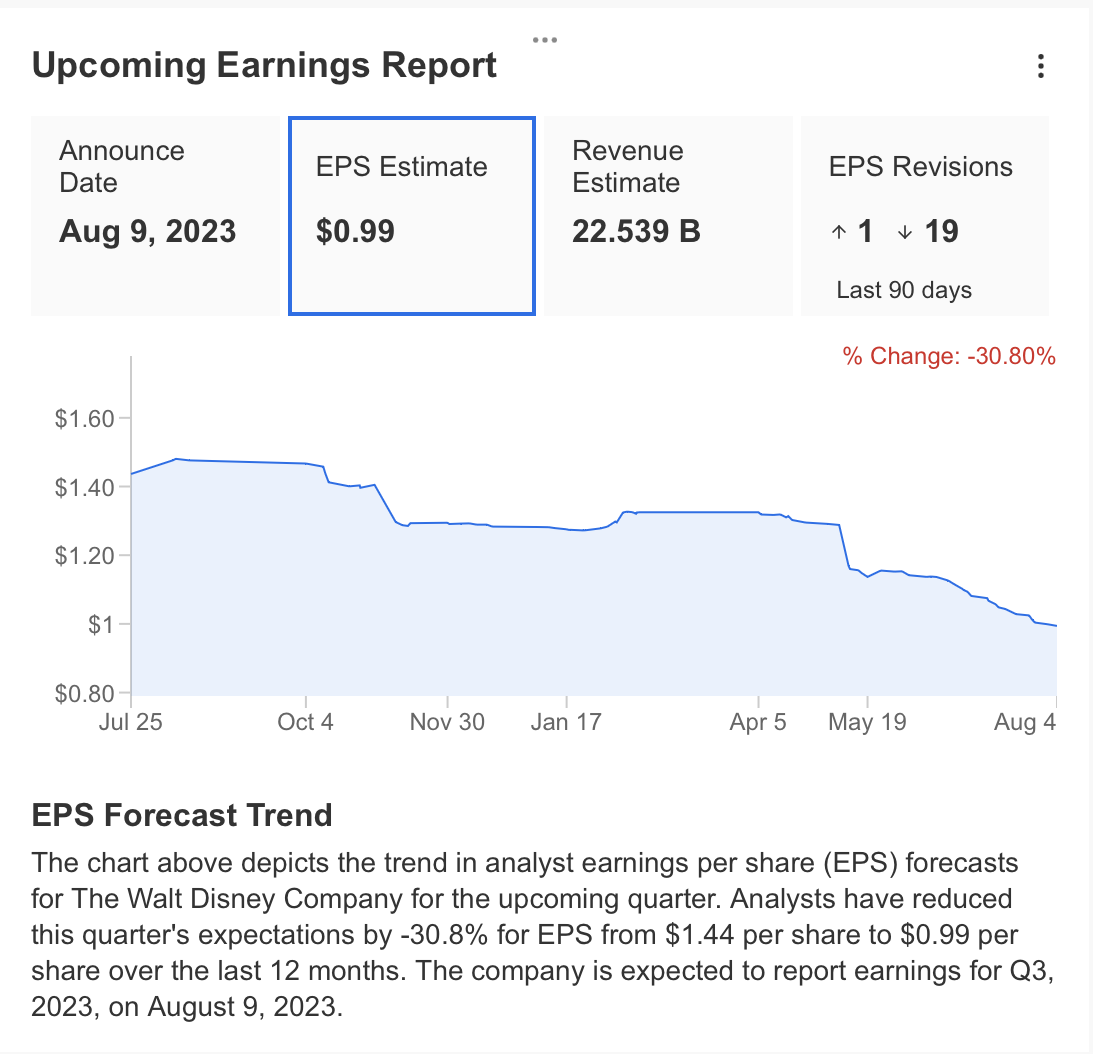

Now, things have settled a bit, and even though expectations have been adjusted since that last quarterly report, we’re still curious to see if the house of Mikey has any surprises up its sleeve this time around. According to InvestingPro, earnings per share (EPS) could be around $0.99 for the quarter, with revenue forecasts hovering at approximately $22.53 billion.

Here’s the twist: those same analysts who previously had higher expectations have now lowered their HBK from $1.44 and brought down the revenue estimates from $22.97 billion.

Source: InvestingPro

Source: InvestingPro

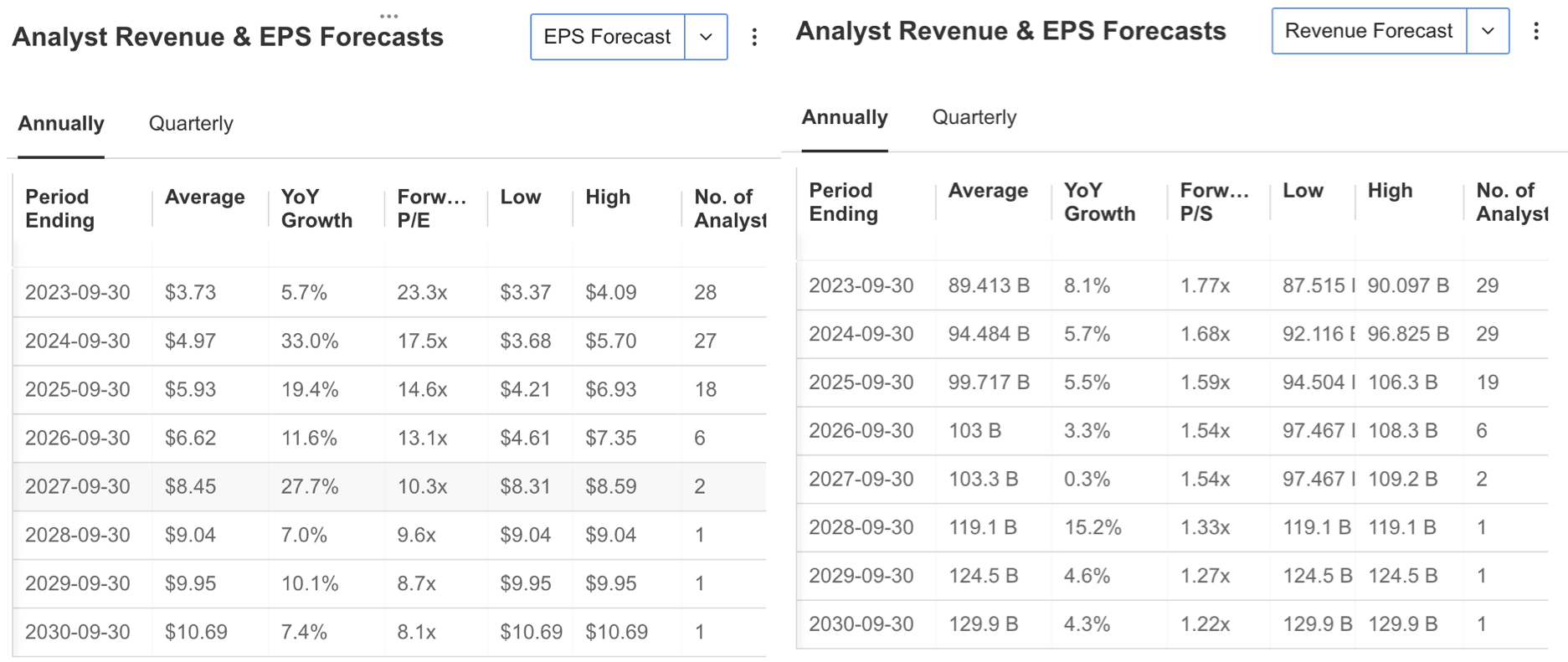

Forecasts for the rest of the year suggest that Disney could reach an average HBK of 3.73 and a price/earnings ratio of 23.3X by the end of the year. Year-end revenue expectations are estimated at $89.41 billion, up 8%. In the longer term expectations, Disney’s revenue is expected to reach $100 billion by 2026. Earnings per share expectations come in the form of an average of $5, with an increase of 33% by the end of next year.

Analyst Revenue and EPS ForecastSource: InvestingPro

Analyst Revenue and EPS ForecastSource: InvestingPro

Disney’s Prowess: A Deep Dive Into Key Financial Ratios

With a substantial market capitalization reaching almost $158 billion, Walt Disney stands as a cornerstone in the entertainment industry, making waves across two distinct sectors. Beyond its renowned amusement parks and product sales, Disney’s influence extends to the media realm, encompassing digital platforms and the film industry. Operating under the banner of Disney Plus, its digital platform efforts in media are noteworthy, while its cinematic prowess is highlighted through heavyweight studios like Walt Disney Pictures, Marvel Studios, and Lucasfilm.

This esteemed stature in the industry commands considerable attention from institutional investors, with large firms recently underscoring their confidence in Disney by increasing exposure to DIS shares within their portfolios. What merits attention is the fact that hedge funds and institutional investors display their trust in Disney from a long-term perspective, controlling over 60% of the ownership in DIS shares. This factor could potentially encourage individual investors to perceive the recent downtrend in DIS stock as a promising buying opportunity.

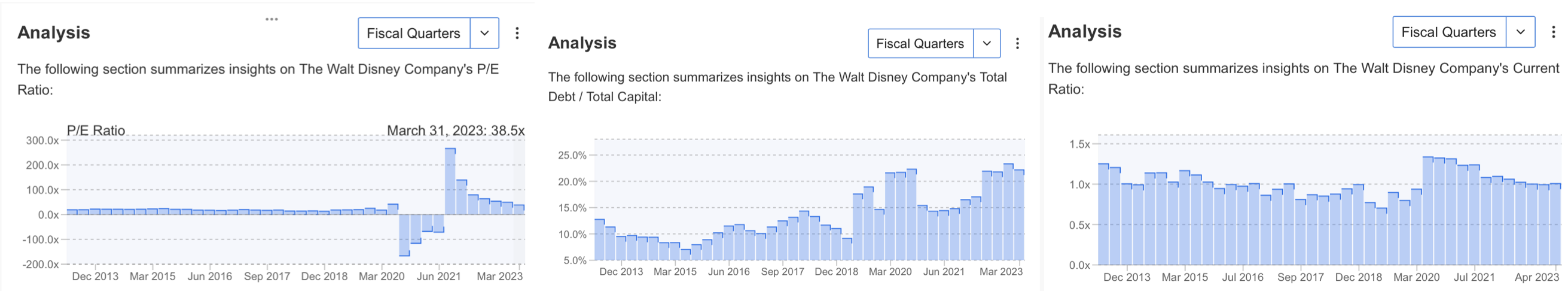

Now, let’s delve into a few pivotal ratios concerning the company, leading up to the imminent announcement of earnings this week. Firstly, the price/earnings (P/E) ratio at 38.5x highlights that despite a notable decline over the past two years, the stock remains positioned at a premium level. With a steady total debt-to-capital ratio of 22%, Disney’s financial stability is evident, mirroring sector averages and indicating relatively lower financial risk. Notably, Disney’s current ratio is at 1, suggesting its capacity to meet short-term obligations effectively.

P/E Ratio, Debt/Capital RatioSource: InvestingPro

P/E Ratio, Debt/Capital RatioSource: InvestingPro

Consequently, the consistent upward trajectory in earnings per share is favorable for the company, amplifying its allure for investors eyeing long-term commitments. The added allure of consistent dividend disbursements enhances the stock’s appeal, especially to those with a long-term investment horizon. InvestingPro’s comprehensive assessment of the company aligns with this sentiment, identifying another encouraging aspect: the company maintains a low F/K ratio, despite the recent surge in short-term profits.

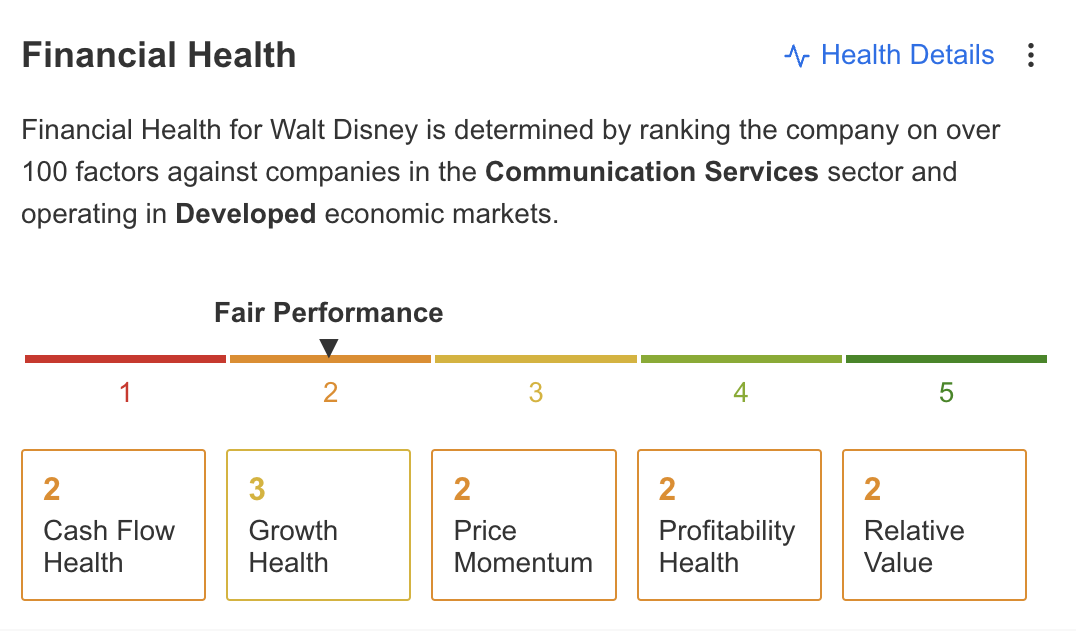

Analyzing the current data available on the InvestingPro platform, Disney’s financial health falls short of the average benchmark. While the company’s growth is pegged at median levels, aspects like profitability, cash flow, relative value, and price momentum require attention and improvement. As a result, the outlook validates analysts’ downward revisions of their short-term expectations for the company.

Source: InvestingPro

Source: InvestingPro

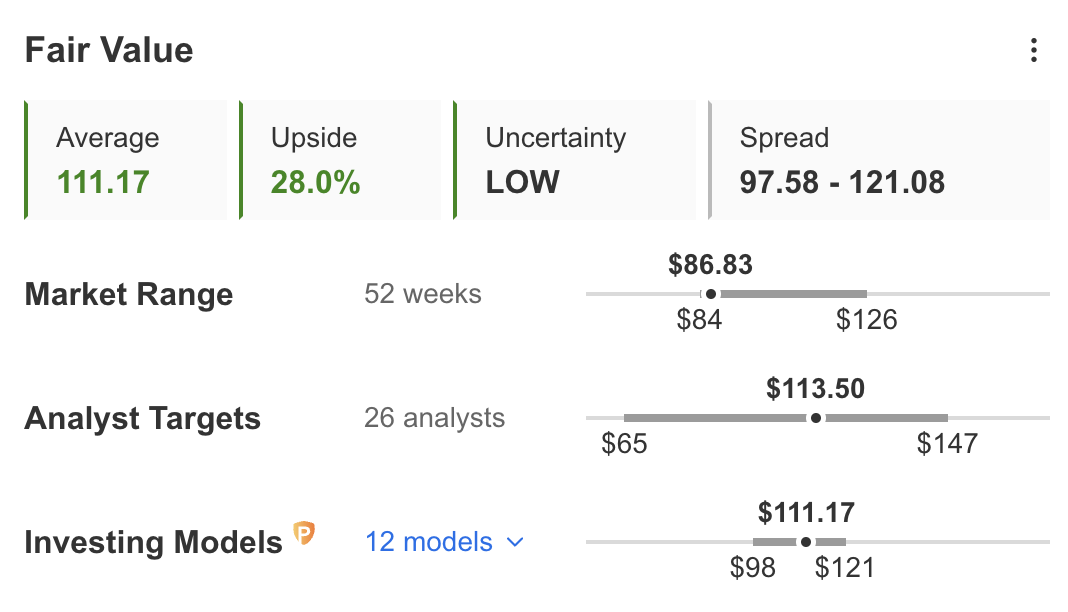

Despite the company’s financial health being below average, the outlook for its stock price appears promising. In fact, according to InvestingPro’s calculations based on 12 financial models, the fair value for the stock today is $111. Analysts have similar expectations, with their targets hovering around $113.

Interestingly, these estimates indicate that the DIS stock is currently trading at a discount of around 28% compared to its current price. This suggests that the stock might be undervalued based on these assessments.

Source: InvestingPro

Source: InvestingPro

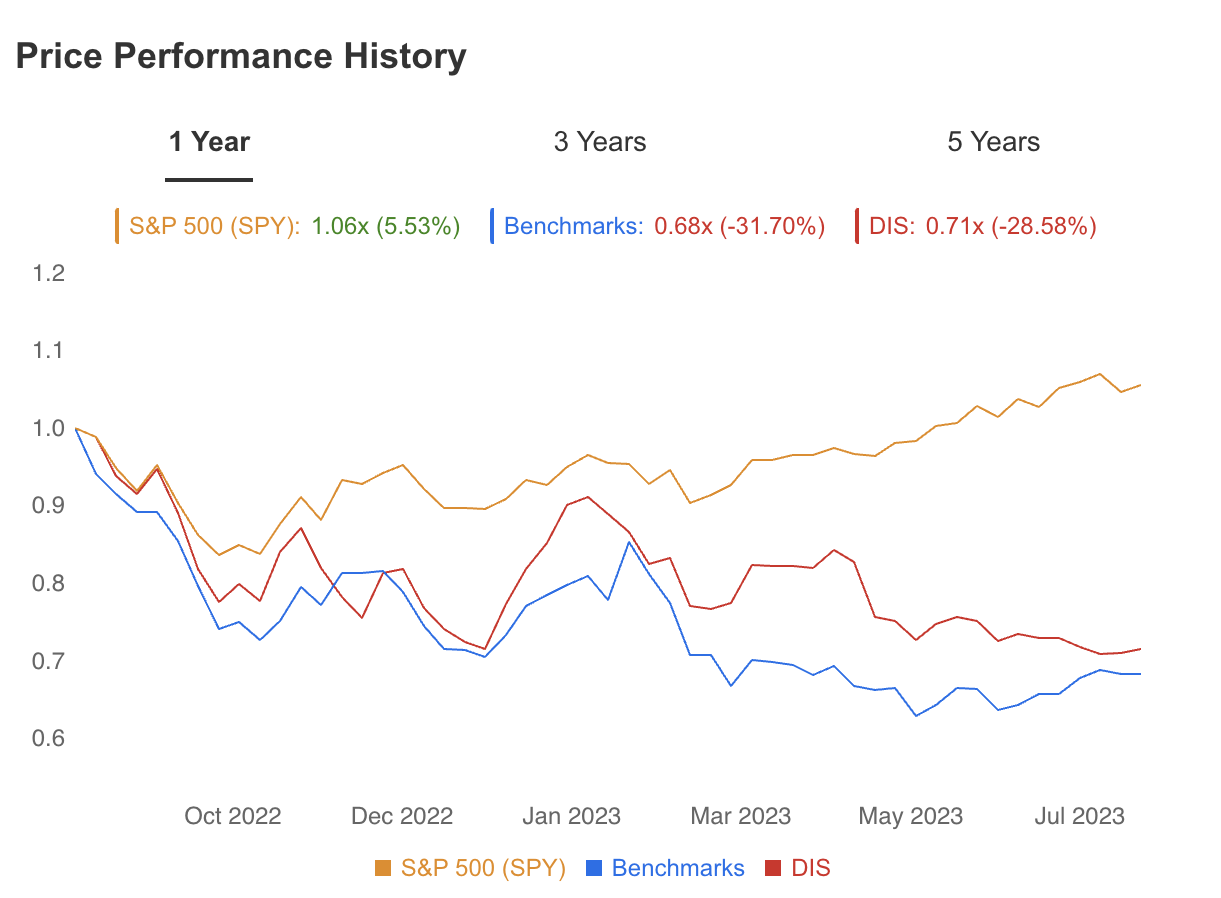

Another striking criterion about DIS stock is that its beta is at 1.28. This ratio means that the stock reacts higher than the general market trend. Accordingly, DIS share, which has a beta above 1 from possible price fluctuations, can be expected to move more volatile.

Price Performance History: S&P 500 Vs. DISSource: InvestingPro

Price Performance History: S&P 500 Vs. DISSource: InvestingPro

Examining the stock’s price performance over the past year, we observe a decline that’s slightly above the sector average but below the for this timeframe. A more detailed analysis of DIS’s price movement reveals that while the negative trend has been valid throughout 2023, the pace of the downward momentum is easing, showing a slight sideways shift.

Disney: Technical View

Over the past two years, DIS stock has experienced a consistent downtrend. Despite showing some signs of recovery in the previous year, as indicated by the weekly chart, the trend reversal hasn’t fully materialized yet. Nevertheless, the current outlook suggests that the stock has reached a point where it has historically encountered buying interest, forming a potential bottom.

DIS stock is presently undergoing a test of its long-term support at $85. Interestingly, this zone has previously triggered a rapid uptrend after its last test at the close of 2022. However, it’s worth noting that these upward moves were in response to sharp declines. Regardless, the current situation could be viewed as an opportunity for investors to consider re-entry.

DIS stock is presently undergoing a test of its long-term support at $85. Interestingly, this zone has previously triggered a rapid uptrend after its last test at the close of 2022. However, it’s worth noting that these upward moves were in response to sharp declines. Regardless, the current situation could be viewed as an opportunity for investors to consider re-entry.

In this context, DIS needs to achieve a weekly close above $95 in order to break free from its downtrend. Once this milestone is reached, the initial target could be around the $113 mark. Looking further down the line, medium and long-term goals beyond that level lie at $128, $141, and $155.

It’s worth paying attention to the Stochastic RSI indicator on the weekly chart as well. Positioned in the oversold zone, it could potentially signal an upward movement beyond the $95 mark.

Conclusion

To sum it up, while Disney’s conservative financial outlook might bring about short-term hurdles, the long-term outlook seems promising, particularly with the sustained interest from institutional investors.

Yet, it’s crucial to highlight that although expectations for the current quarter have been revised downward, the upcoming announcement of the financial results on August 9th could potentially spark an uptrend in the stock price.

***

Find All the Info you Need on InvestingPro!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered investment advice.